Against the backdrop of inflation and high-interest rate concerns, U.S. consumers showcased remarkable resilience during the 2023 holiday season. Data released by the National Retail Federation (“NRF”) reveals a noteworthy 3.8% surge in sales, reaching a record-breaking $964.4 billion. This impressive performance aligns seamlessly with the NRF’s forecast, indicating a rise between 3% and 4%.

Despite tighter budgets, Americans embraced the festive season, capitalizing on substantial discounts available across various retail categories. NRF Chief Economist Jack Kleinhenz emphasized the enduring strength of consumer spending throughout 2023, concluding the year on a high note during the holiday season. The ease in goods prices, coupled with a healthy labor market, underscored the success of the season for retailers.

The 2023 holiday sales results surpassed the previous record set in 2022 by an impressive $34.9 billion. The holiday season, spanning from Nov 1 through Dec 31, saw a stellar 8.2% increase in online and non-store sales, amounting to $276.8 billion. This indicates a shift in consumer preferences toward digital channels.

Diving into the data, impressive year-over-year gains in various retail categories during the November-December holiday sales period reveal the diverse spending patterns of consumers. Electronics and appliance stores led the pack with a remarkable 9.3% increase, followed closely by health and personal care stores at 9%. Clothing and clothing accessory stores also experienced a noteworthy 3% jump.

General merchandise stores showcased resilience with a 2% year-over-year increase, while grocery and beverage stores experienced modest 1.1% growth. Sporting goods stores saw a 0.3% uptick. However, building materials and garden supply stores faced a decline of 3.9%, while furniture and home furnishings stores encountered a downturn of 6.2%.

The resilience displayed by Americans in their spending spree defies speculations about a potential economic slowdown in the new year. That said, we have highlighted four stocks from the sector that look well-poised to capitalize on the resilient consumer environment.

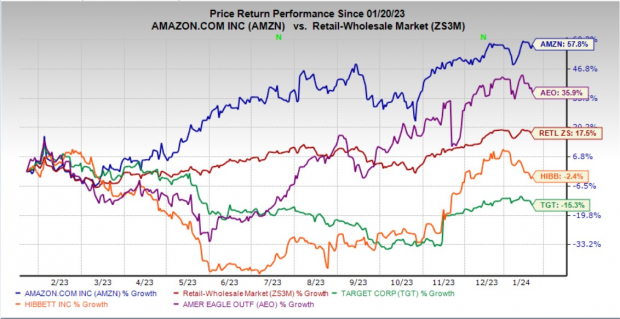

Past-Year Price Performance

Image Source: Zacks Investment Research

4 Top Stock Picks

Hibbett, Inc. HIBB is a potential pick. Hibbett boasts distinct competitive advantages, including superior customer service, a best-in-class omnichannel shopping experience, strong vendor relationships, strategic in-store placement, and a presence in underserved markets. These advantages contribute to the company’s ability to maintain and grow its market share. The company’s focus on improved expense management and disciplined inventory controls demonstrates a commitment to operational efficiency.

The Zacks Consensus Estimate for Hibbett’s current fiscal sales suggests growth of 1.7% from the year-ago reported figure. This Zacks Rank #1 (Strong Buy) company has a trailing four-quarter earnings surprise of 24.2%, on average.

Amazon.com, Inc. AMZN is worth considering. The company’s robust e-commerce platform, renowned for its vast product selection and efficient delivery services, continues to be a primary driver of revenue growth. Prime membership, a cornerstone of Amazon’s success, not only fosters customer loyalty but also drives recurring revenues through subscription fees, offering members exclusive access to a myriad of services, such as expedited shipping.

The Zacks Consensus Estimate for Amazon’s current financial-year sales and EPS suggests growth of 11.1% and 278.9%, respectively, from the year-ago reported figure. AMZN, which carries a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 54.9%, on average.

Investors can count on Target Corporation TGT. This Minneapolis, MN-based company has been making multiple changes to its business model to adapt and stay relevant in the dynamic retail landscape. Target has been deploying resources to enhance omnichannel capabilities, come up with new brands, refurbish stores, and expand same-day delivery options to provide customers with a seamless shopping experience. These have been contributing to the top line.

The Zacks Consensus Estimate for Target’s current financial-year EPS suggests growth of 38.5% from the year-ago reported figure. TGT, which carries a Zacks Rank #2, has a trailing four-quarter earnings surprise of 30.8%, on average.

American Eagle Outfitters, Inc. AEO is worth betting on. The company’s efforts to rationalize inventory and contain costs are paying off. The strong performance of key brands like American Eagle and Aerie, coupled with expansions into premium and activewear segments, indicates potential for growth. Its store designs and online enhancements demonstrate a commitment to improving the customer experience.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal sales and EPS suggests growth of 5% and 43.3%, respectively, from the year-ago reported figure. AEO, which carries a Zacks Rank #2, delivered a trailing four-quarter earnings surprise of 23%, on average.

Source: Zacks Investment Research