Amidst the tempest of underwhelming Q3 data, Tesla (NASDAQ:) finds itself charting a course through turbulent waters. The recent shortfall in production and delivery numbers has plunged the EV maker’s shares into a bearish spin.

The stock, which had soared to the skies earlier this month, has now plummeted below recent highs, battered by fierce competition from Chinese contenders such as BYD (OTC:) and Geely (OTC:), as well as stalwarts like Ford (NYSE:) and General Motors (NYSE:).

With the share price taking a 3.36% nosedive to close at $240, hitting an intraday low of $237, the atmosphere is heavy with uncertainty, reminiscent of the low point observed on September 20.

From the doldrums of $182 on August 5, Tesla’s remarkable ascent of 45.5% to a peak of $264.86 not long ago feels like a distant memory.

The Weight of Production and Delivery Numbers

Investor sentiment is still reeling from the sting of Tesla’s latest production and delivery figures that failed to meet lofty expectations.

In Q3, Tesla handed over 462,890 vehicles, just shy of the 463,310 predicted by analysts, while production figures reached 469,796 units.

Comparatively, this marks an upturn from the prior year’s Q3, where Tesla reported 435,059 deliveries and 430,488 vehicles produced.

In the EV arena, Tesla is grappling with intensified competition, especially in China, from rivals like BYD, Geely, Li Auto (NASDAQ:), and Nio (NYSE:). Meanwhile, on American soil, players like Rivian (NASDAQ:), Ford, and GM are revving up their EV game.

The Road Ahead: Can Robotaxis Spark a Revolution?

Come the horizon of October 10, all eyes are fixated on Tesla as it gears up for its much-anticipated robotaxi event.

Postponed from its original August slot, the event promises a showcase of Tesla’s autonomous “Cybercab,” unveiling insights into production costs, operation locations, and potential app features. Anticipated are updates on a new budget-friendly vehicle and Tesla’s autonomous driving software, alongside the Optimus humanoid robot.

With a touch of Elon Musk’s captivating showmanship, these revelations could very well outshine the recent lukewarm delivery statistics, stirring the investment waters.

Q3 Earnings Loom: A Crucial Reality Check

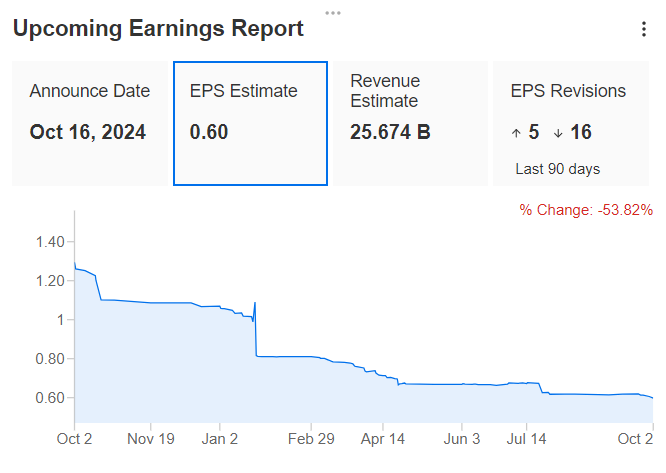

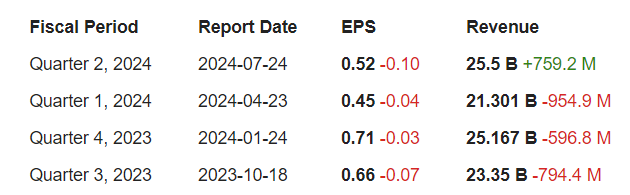

Yet, the reckoning approaches swiftly with Tesla’s Q3 earnings report looming on October 16.

Projections hint at an EPS of $0.60, a decline of 11% from the same quarter in the previous year. Sales are speculated to hit an average of $25.674 billion, signaling a 10% annual uptick.

Is Tesla Stock a Buy?

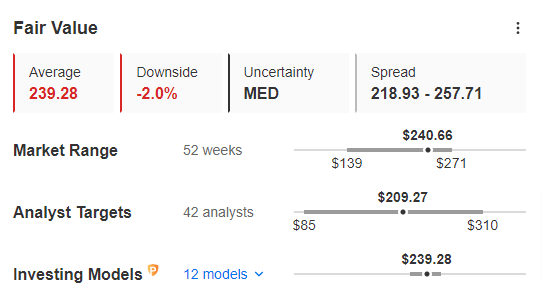

To gauge Tesla’s stock trajectory, a peek at analysts’ valuations is imperative.

Despite recent climbs, Tesla’s stock stands above the average target of $209.27, though still under Wednesday’s closing price.

At $239.28, Tesla’s fair value estimation by InvestingPro forecasts a potential 2% downturn.

Closing Remarks

Following a 45% surge, the disappointing Q3 deliveries could herald the advent of a correction phase for Tesla’s shares.

While the impending robotaxi extravaganza may reignite investor fervor, the subsequent Q3 earnings disclosure could ground the euphoria. For Tesla devotees and investors alike, the approaching weeks will hold the key to Tesla’s financial odyssey.

***

Disclaimer: This article is penned for informational purposes solely. It aims not to nudge asset purchases or feature any solicitation, offer, endorsement, or investment counsel. Remember, assets are evaluated from numerous facets and involve high risks, thus any investment action and its associated perils remain solely on the investor. No investment advisory services are offered.