We all know the age-old adage that looks can be deceiving, and it holds true even in the world of stocks.

Enter Micron (MU), a semiconductor company renowned for its memory chip designs. At first glance, the stock may appear overvalued with earnings of $0.67 per share over the last 12 months, resulting in a price-to-earnings ratio of 161x. However, focusing solely on these historical metrics fails to consider the future guidance and consensus estimates, which provide a clearer picture of the stock’s true worth.

But let’s leave the past behind and delve into three crucial reasons why Micron’s valuation is more than meets the eye.

- Looking Ahead: While Micron’s current price-to-earnings ratio may seem inflated, forecasts for the upcoming quarter and beyond paint a more optimistic outlook. With projected earnings of $1.74 per share for the next quarter and a stellar $8.93 per share for Fiscal 2025, the anticipated multiples of 11.8 and 8.2, respectively, offer enticing potential upside.

- Comparison to Peers: Contrasting Micron’s expected valuations with industry peers like Nvidia and AMD reveals a more compelling narrative. Despite lower gross margins and a less glamorous focus on chip memory compared to AI processors, Micron’s specialization in memory chips for GPU processors positions it well for the evolving AI landscape, where robust RAM memory plays a critical role.

- Technological Prowess: Micron’s expertise lies in high bandwidth memory chips crucial for powering AI-driven GPUs, aligning perfectly with the increasing demand for data processing. As AI capabilities advance, the need for efficient RAM solutions grows, making Micron’s offerings indispensable for cutting-edge technologies.

The Path to Micron’s Price Target

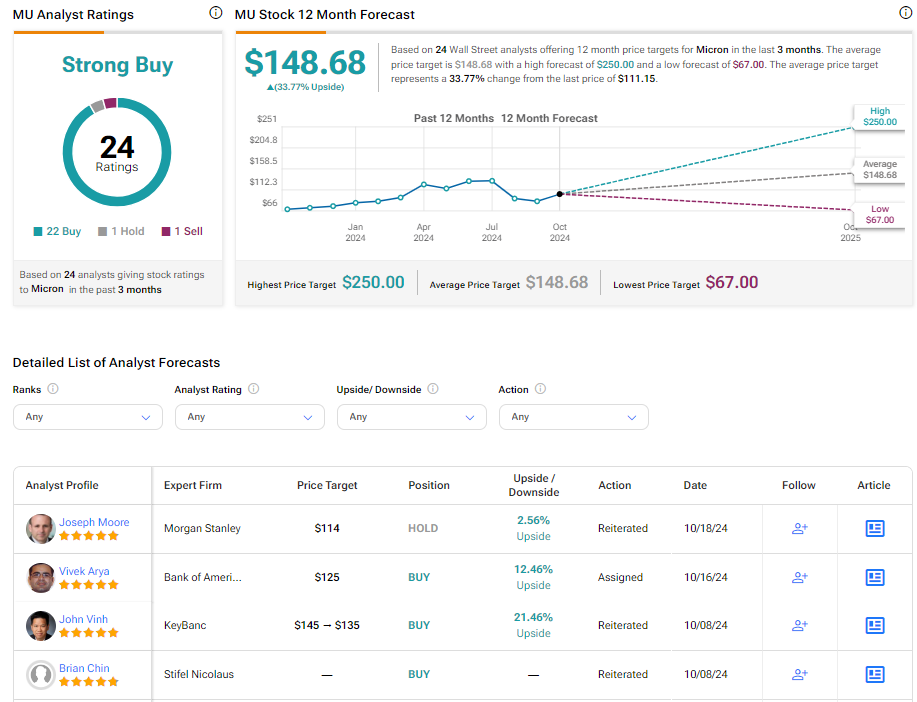

Wall Street labels Micron as a Strong Buy, with an average price target of $148.68, signifying a potential upside of 33.77%.

Explore more analyst ratings for MU here

In Summary

While Micron’s initial valuation may seem daunting, a deeper dive into its growth prospects unveils a compelling investment opportunity. Positioned to capitalize on the AI revolution’s demand for advanced memory solutions, Micron stands at the forefront of a tech-driven future that necessitates copious amounts of RAM.