Deciding whether to invest in a stock often involves heeding the advice of Wall Street analysts. These recommendations, ranging from Buy to Sell, can significantly impact stock prices. But can investors truly rely on them?

Let’s delve into the views of brokerage heavyweights regarding Marathon Petroleum (MPC), explore the credibility of such recommendations, and understand how investors can leverage them effectively.

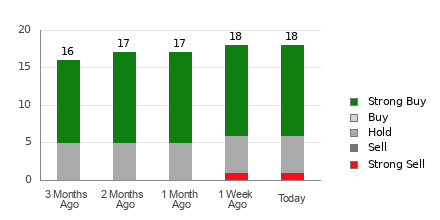

Marathon Petroleum currently boasts an Average Brokerage Recommendation (ABR) of 1.78, falling between a Strong Buy and Buy on a scale of 1 to 5. This ABR is an aggregation of 18 brokerage firms’ actual recommendations (Buy, Hold, Sell, etc.), with 12 out of 18 being Strong Buy, accounting for 66.7% of all recommendations.

Brokerage Insights on MPC

The ABR implies a recommendation to buy Marathon Petroleum, but solely basing investment decisions on this metric may prove unwise. Studies indicate that brokerage recommendations have limited success in identifying stocks poised for significant price appreciation.

Have you ever pondered why? Brokerage firms, driven by their stock interests, tend to exhibit a strong positive bias when rating the companies they cover. For every “Strong Sell,” there are typically five “Strong Buys” – a clear indication of skewed recommendations.

Therefore, caution is warranted when considering brokerage advice and it might be more beneficial to use these ratings as a validation tool alongside your independent research or a reliable predictive indicator.

Our proprietary stock rating tool, the Zacks Rank, backed by a reputable track record, categorizes stocks into five distinct ranks, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Flanked by reliable earnings estimate revisions, the Zacks Rank serves as a dependable gauge for short-term stock performance, complementing the ABR analysis.

ABR vs. Zacks Rank: The Distinction

While both ABR and Zacks Rank utilize a 1-5 scale, their methodologies differ considerably.

ABR hinges solely on brokerage recommendations and is usually depicted in decimals (e.g., 1.28). Conversely, the Zacks Rank is a quantitative model underpinned by earnings estimate revisions, represented in whole numbers from 1 to 5.

Brokerage analysts, due to inherent biases, commonly exhibit an overly optimistic outlook. Their ratings often surpass the firmness of their research findings, potentially leading investors astray more often than not.

On the other hand, the Zacks Rank thrives on the dynamism of earnings estimate revisions, reflecting a robust correlation between short-term stock prices and trend variations in earnings estimates.

Furthermore, unlike ABR, which may lack real-time relevance, the Zacks Rank remains continuously updated as analysts tweak their earnings estimates in response to evolving business landscapes. This timeliness ensures that the Zacks Rank paints an accurate picture of future price movements.

Assessing MPC Investment Viability

In terms of earnings estimate alterations for Marathon Petroleum, the current Zacks Consensus Estimate for the year has plummeted by 19.4% in the past month, settling at $10.76.

The prevailing pessimism among analysts regarding the company’s earnings trajectory, evident through a unanimous downtrend in EPS estimates, presents a plausible catalyst for a potential near-term decline in the stock value.

With the recent substantial consensus estimate modification and other pertinent factors affecting earnings projections, Marathon Petroleum lands a Zacks Rank #5 (Strong Sell). Delve into the full list of currently favored Zacks Rank #1 (Strong Buy) stocks here.

Hence, it might be judicious to approach the Buy-equivalent ABR for Marathon Petroleum with a grain of skepticism.

Infrastructure Stock Boom Anticipated Nationwide

A nationwide endeavor to revamp the deteriorating U.S. infrastructure is imminent. With bipartisan support and a critical mandate, trillions will be funneled into this initiative, presenting unparalleled wealth-creation prospects.

The looming question is, “Will you identify the prime stocks early, maximizing their growth potential?”

Zacks has unveiled a Special Report to aid your selection process, available at no cost. Unearth 5 companies poised to reap substantial benefits from the monumental infrastructure overhaul, encompassing renovations to roads, bridges, structures, and the transformative sectors of cargo transportation and energy.

Obtain FREE insights: How To Capitalize on the Trillion-Dollar Infrastructure Splurge >>