Taiwan Semiconductor Manufacturing Co TSM has embarked on a groundbreaking initiative: producing the Apple Inc’s AAPL A16 system-on-a-chip at Phase 1 of its renowned Fab 21 in Arizona.

The Apple A16 chip, leveraging Taiwan Semiconductor’s cutting-edge 5nm family, N4, marked its debut in 2022 with the remarkable iPhone 14 Pro. In a move signaling their commitment to innovation, Taiwan Semiconductor’s board greenlit an impressive capital injection of up to $7.5 billion into their Arizona operations in 2024.

Renowned journalist Tim Culpan has shed light on Taiwan Semiconductor’s ambitious plans to scale up production significantly upon the successful completion of the second stage of the Phase 1 fab.

Recent reports have surfaced, affirming that the production yields at the Arizona facility are on par with the impeccable standards set by Taiwan Semiconductor’s facilities in Taiwan.

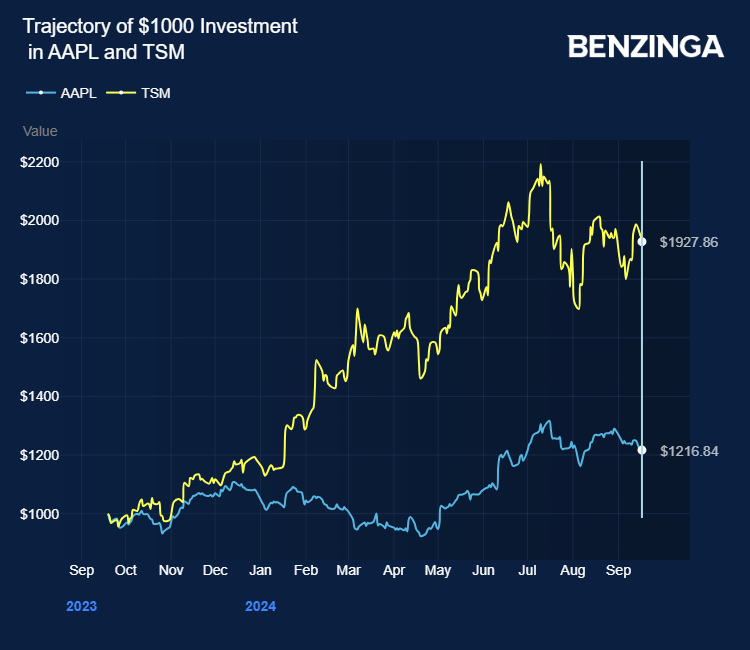

Notably, this pivotal development in Apple’s chip manufacturing landscape coincides with a challenging period for the tech giant in the crucial Chinese market. Apple witnessed a dip in its market share in China, falling to 14% in the second quarter of 2024, a decline of two percentage points compared to the previous year. The competitive landscape intensified further as Huawei Technologies Co set its sights on Apple’s premium smartphone market, unveiling the innovative tri-fold smartphone, Mate X, in close proximity to Apple’s iPhone 16 series launch. Despite these challenges, Apple’s stock value has surged by an impressive 22% over the last 12 months.

Meanwhile, the horizon appears bright for Taiwan Semiconductor as the revival of the smartphone market and the sustained demand for Nvidia Corp NVDA AI chips serve as potent growth drivers.

Recent industry murmurs suggest that Taiwan Semiconductor is poised to secure a lucrative deal with Alphabet Inc GOOG GOOGL for Google’s smartphone chip requirements related to Pixel 10 and Pixel 11, as tech juggernaut Samsung Electronics SSNLF and its subsidiary, Samsung Foundry, faced setbacks in delivering on their commitments.

Price Actions: Apple’s stock is currently showing a 1.4% uptick at $219.88 as of the latest market check on Wednesday, while Taiwan Semiconductor is up 0.23% at $167.74, reflecting an impressive 89% surge in value over the past 12 months.

Now Read:

Image: Shutterstock