Nvidia (NASDAQ: NVDA) achieved a significant milestone by surpassing Microsoft in market value, reaching a staggering $3.335 trillion in market capitalization.

Over the past year and a half, the stock has skyrocketed by a massive 8,280%, driven by the burgeoning demand for artificial intelligence (AI) and the provision of cutting-edge graphics processing units (GPUs) crucial for AI training and inference.

Not content with merely breaking records, Nvidia executed a well-received 10-for-1 stock split, further propelling its stock upward.

Amidst these extraordinary gains, it might be tempting to assume that the best days are behind us. However, venturing down that path could prove to be a costly misstep. My prognostication? Nvidia is on a trajectory towards a $5 trillion market cap, potentially lifting its share price beyond $203, showcasing a 50% uptick from its recent closing value.

How feasible is this ambitious leap? Let’s delve into the future prospects of Nvidia.

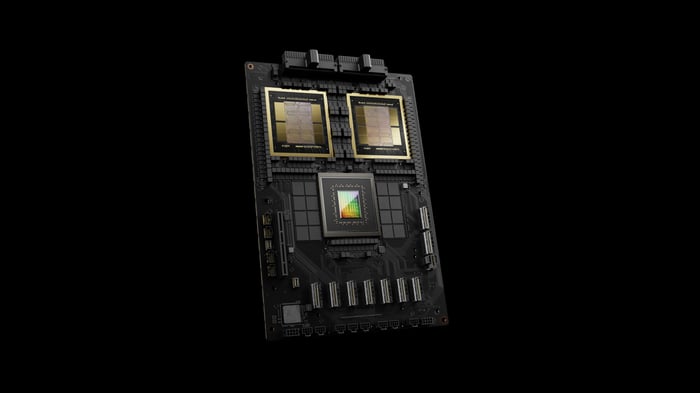

The Nvidia GB200 Grace Blackwell Superchip. Image source: Nvidia.

Unwavering Momentum

Last year saw the emergence of generative AI, promising to streamline and automate laborious tasks, a development enthusiastically embraced by Corporate America. In meeting the escalating demand for these advanced algorithms, Nvidia has been working tirelessly to address supply shortages and boost production.