For the past year, the frenzy over artificial intelligence (AI) has propelled numerous technology stocks, including Microsoft (NASDAQ: MSFT), to soaring heights, with the share price breaching the $400 mark. This steep valuation can present a significant hurdle for individual investors, especially those lacking substantial capital to amass shares for their portfolios.

Given this predicament, Microsoft is now under scrutiny for a potential stock split.

Stock splits are a conventional maneuver that can afford advantages to both investors and employees. Yet, it is crucial for investors to discern certain critical aspects of stock splits.

Microsoft’s Historical Stock Splits and the Current Outlook

Stock splits serve a purpose, particularly in alleviating challenges for investors and employees. A high share price can complicate the accumulation of full shares, and for companies that furnish stock as part of employee compensation, it can undermine the employees’ ability to manage their stock liquidation. Consequently, a stock split diminishes these impediments for buyers and sellers alike.

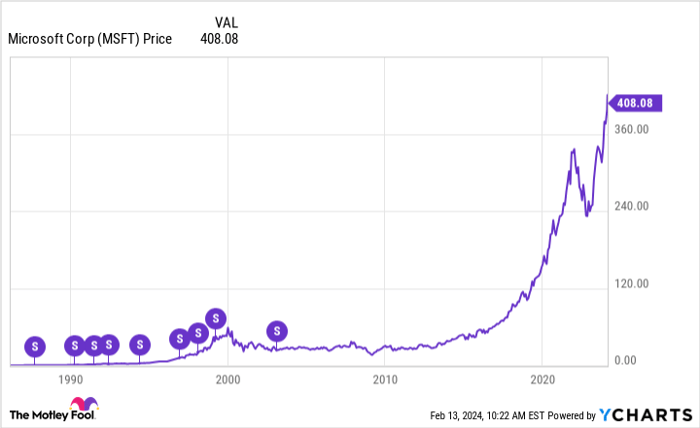

Notably, Microsoft has undergone multiple stock splits over the years, spanning from the late 1980s to the early 2000s. However, the company has refrained from executing a split for a considerable time. This prolonged hiatus is juxtaposed against the considerable appreciation in the share price, as evidenced in the chart below:

In 2010, Microsoft ushered in the era of Azure and cloud computing, and now, with the advent of artificial intelligence (AI), 2023 potentially marks the onset of Microsoft’s next prosperous epoch. A stock split could better position investors and employees for the seemingly bright prospects ahead.

The Crucial Fact About Stock Splits

One prevalent blunder made by investors with regards to stock splits is equating a lower share price with a reduced valuation. It is imperative to discern that price and valuation are not synonymous. In essence, investors are paying a specific amount for a share of the company’s profits. While a stock split divides the company into more units, each unit represents a proportionally lesser share of the company’s profits.

If Microsoft were to declare a 10-for-1 split, transitioning one share of stock into 10 smaller shares, for a $400 stock, each share would be priced at $40. This would result in Microsoft’s profits also being divided into 10 parts, leading to an earnings per share of $1.16, should the company earn its estimated $11.60 per share this fiscal year, which concludes in June.

The stock’s P/E ratio would remain constant, as the division yields the same quotient for $400 divided by $11.16 and $40 divided by $1.16: 34.5.

Contemplating an Investment in Microsoft

While the occurrence of a stock split should not be the basis for purchasing a stock, as it has no bearing on the underlying value of the investment, evaluating Microsoft’s valuation vis-à-vis its anticipated growth is an astute approach. Presently, Microsoft boasts a P/E ratio of approximately 35, and analysts project an average annual earnings growth of 15% over the long term. This translates to a PEG ratio of 2.3, indicating that Microsoft’s valuation is somewhat elevated in relation to its growth prospects.

MSFT PE Ratio (Forward) data by YCharts

The realm of stock valuation is not exact science; a company may outperform or underperform expectations, and hindsight often shapes the narrative. A long-term outlook is beneficial, affording Microsoft the opportunity to align its growth trajectory with and potentially surpass its stock’s valuation.

Regardless of the decision to invest in Microsoft, it is imperative to base it on the company’s fundamentals rather than speculation about a prospective stock split.

Where to invest $1,000 right now

It pays to heed stock tips from our analyst team, who have steered the Motley Fool Stock Advisor newsletter to more than triple the market over two decades.* The team has recently unveiled what they consider the 10 best stocks for current investment. Microsoft features in the list, among nine other potentially overlooked stocks.

*Stock Advisor returns as of February 12, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.