Marvell’s Strategic Success

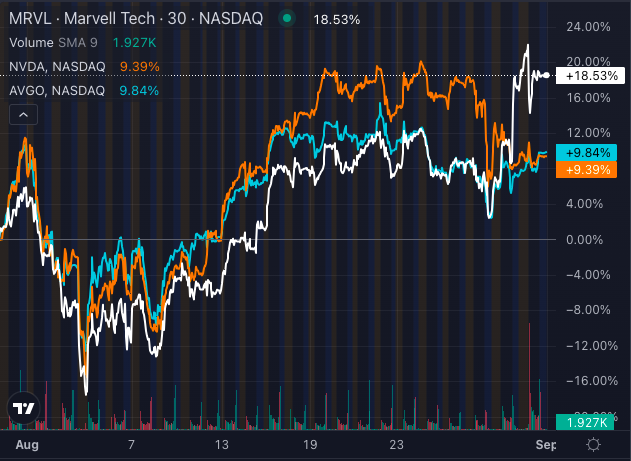

Marvell Technology Inc. has shone brightly in the semiconductor realm, leaving tech giants Nvidia Corp. and Broadcom Inc. in its wake during August 2024. Its impressive 18.53% stock surge surpassed the gains of Broadcom and Nvidia, capturing the attention of savvy investors eager to ride the growth wave in the semiconductor landscape.

Marvell’s exceptional performance can be credited to its strategic focus as a fabless chip designer with a strong presence in wired networking. Ranking second in market share in this sector, Marvell caters to a broad range of industries, including data centers, automotive, and consumer electronics. Its array of processors, switches, and storage controllers positions it as a prime contender to meet the escalating demand across these industries effectively.

Bullish Analyst Sentiment

The optimism surrounding Marvell is palpable among analysts, reflected in a 12-month price target range of $82.00 to $120.00, with an average target of $101.00. This optimistic outlook foresees a potential upside of 25.96% in the coming year, underscoring confidence in Marvell’s growth trajectory and market positioning.

Broadcom’s Diversification Drive

On the other hand, Broadcom, a major player in the semiconductor realm, has expanded its horizons beyond traditional chip manufacturing into software, aiming to diversify its revenue streams. With an annual revenue exceeding $30 billion and an extensive product range spanning wireless, networking, and storage sectors, Broadcom remains a formidable competitor in the semiconductor arena.

Nvidia’s AI Frontier

Nvidia, renowned for its supremacy in the GPU domain and burgeoning presence in AI and data center networking, demonstrated a robust performance in August. However, it fell short of Marvell’s meteoric rise, signaling a competitive edge in Marvell’s favor.

Analysts’ outlook on Nvidia projects a 12-month price target range of $90.00 to $1,275.00, with an average target of $682.50, indicating an anticipated upside of 46.93%. While Nvidia holds promising long-term growth potential driven by AI technology adoption, its recent lag in percentage gain compared to Marvell may give investors pause in the short term.

Semiconductor investors are urged to heed Marvell’s recent triumph as a clarion call to consider stocks with precise market strategies and high growth potential. While Broadcom and Nvidia retain their footing, Marvell’s agility and dominant market positioning present an enticing opportunity for those eyeing substantial gains in the semiconductor sector.