Nvidia Corp – A Tech Giant’s Meteoric Rise

Nvidia Corp shares closed up 0.8% at $138 on Friday, with a staggering market capitalization now exceeding $3 trillion, leaving investors in awe. However, market enthusiasts and financial analysts remain divided on the future trajectory of this tech giant.

Experts Weigh In: Optimism vs. Caution

CEO of Lumida Wealth Management, Ram Ahluwalia, is optimistic, envisioning a future where Nvidia could touch a $4 trillion market valuation. Such bullish sentiments are echoed by industry veterans like T. Rowe Price portfolio manager Tony Wang and Dan Niles, founder of Niles Investment Management, foreseeing a doubling of Nvidia’s revenues and stock value over the coming years.

The Goldman Sachs Perspective

Intriguingly, Goldman Sachs chimes in, highlighting the growth potential in Inference compute for Nvidia. Their optimism is palpable, with a price target of $150 set for the stock, emphasizing Nvidia’s strategic positioning to capitalize on this emerging market trend.

Rating Upgrades and Price Targets

Even Bofa Securities has upped the ante by maintaining a ‘Buy’ rating on Nvidia and revising the price target upwards from $165 to $190. With a consensus price target of $234.49 supported by the analyses of 38 analysts, the bullish sentiment around Nvidia remains resilient.

The Phenomenal Growth Story

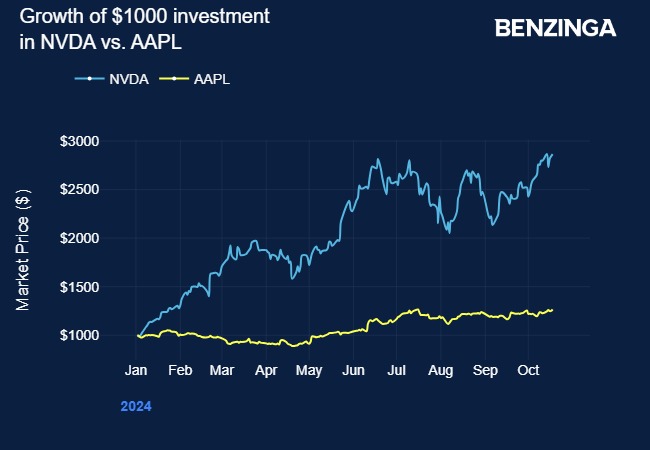

Nvidia’s stock surge of over 233% in the past year is nothing short of monumental. Starting from $41, the stock has catapulted to $138, leaving investors with sizable gains. Exchange-traded funds (ETFs) tracking Nvidia, such as GraniteShares 2x Long NVDA Daily ETF and Direxion Daily NVDA Bull 2X Shares, have witnessed meteoric rises of over 440% during the same period, adding to the frenzy surrounding the stock.

Reflections on Market Capitalization

Apple stands as the only American company with a market cap surpassing Nvidia, yet even Apple falls short of the elusive $4 trillion benchmark. The comparison underscores the remarkable journey of Nvidia’s market capitalization, signaling a paradigm shift in the tech industry landscape.

The Verdict – A Tale of Potential or a Cautionary Tale?

Nvidia’s remarkable ascent presents a conundrum to investors – a tale of unbounded potential or a cautionary narrative of a market bubble waiting to burst. With contrasting views prevailing in the industry, only time will reveal the true destiny of Nvidia’s stock journey.

Implications and Investor Sentiment

The soaring trajectory of Nvidia’s stock pondered by investors symbolizes both promise and peril. The current landscape is rife with anticipation and skepticism, with Nvidia poised at a crossroads of historic proportions in the realm of tech investments.

Image Via Shutterstock