Shares of electric vehicle maker Tesla are down 8% after the company’s Cybercab event failed to impress Wall Street analysts.

At the launch of the Cybercab, previously called the Robotaxi, Tesla CEO Elon Musk unveiled a self-driving concept car that had two seats and no steering wheel or pedals. Tesla said the car will be fully autonomous when it launches sometime by 2027, and will come with a starting price under $30,000.

Musk has staked Tesla’s future largely on self-driving vehicles. At the Cybercab unveiling, he pledged to have full self-driving functionality in Tesla’s Model 3 and Model Y electric vehicles in Texas and California by the end of 2025. However, despite Musk’s enthusiasm, it’s unclear when regulators will approve widespread use of self-driving vehicles.

Analysts Express Discontent

The Cybercab launch drew sharp criticism from analysts across Wall Street who quickly issued commentary condemning the event as little more than a publicity stunt. Barclays said that the event failed to highlight any near-term opportunities for Tesla that will boost the company’s sales.

Piper Sandler said it was “underwhelmed by the Robotaxi unveiling” and added that it expects the stock to selloff through the remainder of 2024. Analysts at Morgan Stanley said that Elon Musk failed to make the case that Tesla is an artificial intelligence (AI) company, adding that it left with “overall disappointed expectations.”

TSLA stock has now declined 15% over the last 12 months.

Assessing TSLA Stock

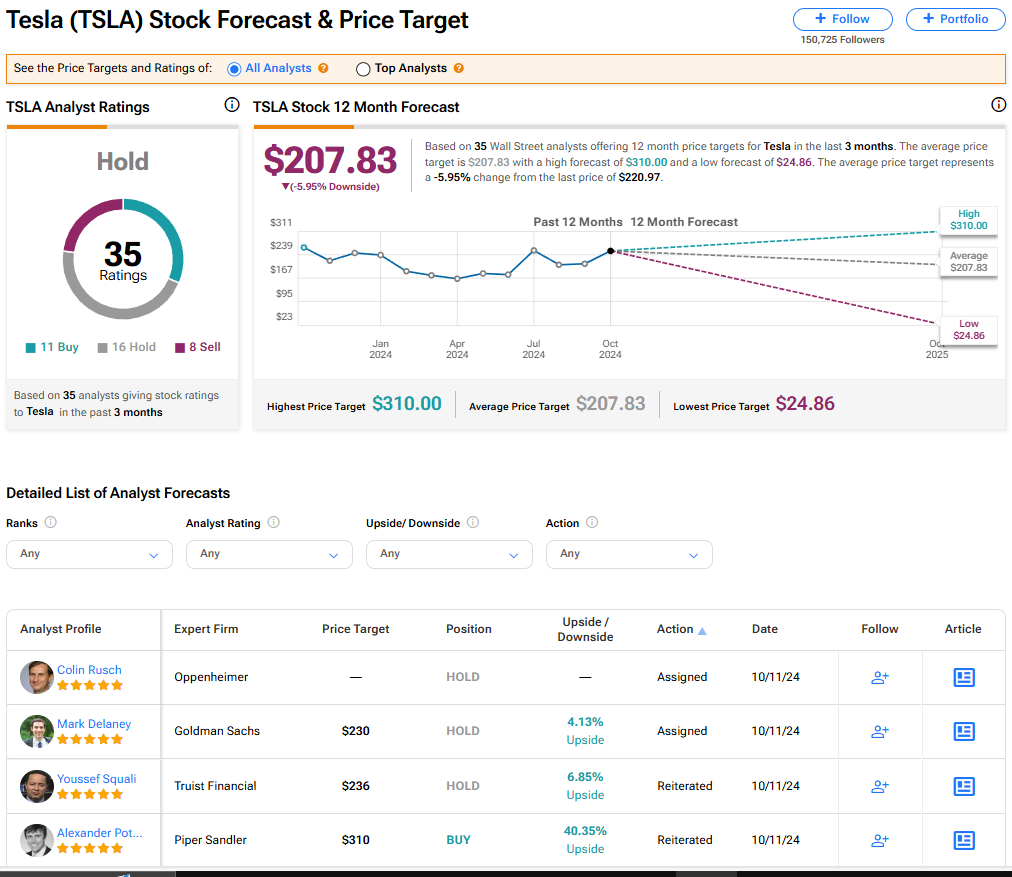

Tesla stock has a consensus Hold rating among 35 Wall Street analysts. That rating is based on 11 Buy, 16 Hold and eight Sell recommendations made in the last three months. The average TSLA price target of $207.83 implies 5.95% downside from current levels.

Read more analyst ratings on TSLA stock