Have concerns cropped up that the “Magnificent Seven” stocks are losing their luster? In recent times, these high-flying stocks have continued their ascent, albeit at a pace below 10%.

While these companies may still hold their magnificence, lofty valuations may be causing some investors to pause. Analysts suggest that there could still be lucrative opportunities hidden within the Magnificent Seven, though perhaps not where one might presume.

New Insights into the “Magnificent Seven” Stock Selection

Let’s delve into the consensus analyst price targets for each of the Magnificent Seven, along with the potential upside based on their closing prices from the previous week.

| Stock | Price Target | Upside % |

|---|---|---|

| AAPL | $205.27 | 19% |

| AMZN | $197.95 | 13% |

| GOOG | $146.33 | 3% |

| MSFT | $415.00 | 0% |

| META | $494.53 | 2% |

| NVDA | $829.66 | (6%) |

| TSLA | $211.93 | 30% |

Source: MarketBeat. Upside based on closing prices from March 15, 2024.

Price targets represent analysts’ expectations on a stock’s future performance, typically over the next 12 months. A high price target or negative upside, like in the case of Nvidia, which has seen substantial gains, may not imply an immediate price decline. As Nvidia, with its low price target and negative upside, may have been hindered by its rapid growth. Considering the potential long-term growth prospects of the company, it might still pose a promising investment.

In Tesla’s scenario, its appeal may arise from recent downward movement. The electric vehicle maker has experienced a 30% decrease in shares this year, attributed to shrinking margins, heightened competition, and concerns about EV demand amidst economic uncertainties. This discrepancy in Tesla’s stock valuation could be a result of analysts lagging in factoring such adversities into their price targets.

The Reality Behind Tesla’s Position in the Magnificent Seven

Looking at current price targets, one might be tempted to consider Tesla as the prime investment option. Yet, the scenario changes when incorporating expected earnings figures, revealing Tesla as the most overpriced stock in the group.

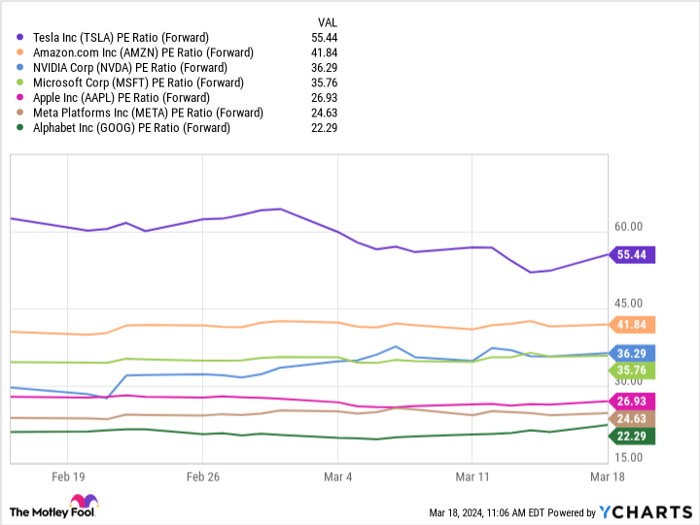

Forward PE Ratios data by YCharts

Looking at forward price-to-earnings multiples serves as a compass for investors relying on expected earnings over the upcoming year.

Yet, Tesla’s valuation predicament comes to light; investors continue to pay a premium for the stock. Surprisingly, amidst Nvidia’s remarkable returns, it stands in the middle ground due to sturdy profits and foreseeable growth prospects.

Rethinking Tesla’s Viability Within the Magnificent Seven

While Tesla may recuperate in the long haul, it presently holds the highest risk among the Magnificent Seven stocks. Other options within the group could offer a more secure long-term investment.

Investors should tread carefully, avoiding heavy reliance on outdated analyst price targets. A rapidly declining stock might falsely present significant upside potential, evident in Tesla’s case.

Focus on the long term—whether embracing Nvidia for its AI chips or Amazon for its flourishing e-commerce expansion, there exist more enticing picks compared to Tesla at the moment.

Where to invest $1,000 right now

When our analyst team speaks, it’s prudent to lend an ear. Their two-decade-long newsletter, Motley Fool Stock Advisor, has outperformed the market threefold.*

They’ve divulged what they deem the 10 best stocks for current investors to consider, with Tesla making the list—nonetheless, there are nine other overlooked stocks worth exploring.

*Stock Advisor returns as of March 20, 2024

Suzanne Frey, an Alphabet executive, sits on The Motley Fool’s board of directors. Randi Zuckerberg, a former Facebook director, and spokesperson, and sister to Meta Platforms CEO Mark Zuckerberg, is another board member. John Mackey, the former Whole Foods Market CEO and an Amazon subsidiary, is also a board member. David Jagielski holds no position in any stock mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. Additionally, The Motley Fool recommends specific options. It upholds a strict disclosure policy.