The impending Q3 earnings season is imminent, with the much-anticipated unveiling of the big banks’ financial results scheduled for next Friday. Leading up to that, PepsiCo (PEP), a stalwart in the consumer staples domain, is poised to reveal its earnings on Tuesday, October 8th, prior to the markets opening.

Let us delve into the outlook for this consumer staples behemoth.

PepsiCo: What to Expect

PEP shares have displayed tepid performance in 2024, registering a modest 1.2% uptick as they largely meandered sideways throughout the year. Noteworthy is the fact that investors, influenced by the fervent rally in Technology stocks, have been progressively reducing their exposure to Consumer Staples stocks this year.

Displayed below is a visual representation of PEP shares’ year-to-date performance relative to the Zacks Consumer Staples sector and the S&P 500.

Image Source: Zacks Investment Research

Analysts have moderated their earnings forecasts for the upcoming quarter over recent months, with the Zacks Consensus EPS estimate resting at $2.30, reflecting a 2% dip since mid-July but indicating a 2.2% growth from the same period last year.

Image Source: Zacks Investment Research

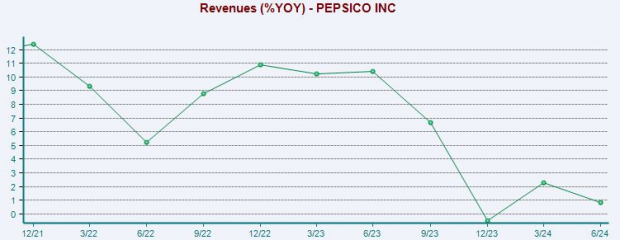

Revenue projections have followed a similar trajectory, with the expected $23.9 billion down marginally by 1% over the same period and reflecting a 1.9% upsurge from the corresponding period last year. Notable is the significant deceleration in the company’s revenue growth pace in recent periods, visually depicted below.

It is crucial to clarify that the chart below tracks the year-over-year percentage change, not actual sales figures.

Image Source: Zacks Investment Research

The current 19.6X forward 12-month earnings multiple for PEP shares does not reflect an expensive valuation historically, notably lower than the five-year median of 23.6X and the five-year peak of 27.8X. This reduced multiple mirrors investors’ tempered growth prospects, as mentioned earlier.

The sentiment leading into PepsiCo’s impending quarterly disclosure is cautiously subdued, with analysts mildly downward revising their earnings and revenue forecasts. While PEP shares have underwhelmed in 2024, a positive guidance could potentially inject vitality into the stock.

This scenario appears to call for a ‘wait and see’ approach, particularly in light of the downward revisions. Yet, as a defensive equity, PEP shares are less likely to suffer a severe downward plunge if the results fall short of expectations.