Shaking up their management teams, both Nike NKE and Starbucks SBUX are striving to regain their former glory after a period of sluggish growth.

Nike recently announced the retirement of its CEO John Donahoe, with veteran executive Elliot Hill stepping up to take the helm. On the other hand, Starbucks welcomed Brian Niccol as its new CEO, known for his remarkable stint at Chipotle Mexican Grill CMG.

Nike Faces Stock Decline Post Earnings

Although Nike surpassed earnings forecasts for its fiscal first quarter, its stock plummeted by over 5% in the subsequent trading session. Despite posting an EPS of $0.70, beating estimates by 34%, the company withdrew its full-year guidance. Nike’s Q1 sales of $11.58 billion fell short of expectations and decreased by 10% from the previous year.

Comparing NKE and SBUX Stock Performance

Year to date, Nike’s stock has witnessed a decline of over 20%, while Starbucks shares have remained relatively stable. Both companies have notably underperformed the broader market indexes, with Nike down by 46% from its 52-week high, and Starbucks trailing by 11% from its peak.

China Optimism for Nike and Starbucks

The significant presence of Nike and Starbucks in the Chinese market presents an optimistic outlook for long-term investors. With China’s recent stimulus measures aimed at boosting consumer spending, both companies stand to benefit from the evolving economic landscape.

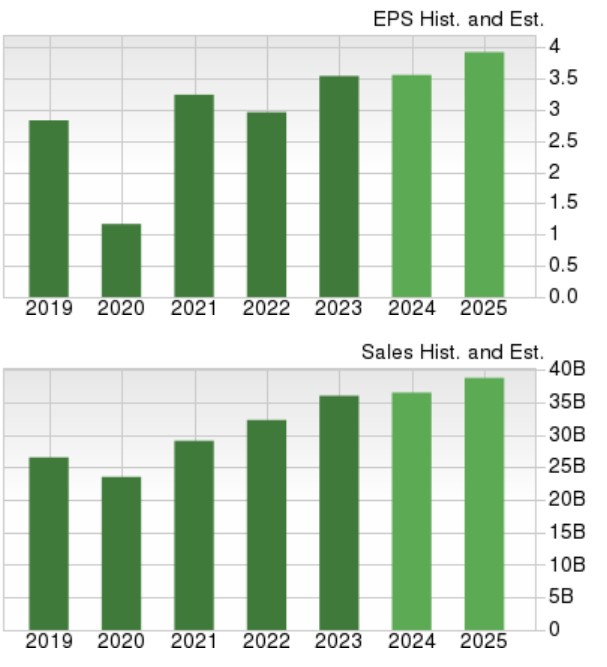

Projected EPS for NKE and SBUX

Zacks estimates indicate a projected 5% decline in Nike’s total sales for the current fiscal year, with a subsequent 4% increase forecasted for the following year. Nike’s annual earnings are expected to dip by 23% in FY25 but show a rebound of 13% in FY26. On the other hand, Starbucks is anticipated to witness a 1% rise in sales this year, with a further 6% expansion in FY25, accompanied by an expected 10% increase in EPS.

Image Source: Zacks Investment Research

Final Thoughts

While the legacy brands of Nike and Starbucks remain robust, investors may want to tread carefully in the current market landscape to capitalize on potential buying opportunities.