“Tokenization,” specifically of “real world assets,” or RWAs, has recently been heralded as the next big thing in crypto. But is this resurgence simply a reincarnation of the security tokens frenzy of 2018?

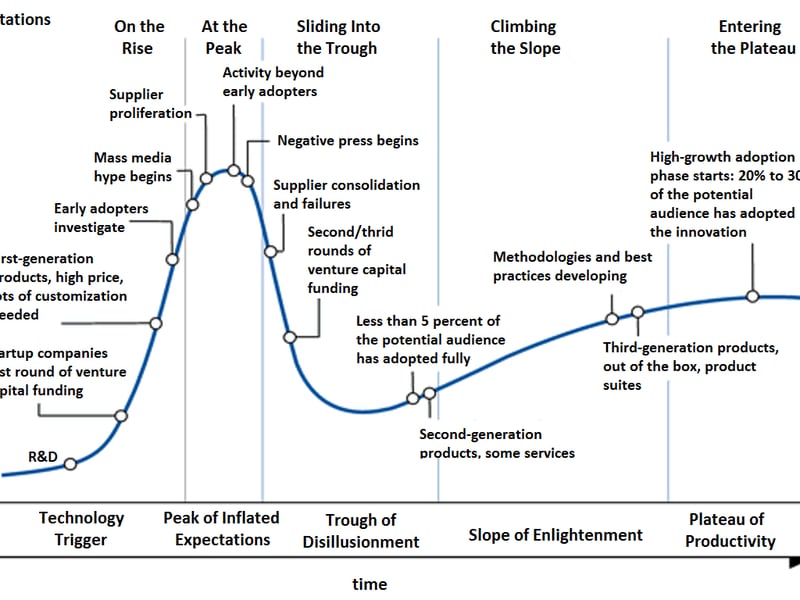

The people hyping tokenization are mostly misguided, yet their intentions are admirable. Trends can become all the rage, but if “security tokens,” “tokenization,” and RWAs are part of the same continuum, as per the Gartner “Hype Cycle,” history may repeat itself with another inevitable downturn.

Many current advocates of tokenization are former enthusiasts of decentralized finance (DeFi), which has had its own rise and fall. Traditional finance influencers view tokenization as a natural evolution, while the reality is far more complex and often misunderstood.

The tokenization of RWA assets industry dates back to late 2017. Challenges encountered during that time led firms to pivot and re-purpose their technology for broader digital asset integration.

The rise and subsequent fall of non-fungible tokens (NFTs) and DeFi have paved the way for the adoption of the RWA moniker and a shift from the more volatile DeFi landscape.

The current landscape of RWA tokenization seems to be at a stage of “Supplier Proliferation,” as the rush to capitalize on the RWA business gains momentum.

Tokenization presents a compelling notion. Today, ownership of most private assets is tracked through outdated systems. Proponents argue that tokenization offers a solution to this inefficiency.

Addressing the Reality of RWA Tokenization

While there is merit to the idea, tokenization alone does not resolve liquidity or legal issues associated with private assets. Furthermore, RWA projects often engage in lightly regulated practices, raising concerns about the quality of the collateral.

Borrowing and lending are fundamental aspects of finance, making the long-term success of tokenization likely. However, the depiction of bringing “real world assets on-chain” is misleading, as it primarily involves collateralizing crypto assets.

First-Hand Insight

After years of involvement in digital transfer agent and tokenization platforms, the practicalities of mass financial asset tokenization are far more intricate. Tokenization alone is not a lucrative endeavor and quickly becomes commoditized.

Furthermore, fiduciary responsibilities associated with tokenizing and transferring RWAs represent the true challenge, where distributed ledgers play a crucial role in fostering trust and provable ownership.

Before embracing the hype surrounding RWA tokenization, it is essential to acknowledge the lessons of the past and the path forward. History has a way of repeating itself, and one might not want to end up caught in a second iteration of NFT mania.