We aren’t just talking success; we’re talking triumph. The stellar earnings results from market giants like Microsoft MSFT, Meta Platforms META, and Amazon AMZN come as a reverberating confirmation of their unshakable reign atop the market hierarchy. Alongside steadfast companions Apple AAPL, Alphabet GOOGL, Tesla TSLA, and Nvidia NVDA in the vaunted ‘Magnificent 7’ league, these tech titans orchestrated a bull charge last year, a momentum they’ve carried into the new year.

Mixed Bag of Earnings

While the market rode the updraft of impressive growth numbers from most of the group, Tesla marked the fourth consecutive quarter of disappointing results, with a disconcerting -45.8% tumble in earnings in Q3 against a meager +3.5% revenue uptick amidst an increasingly cutthroat EV landscape. The lofty reports from Alphabet and Apple, despite not striking the market’s fancy, painted a portrait of Q4 earnings growth at +51.8% and +13.1%, respectively.

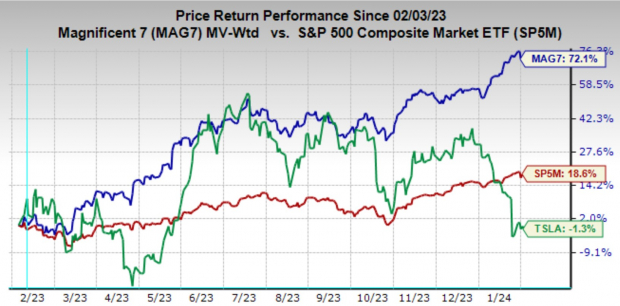

The visual below chronicles the one-year ascent of the Magnificent 7 stocks relative to the S&P 500 index and Tesla.

Image Source: Zacks Investment Research

Financial Muscles on Full Display

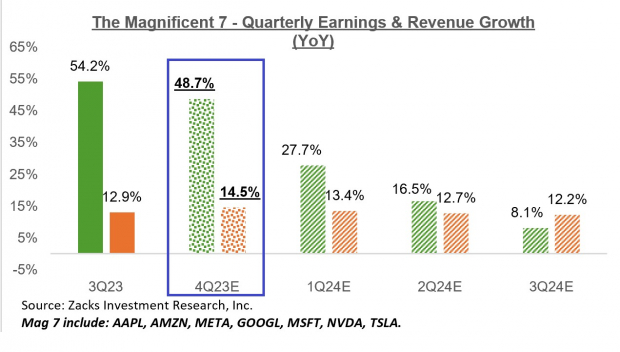

Deriving estimates from Nvidia and the delivered results from the other six members of the group, the cumulative Q4 earnings for the ensemble are poised to ascend by +48.7% from the previous year, coupled with a +14.5% uptick in revenues. The subsequent visual reveals the growth performance of the group during Q4 in relation to preceding and anticipated quarters.

Image Source: Zacks Investment Research

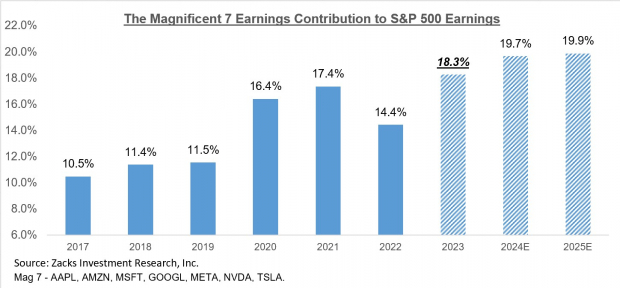

Indeed, the Mag 7 companies presently hold a commanding 28.6% share in the S&P 500 index’s total market capitalization, with projections to contribute a formidable 19.5% to the index’s cumulative earnings by 2024. In the elapsed 2023 Q4, the Mag 7 group carried a more substantial weightage, delivering 23.1% of all S&P 500 earnings. The chart following illustrates the group’s earnings contribution evolution across time and the trajectory expected for the ensuing two years.

Image Source: Zacks Investment Research

Significant Sectoral Growth

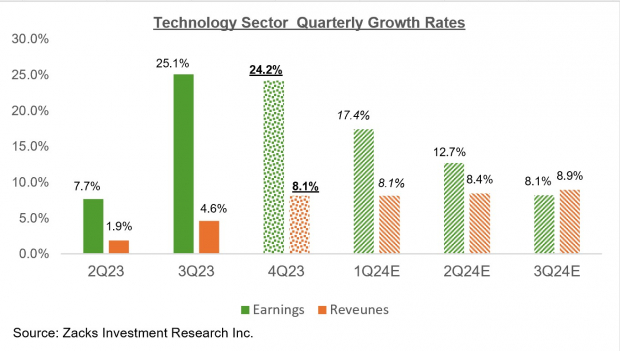

Beyond the colossal players of the Mag 7, an aggregate Q4 earnings surge of +24.2% for the Technology sector looms against +8.1% elevated revenues from the preceding year. A visual depiction of the sector’s Q4 earnings and revenue growth outlook vis-à-vis previous quarters and forthcoming periods is seen below.

Image Source: Zacks Investment Research

The Bigger Earnings Canvas

The comprehensive visual representation below reveals the fared earnings and revenue growth rates over the preceding quarters and the expectations for the S&P 500 index for 2023 Q4 and the ensuing three quarters.

Image Source: Zacks Investment Research

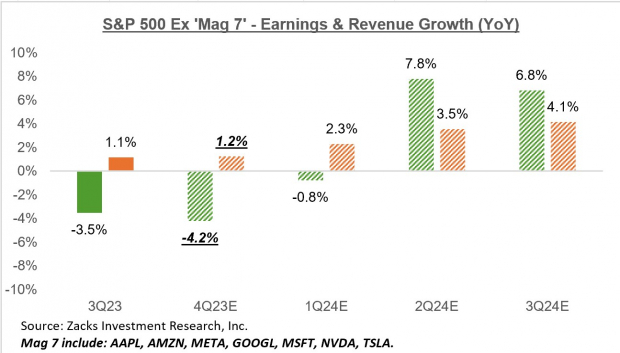

This week’s spectacular Tech performances have catapulted the aggregate earnings growth outlook for the S&P 500 index to +4.3% from last week’s +1.1%, underscoring the pivotal role of the Mag 7 stocks. Excluding the contribution from these behemoths, Q4 earnings for the rest of the index would plunge by -4.2%, laying bare the vital positioning of the Mag 7. The visual below captures this contrasting narrative.

Image Source: Zacks Investment Research

Forthright Earnings Profile

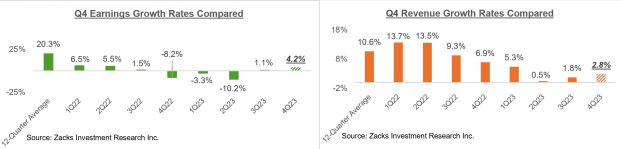

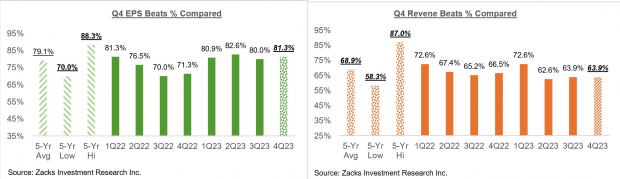

The earnings credits from the 230 index members that have already disclosed their Q4 results are stacking up at an impressive +4.2% from last year, accompanied by a +2.8% increase in revenues. Notably, 81.3% have beaten EPS estimates, alongside 63.9% that have trumped revenue estimates. The visual aids below contextualize the Q4 earnings and revenue growth rates, as well as the EPS and revenue beat percentages.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research