Tesla (NASDAQ:TSLA) is gearing up to reveal its financial results for the fourth quarter of 2023 on Wednesday, January 24. The electric vehicle (EV) giant is expected to see a boost in top-line growth due to higher deliveries, while the bottom line may face pressure from lower average selling prices compared to the previous year.

Tesla – Q4 Expectations

Wall Street analysts anticipate Tesla to report revenue of $25.63 billion in Q4, signaling a year-over-year growth of 5.4%. This growth is primarily driven by increased deliveries and higher automotive sales revenue. However, a reduction in overall price and adverse sales mix could counteract this growth.

Despite the expected improvement in the top-line, analysts foresee a decline in Tesla’s bottom line due to the reduction in the average selling price of its vehicles. The company’s cost-reduction efforts, however, are expected to soften this impact. It is estimated that Tesla will post earnings of $0.73 per share in Q4, down 38.7% from the previous year.

Analysts’ Ratings Ahead of Q4 Print

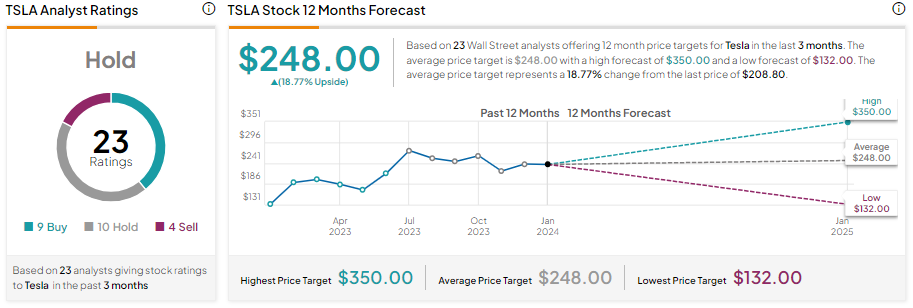

Morgan Stanley analyst Adam Jonas recently lowered Tesla’s price target to $345 from $380, citing a slowdown in demand. Meanwhile, Barclays analyst Dan Levy cut Tesla’s price target to $250 from $260 due to expected volume headwinds amid softening demand.

Is Tesla a Buy or Sell Now?

Despite facing macroeconomic challenges, Tesla stock has shown significant gains over the past year. However, consistent margin declines have led analysts to remain cautious. As of now, Tesla stock carries nine Buy, 10 Hold, and four Sell recommendations, indicating a Hold consensus rating. The average price target of $248 implies 18.77% upside potential from current levels.

Insights from Options Trading Activity

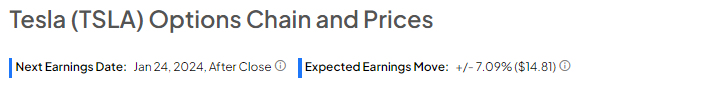

Options traders are currently pricing in a +/- 7.09% move on earnings, which is smaller than the previous quarter’s earnings-related move of -9.3%. This anticipated move is based on the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Tesla’s strategic focus on ramping up its vehicle production and delivery capabilities, cost reduction, and advancements in battery technologies bode well for long-term growth. However, concerns persist over near-term margin headwinds and softening demand.