Last summer, the U.S. Securities and Exchange Commission (SEC) filed lawsuits against prominent crypto exchanges Coinbase and Binance, alleging that they facilitated the trading of unregistered securities through various cryptocurrencies. This week, the courtroom hosted a tense face-off between the regulatory authority and the accused exchanges as each side presented arguments, reigniting a contentious legal saga.

You’re reading State of Crypto, a CoinDesk newsletter focusing on the intertwining of cryptocurrency and government.

The Ongoing Legal Contest

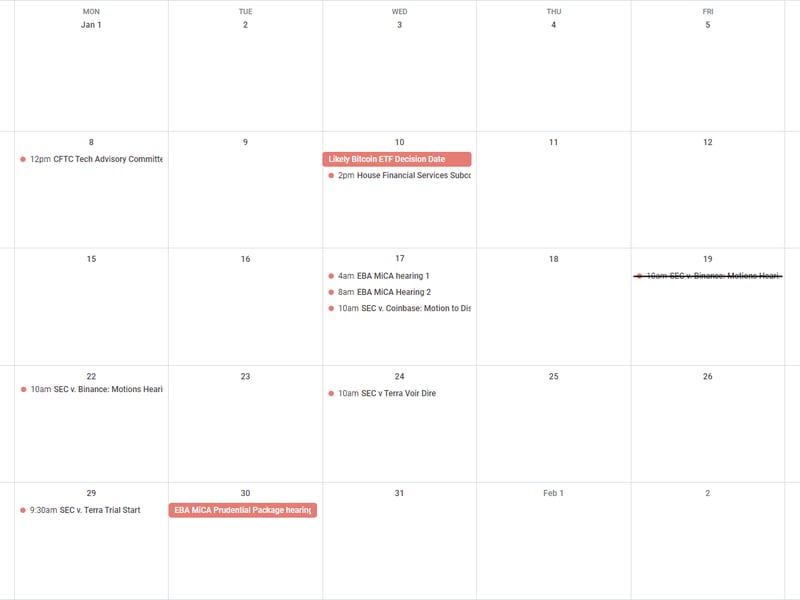

After last week’s anticipation surrounding the SEC’s potential approval of spot bitcoin exchange-traded funds (ETFs), attention has cycled back to the federal court as the SEC’s Enforcement Division contends that cryptocurrencies are indeed securities.

Implications for the Crypto Industry

The outcome of the SEC’s lawsuits against Coinbase, Binance, and Kraken holds significant consequences for the U.S. crypto sector. If the courts uphold the SEC’s position that certain digital assets are securities, it would impose stringent registration and reporting mandates on issuers and trading platforms. Conversely, a judicial ruling in favor of the defendants could provide a considerable boost to the industry, signaling a reprieve from the SEC’s oversight.

Nuts and Bolts

In June 2023, the SEC filed suits against Coinbase and Binance, accusing the platforms of listing digital assets such as solana (SOL), filecoin (FIL), and axie infinity (AXS), asserting that these assets qualified as unregistered securities.

Despite the inevitability of these suits, industry stakeholders, including lawmakers and lobbyists, have rallied in protest and submitted amicus briefs in support of the defendants’ pleas for dismissal.

Judge Katherine Polk Failla engaged in rigorous questioning during the hearing but has yet to deliver a verdict.

An SEC attorney emphasized during the hearing that the token itself was not a security but rather the transactions associated with it.

The SEC’s case against Binance faced a scheduling inconvenience, being postponed to Monday due to adverse weather conditions in Washington, D.C.

Elsewhere, a separate hearing contested the longstanding Supreme Court precedent known as the Chevron doctrine, with a potential overturn speculated following the proceedings.

Legal experts anticipate that an upheaval in this doctrine could discourage federal regulatory agencies from broadening interpretations of ambiguous statutes, potentially prompting Congress to take on a more proactive role in shaping industry regulations.

The week also witnessed a series of significant events:

- 09:00 UTC (10:00 a.m. CET) – The European Banking Authority (EBA) conducted the inaugural session of two hearings on the Markets in Crypto Assets Regulation (MiCA), focusing on regulatory technical standards (RTS) and implementing technical standards (ITS).

- 13:00 UTC (2:00 p.m. CET) – The EBA convened the second MiCA hearing, centering on guidelines for preventing illicit crypto activities.

- 15:00 UTC (10:00 a.m. EST) – A hearing in SEC v. Coinbase took place.

Additionally, the media provided valuable insight:

- Axios delivered a comprehensive timeline tracking the bitcoin ETF saga.

- The Air Current compiled a reading list offering an in-depth look at Boeing’s recent headline-making challenges.

- IRS announced a delay in implementing a controversial reporting requirement for businesses engaged in crypto transactions.

If you have any thoughts, questions, or suggestions for future topics, feel free to reach out to me at nik@coindesk.com or connect on Twitter @nikhileshde.

Join the group conversation on Telegram.

Until next week!