Stocks at their Zenith, with 52-week highs in view, are signals of unbridled bullish optimism, where market forces are at play. Companies scaling newfound heights often ascend even further, particularly as favorable earnings forecasts from industry analysts swirl in the financial ether.

This narrative rings especially true for Arista Networks (ANET), Datadog (DDOG), and Walmart (WMT), each boasting a glowing Zacks Rank and hovering near 52-week peaks. Let’s delve deeper into the driving forces behind this whirlwind of optimism.

The Ascending Arc of Arista Networks

Following its latest quarterly results, Arista Networks surged, revising their revenue growth projection for the current fiscal year upwards. The company specializes in cloud networking solutions for data centers and cloud computing realms, offering investors a tantalizing gateway to the AI wave.

Arista Networks stands tall with a Zacks Rank #1 (Strong Buy), a testament to the bright outlook crystallizing from robust market demand. ANET has witnessed stellar revenue growth, with Q1 sales at $1.5 billion scaling 16% higher compared to the same period last year.

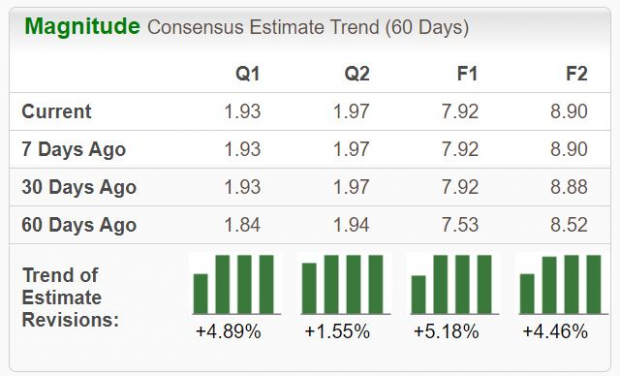

Image Source: Zacks Investment Research

Projections bode well, showcasing robust growth trends for the ongoing fiscal cycle, with anticipated 14% EPS growth mirrored by a 14% surge in sales. The growth narrative extends into the upcoming year, with estimates hinting at a further 12% uptick in earnings complemented by a 15% sales surge.

Datadog’s Unstoppable Sales Trajectory

Datadog, a proud bearer of a Zacks Rank #1 (Strong Buy), functions as a monitoring and analytics platform catering to developers, IT teams, and business users amidst the digital age. Analysts have overwhelmingly revised their earnings projections skyward.

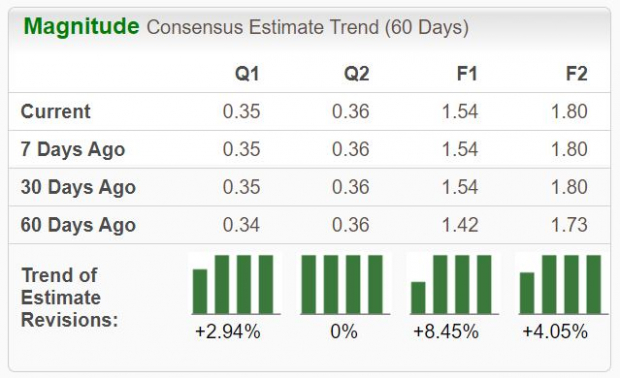

Image Source: Zacks Investment Research

The company’s track record is gleaming, surpassing our consensus EPS estimate by a whopping average of 23% across the last four releases. Revenue expansion has been robust, with double-digit year-over-year sales growth figures notching up in each of Datadog’s last ten quarters.

Walmart’s Splendid Split Saga

An interesting development unfolded at the retail titan, Walmart, as it underwent a 3-for-1 split earlier this year, reshaping its trading dynamics from February 26 onwards. The stock stands tall with a Zacks Rank #1 (Strong Buy), backed by a visibly optimistic revision trend for the current fiscal term.

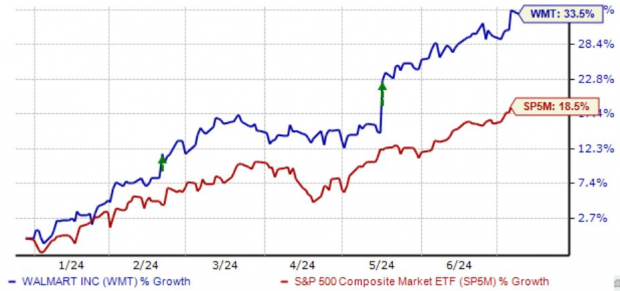

Image Source: Zacks Investment Research

Key metrics from its recent financial disclosure painted a rosy picture, with Walmart surpassing the Zacks Consensus EPS estimate by a commendable 15% and revenues eclipsing expectations by 1.3%. Earnings witnessed a robust 22% year-over-year surge, while sales registered a 6% climb from the corresponding period.

Post-earnings, Walmart’s stock skyrocketed, further bolstering its already impressive year-to-date gains.

Image Source: Zacks Investment Research

Noteworthy is Walmart’s shareholder-friendly stance, epitomized by a modest 2.2% five-year annualized dividend growth rate. The stock presently boasts an annual yield of 1.2%, aligning closely with the S&P 500’s yield.

Embrace the Momentum

Amidst the current market exuberance, stocks hitting fresh highs often pave the way for loftier peaks, especially when buoyed by positive earnings revisions.

This is the very tale unfurling for Arista Networks (ANET), Datadog (DDOG), and Walmart (WMT), all donning favorable Zacks Ranks and scaling towards their yearly pinnacles.