Electric vehicle (EV) trailblazer Tesla TSLA achieved a significant legal win, emerging successful in a lawsuit challenging the veracity of the company’s Full Self-Driving (FSD) technology claims. U.S. District Judge Araceli Martínez-Olguín ruled in favor of Tesla, dismissing the case brought by shareholders who alleged CEO Elon Musk overstated the capabilities and timeline of FSD to artificially boost Tesla’s stock value.

Judge Martínez-Olguín found that many of Musk’s statements about Tesla’s self-driving technology were accurate, while others pertained to future plans yet to be realized. Notably, the plaintiffs failed to establish a direct connection between Musk’s involvement and any purported deceptive information. However, she granted the shareholders until Oct. 30 to submit a revised complaint if they opt to pursue the litigation further.

TSLA Gears Up for Q3 Outcomes and Robotaxi Day

October is poised to be a critical month for Tesla, with anticipation building around its upcoming third-quarter 2024 financial results and the highly awaited “Robotaxi Day” event on Oct. 10. The event is expected to showcase Tesla’s latest strides in autonomous driving and unveil its envisioned “cyber-cab.”

Tesla is yet to disclose its third-quarter delivery figures and earnings call date. Estimates suggest revenues for the quarter at $25.8 billion, reflecting a 10.4% rise year over year. The consensus for earnings per share (EPS) in the same quarter stands at 58 cents, signaling a 12% decline year over year. Nevertheless, Tesla holds an Earnings ESP of +7.85%, with the Most Accurate Estimate exceeding the Zacks Consensus Estimate by 5 cents.

Despite fluctuations in Tesla’s stock this year, shares surged by 22% over the last month. Enhanced investor confidence and enthusiasm for the company’s artificial intelligence (AI) and self-driving initiatives likely fueled the uptrend. Tesla outperformed industry, sector, and S&P 500 peers during this period, while traditional automakers like General Motors (GM) and Ford (F) witnessed share declines.

Image Source: Zacks Investment Research

Tesla’s Future Rides on FSD Amidst EV Margins Squeeze

Amidst escalating competition in the EV sector, Tesla’s steadfast focus on autonomous driving and AI is anticipated to be a game-changer. Tesla continues to make strides in FSD, rolling out software updates in September and enabling FSD in select Cybertrucks. The recent debut of Tesla’s humanoid robot project (Optimus) and the FSD Beta software (V12.5) deployment signify promising progress for the company. Tesla aims to launch robotaxis next year and produce several thousand Optimus robots for internal use by 2025.

However, the company faces challenges such as shrinking automotive margins due to aggressive pricing strategies and discounts. Tesla foresees a lower vehicle volume growth rate in 2024 compared to 2023, with margins expected to be under strain from elevated costs of goods sold and frequent price reductions. Projections indicate a drop in the automotive unit’s gross margin from 19.4% in 2023 to 18.4% in 2024.

Evaluating TSLA’s Market Value

At first glance, Tesla may appear overvalued at current levels, trading at 7.59X forward sales, considerably higher than industry averages.

Image Source: Zacks Investment Research

Despite this, Tesla’s involvement in rapidly expanding sectors like solar energy, clean energy, EV charging, and Full Self-Driving technology cannot be disregarded. Noteworthy is the fact that tech companies generally command higher valuations than traditional automakers, a realm where Tesla intersects. Hence, Tesla’s premium valuation may be justified.

Is Investing in Tesla Stock Prudent Now?

While Tesla’s AI and autonomy initiatives hold promise, presenting a strong long-term investment opportunity, immediate concerns must be acknowledged.

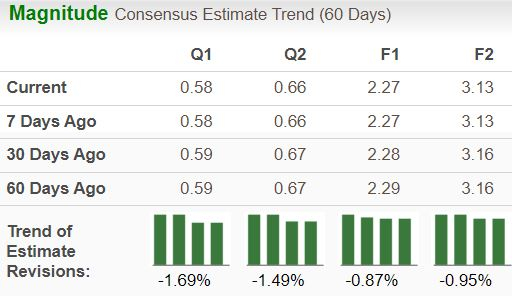

Over the past 60 days, EPS projections have been revised downward, reflecting apprehensions about Tesla’s short-term profitability.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Tesla’s 2024 EPS stands at $2.27 per share, indicating a 27.3% decline year over year.

Tesla’s ambitious plans are intriguing, but successful execution will be pivotal for its sustained growth. It might be prudent to observe Tesla’s performance in the third quarter and assess whether it aligns with the mounting expectations and excitement surrounding the upcoming robotaxi event. Presently, Tesla holds a Zacks Rank #3 (Hold).

You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boost in Infrastructure Stocks Imminent

A major initiative to revamp the deteriorating U.S. infrastructure is on the horizon. This bipartisan, urgent endeavor is inevitable, with trillions set to be allocated, and fortunes poised to be made.

The crucial question remains: “Will you invest in the right stocks early to maximize their growth potential?”

Zacks has unveiled a Special Report to guide you in this venture, available for free today. Uncover 5 key companies primed to benefit significantly from the massive construction projects on roads, bridges, buildings, as well as cargo transport and energy evolution on an immense scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want to stay updated with the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report