Intel Corporation INTC is gearing up to unveil its financial performance for the second quarter of 2024 on August 1. Analysts are setting the stage for revenue of $12.9 billion and earnings of 10 cents per share in their consensus estimates.

Over the past 90 days, earnings projections for INTC have witnessed a downward trend, slipping from $1.12 to $1.03 per share for 2024 and from $1.89 to $1.82 per share for 2025.

Forecast Trends for INTC

Image Source: Zacks Investment Research

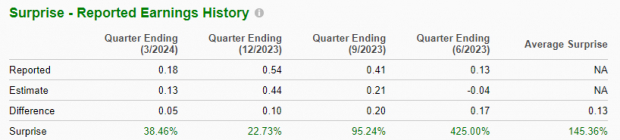

Earnings Performance Overview

Intel has been exceeding market expectations consistently, delivering an average earnings surprise of 145.4% over the past four quarters. In its most recent quarter, the company outshone estimates with a 38.5% earnings surprise.

Image Source: Zacks Investment Research

Earnings Speculation

Despite positive indicators typically leading to earnings beats, our model suggests that Intel might not surprise the market this quarter. The Earnings ESP stands at +10.79% combined with a Zacks Rank #4 (Sell), signaling the odds against an earnings beat.

Factors Influencing Upcoming Results

Intel’s recent advancements, such as the launch of the optical compute interconnect (OCI) chiplet and AI-focused Core Ultra processors, have showcased the company’s commitment to innovation. These developments aim to revolutionize data transmission, edge computing, and AI processing, potentially bolstering Intel’s competitive stance in the market.

However, geopolitical tensions, particularly China’s inclination towards domestic chip solutions over U.S.-based offerings and escalating competition from industry peers, pose challenges that may impact Intel’s earnings trajectory.

Market Dynamics and Competitor Landscape

Intel faces stiff competition in various sectors from rivals like Advanced Micro Devices, Arm Holdings plc, and NVIDIA Corporation. These competitors pose a threat to Intel’s market share in the server, storage, and networking domains, exerting downward pressure on its financial performance.

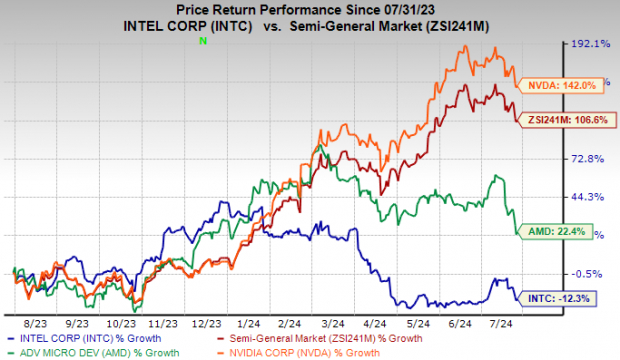

Stock Performance Analysis

Over the past year, Intel has witnessed a dip of 12.4% in its stock value, contrasting sharply with the industry’s growth of 106.6%. This underperformance against industry peers reflects the challenges Intel is encountering in the competitive landscape.

Image Source: Zacks Investment Research

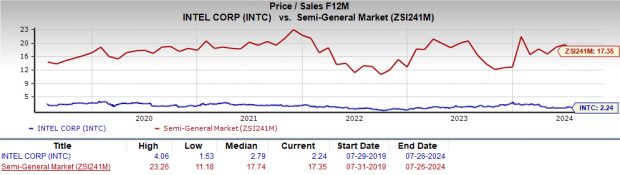

Valuation Metrics Review

From a valuation perspective, Intel appears undervalued compared to industry averages. With a price/sales ratio below the industry mean, Intel shares present an intriguing proposition for investors looking for potentially undervalued assets.

Image Source: Zacks Investment Research

Investment Outlook

Intel’s strategic focus on AI solutions underscores its commitment to driving innovation in the semiconductor industry. While opportunities abound, challenges stemming from intensified competition and geopolitical uncertainties necessitate a cautious approach for potential investors evaluating Intel’s prospects.

Intel’s ability to navigate these headwinds will be essential in determining its future performance.

Concluding Thoughts

Intel’s collaborative ethos in fostering AI ecosystems signifies its dedication to industry-wide progress. However, the evolving competitive landscape and geopolitical shifts call for a nuanced evaluation of Intel’s position in the semiconductor domain. As the company braces for its next earnings release, stakeholders await insights that will shed light on its trajectory amidst industry turbulence.