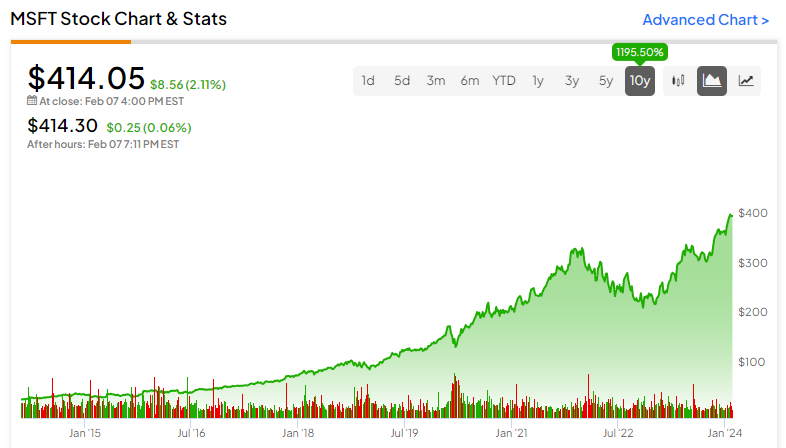

Software behemoth Microsoft (NASDAQ:MSFT) now leads as the most valuable stock in the world with a market cap of $3.08 trillion. Less than six months ago, when the writer discussed Microsoft, it was already nearing its all-time high, and the bullish stance was reaffirmed. Since then, the stock has gained another whopping 28%. At this juncture, the bullish stance is being reasserted because MSFT is ready to embark on another decade of supernormal returns supported by multiple growth catalysts.

Microsoft’s Upbeat Quarterly Results

On January 30, Microsoft reported upbeat Q2 results for the sixth consecutive quarter, driven by robust cloud computing momentum and strong growth across all segments. Adjusted earnings of $2.93 per share handily beat analysts’ estimates of $2.77. Also, the figure was 26.3% higher than last year’s figure of $2.32 per share. Revenues came in at $62.02 billion, jumping 17.7% year-over-year and surpassing analysts’ estimates of $61.1 billion.

All eyes were waiting for the Cloud segment’s numbers, and investors were not disappointed. The Intelligent Cloud business segment, which includes Azure Cloud, SQL Server, and Windows, among others, grew 20% year-over-year to $25.8 billion, beating expectations. Notably, Azure and other cloud services reported revenue growth of 30% (28% in constant currency), again much ahead of Wall Street’s expectations. Despite the upbeat Q2 print, Microsoft gave out an outlook that came in below expectations. Q3 revenues are expected to range between $60 billion and $61 billion versus the consensus estimate of $60.93 billion.

Driving Future Returns with Cloud + AI Combination

AI and cloud computing will continue to complement and spur demand for each other. Further, the cloud optimization observed in 2023 due to recessionary fears is now over, and cloud computing is once again experiencing significant growth across the industry, as evidenced by reports from various companies. For instance, Amazon’s (NASDAQ:AMZN) AWS now reportedly stands at the cusp of a $100 billion annual run rate.

Microsoft’s Valuation

Despite being the most valuable stock in the world, Microsoft’s valuation isn’t as expensive as one would think. At first glance, it may look expensive, trading at a P/E of 36x currently. Nonetheless, the premium is justified, given its favorable industry-leading market position, robust margins, diversified revenue stream, and huge exposure to high-growth AI and cloud businesses. For the sake of comparison, online retail and cloud computing giant Amazon is trading at a P/E of 58.5x, while social networking company Meta Platforms is trading at a 31.9x P/E.

Analysts’ Perspectives

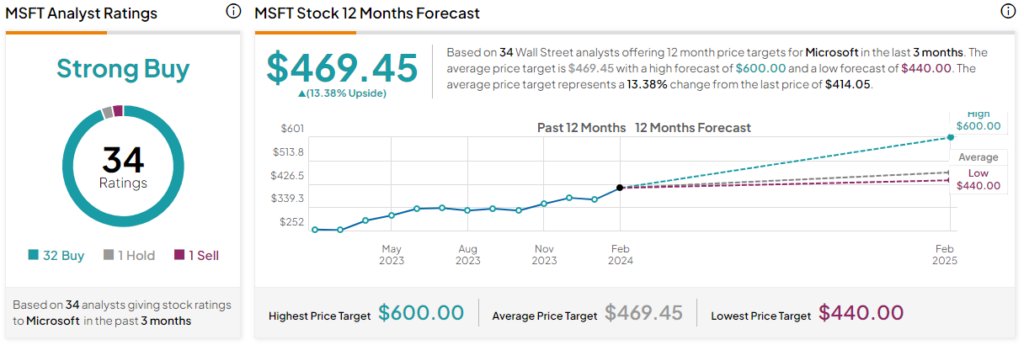

Surprisingly, Microsoft stock hasn’t seen any significant upward movement despite upbeat Q2 earnings, mainly due to weaker-than-expected guidance. However, Wall Street analysts continue their bullish stance, with a majority having raised their price targets on the stock post-earnings. Overall, the stock commands a Strong Buy consensus rating based on 32 Buys, one Hold, and one Sell. Microsoft stock’s average price target of $469.45 implies 13.4% upside potential from current levels.

Consider Buying MSFT for Its Long-Term Growth Outlook

Microsoft stock has returned around 1,200% over the past decade. It will continue to generate attractive long-term returns with its leadership position in the world of AI & computing, coupled with a well-diversified portfolio and an impressive track record of solid execution. AI and cloud computing will be the front runners in driving outstanding growth in the next 10 years. Hence, one should consider buying the stock at current levels with a bullish long-term outlook.

Disclosure