Semiconductor behemoth NVIDIA NVDA stock has witnessed a remarkable surge of about 155% this year, escalating approximately 179% over the past year, and an astounding 2600% leap over the last five years. This colossal growth has propelled NVIDIA’s market cap to an unprecedented $3 trillion mark in the current fiscal.

The stock is currently boasting a Price/Earnings (P/E) ratio (trailing 12 months) of 55.59X, significantly outstripping the industry norm of 8.14X. Moreover, NVIDIA’s price/book ratio stands at a staggering 51.82X, compared to the industry’s modest 1.33X figure. The Price/Cash Flow ratio for NVIDIA stock is an eye-watering 99.02X, dwarfing the industry average of 11.11X.

NVIDIA’s Dominance in AI Chip Market

In terms of AI chip design and software, NVIDIA stands peerless as the global leader, commanding a market share ranging between 80% and 95%. The likes of Microsoft, Google, Oracle, and Meta trust NVIDIA’s advanced technology. Notably, companies in the autonomous vehicle sector such as Tesla heavily rely on NVIDIA’s cutting-edge chips for their operations. In particular, NVIDIA’s AI chips like the H200 are pivotal in training large language models and driving inference tasks, fueled by insatiable demand that has triggered GPU shortages.

Unprecedented Demand for Blackwell AI Chip

CEO Jensen Huang, in an interview with CNBC, expressed astonishment at the overwhelming demand for NVIDIA’s next-gen artificial intelligence chip, Blackwell. Chief Financial Officer Colette Kress has projected several billion dollars in Blackwell revenue for the company’s fourth fiscal quarter. Jensen further outlined NVIDIA’s commitment to enhance its AI platform annually to achieve two to threefold performance improvements.

The Impact of NVIDIA’s Stock Split

NVIDIA’s historic 10-for-1 stock split on June 7 has democratized its shares, making them more accessible to a broader investor base, including small-scale traders. This move has bolstered liquidity and sparked an upsurge in retail trading interest. Notably, some analysts foresee NVIDIA making history by crossing the $10 trillion valuation threshold.

Analysis of NVIDIA’s Earnings Growth

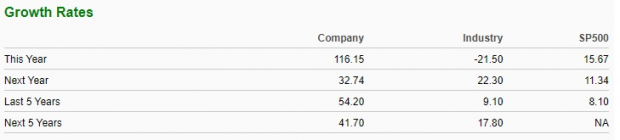

Forecasts indicate that NVIDIA’s earnings are slated to soar by a remarkable 116.2% for the current fiscal year ending in Jan. 2025, in stark contrast to the anticipated 21.5% decline in the industry’s growth rate and the 15.67% growth expectation for the S&P 500 index. While this growth trajectory is expected to decelerate next year, NVIDIA is projected to sustain a robust 41.70% growth rate over the next five years, surpassing the industry average of 17.80%.

Image Source: Zacks Investment Research

Analyst Predictions Leading to Earnings Report

As NVIDIA gears up to disclose its earnings on Nov. 19, 2024, the company’s Earnings ESP currently stands at -0.27% with a Zacks Rank #3 (Hold). Analyst sentiments suggest that positive Earnings ESP coupled with a Zacks Rank of #1 (Strong Buy), 2 (Buy), or 3 enhances the likelihood of an earnings beat. Recent analyst upgrades have lifted the earnings estimate for NVIDIA’s upcoming quarter, with the current projection at 74 cents, up from 68 cents recorded 60 days prior.

NVDA Stock Price Projections

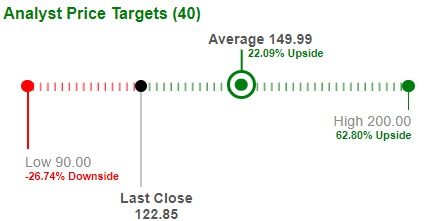

Based on short-term price forecasts by 40 analysts, the average price target for NVIDIA stands at $149.99. Projections range from a low of $90.00 to a high of $200.00, indicating a potential 22.09% surge from the latest closing price of $122.85 as of Oct. 3, 2024.

Image Source: Zacks Investment Research

Exploring NVDA ETF Possibilities

For investors seeking to capitalize on the AI boom and NVIDIA’s promising growth trajectory while mitigating company-specific risks, NVDA-heavy semiconductor exchange-traded funds (ETFs) provide a compelling investment avenue. ETFs such as Strive U.S. Semiconductor ETF, VanEck Vectors Semiconductor ETF, Technology Select Sector SPDR Fund, Grizzle Growth ETF, and TrueShares Technology, AI, and Deep Learning ETF offer exposure to NVIDIA.

Subscribe for Exclusive ETF Insights

Zacks’ free Fund Newsletter delivers top news, analyses, and high-performing ETF recommendations directly to your inbox every week.