Small-cap stocks toasted their third straight week of gains, riding high on a wave of investor sentiment buoyed by hopes of a Federal Reserve rate cut. This rally has been fueled by a bullish outlook on interest rate-sensitive industries and companies, with markets now pricing in a 100% probability of a Fed cut in the near future.

An atmosphere decidedly devoid of impending economic slowdown fears has paved the way for small-cap stocks to shine in Wall Street’s theater of prosperity. The recent economic data paints a rosy picture, with the U.S. economy expanding at a robust 2.8% annualized pace in the second quarter, surpassing predictions and doubling first-quarter performance.

In this landscape of growth, the once ominous specter of inflation has taken a back seat. A key Federal Reserve inflation measure hit 2.5%, its lowest level since February 2021, heralding a period of stabilized price pressures.

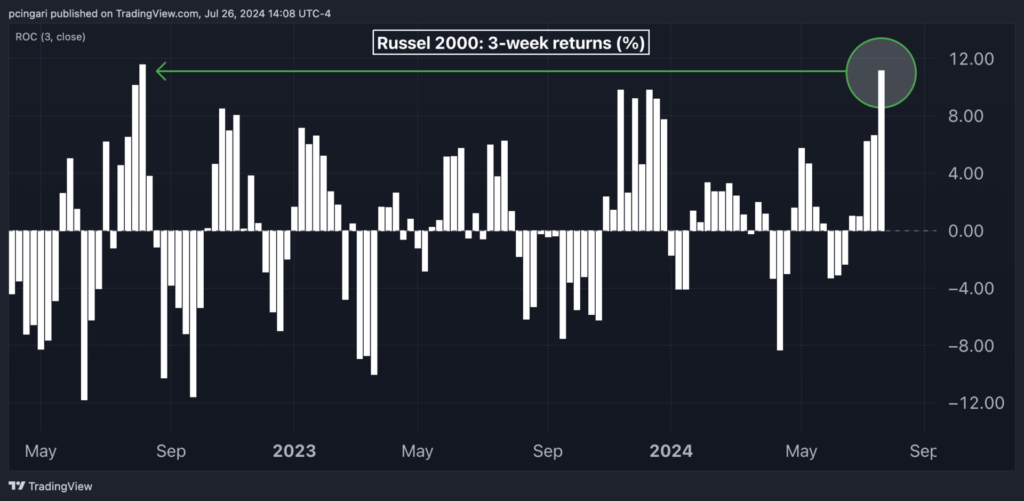

Over the past trio of weeks, small-cap stocks have surged by more than 11%, marking their most spectacular run since August 2022. In July alone, the iShares Russell 2000 ETF (IWM) pulled in over $6 billion in inflows, signaling a triumph in attracting investment this year.

Chart: Russell 2000 Index Notches Strongest 3-Week Rally In Nearly Two Years

Small Caps Reflect Confidence In Solid Economic Backdrop

Small caps serve as a barometer for the economy, as noted by chief global strategist Quincy Krosby of LPL Financial. With the prospect of interest rate cuts on the horizon, smaller stocks, more sensitive to such alterations than the S&P 500, have thrived.

Krosby points out that attractive valuations have further propped up this crescendo. The stability and performance of the broader financial sector have positively influenced the Russell 2000, particularly due to its significant exposure to small to mid-sized banks.

While acknowledging a cooling economy, Krosby emphasizes the resilience within, asserting that a collapse is not looming on the horizon. Continued investor inflows into small-cap stocks, amidst various uncertainties, epitomize faith in a sturdy economic foundation coupled with anticipated rate cuts.

Yet, she sounds a note of caution, highlighting that small-cap stocks, with their elevated risk profile vis-a-vis the S&P 500, could face abrupt sell-offs should investors perceive a seismic shift in economic direction.

In the upcoming week, all eyes will be fixated on a deluge of economic data, from payroll reports to FOMC meetings, which promise to sustain the ongoing small-cap revival.

Read Next:

An invitation to excel in volatile markets awaits at the Benzinga SmallCAP Conference on Oct. 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile. Enjoy exclusive access to CEO presentations, investor meetings, and valuable insights from financial maestros. Traders, entrepreneurs, and investors alike stand to gain at this event brimming with opportunities for portfolio growth and networking with industry stalwarts. Seize your spot and grab tickets today!

Image created using artificial intelligence via Midjourney.