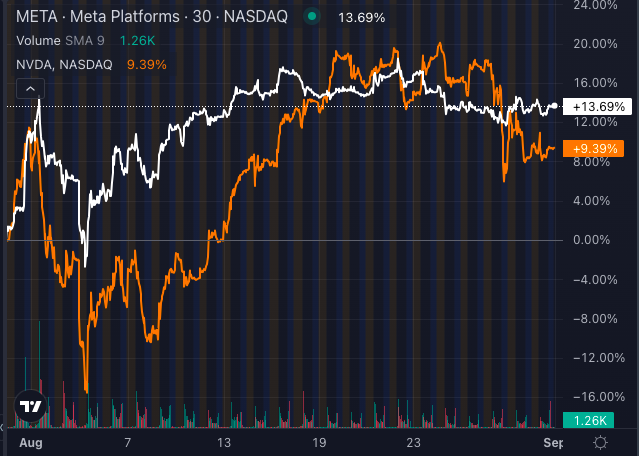

Meta Platforms Inc META outpaced Nvidia Corp NVDA in August, with Meta stock gaining 13.69% versus Nvidia’s 9.39% rise.

This surprising turn of events has ignited discussions surrounding the artificial intelligence (AI) frontrunner, Nvidia, and whether it might be undergoing a sobering reassessment of its market value.

Chart created using Benzinga Pro

Nvidia’s High-Flying Act: A Bubble on the Verge of Bursting?

Having established itself as a dominant force in AI chips and GPU technology, Nvidia soared to great heights on the back of the surging demand for AI and data center solutions. However, with a current price-to-earnings multiplier (P/E) of 55.13, substantially above industry peers, doubts are arising regarding the sustainability of its growth trajectory.

The modest uptick in Nvidia’s stock during August hints at a potential reassessment of its lofty market valuation.

Read Also: Nvidia Down About 10% From All-Time Highs: Prominent Trader Says He Has Cashed Out

The uncertainty surrounding Nvidia’s ability to sustain its rapid growth needed to justify its valuation appears to be dampening investor enthusiasm.

Meta’s AI Magic: A Rising Star In The Tech Arena

Meanwhile, Meta has been capitalizing on its strategic pivot towards AI, leveraging the technology to revamp its advertising efficiency and enhance user interaction. This shift has reignited investor interest in Meta, with the company’s AI investments starting to pay dividends and offering a diversified play within the tech landscape.

Read Also: Mark Zuckerberg’s AI Obsession: Is $8 Billion Too Much For Meta To Handle?

Investors are evidently responding favorably to this strategic shift, perceiving Meta as a robust contender in the AI domain without being exposed to the valuation risks associated with Nvidia.

Valuation Showdown: Is Nvidia’s Dominance Fading?

The recent disparity in performance could symbolize a broader market shift, indicating a growing investor wariness towards overvalued tech stocks. While Nvidia remains at the forefront of AI innovation, the slowing momentum in its stock may point to a market seeking more balanced and less risky AI investment opportunities.

As the debate unfolds, investors must carefully assess Nvidia’s potential for rapid growth against the backdrop of valuation risks. With Meta showcasing its adeptness at leveraging AI without carrying the same premium price tag (trading at a P/E of 26.51), the key question lingers: Is Nvidia traversing a temporary cooling phase, or is this indicative of a more enduring trend?

Only time will unravel whether Nvidia can recapture its luster or if Meta’s diversified AI strategy will continue to outshine its tech adversary.

Read Next: