When examining the Dow Jones Industrial Average, it’s easy to underestimate the diverse potentials hidden within its components. Over the years, the Dow has shed its antiquated skin and embraced a more modern outlook, incorporating innovative companies like Amazon and Nike into its fold.

Despite being stalwarts in their respective industries, both Amazon and Nike show promising signs of growth and stability that could propel them to new heights in 2024 and beyond.

Unpacking Amazon’s Potential

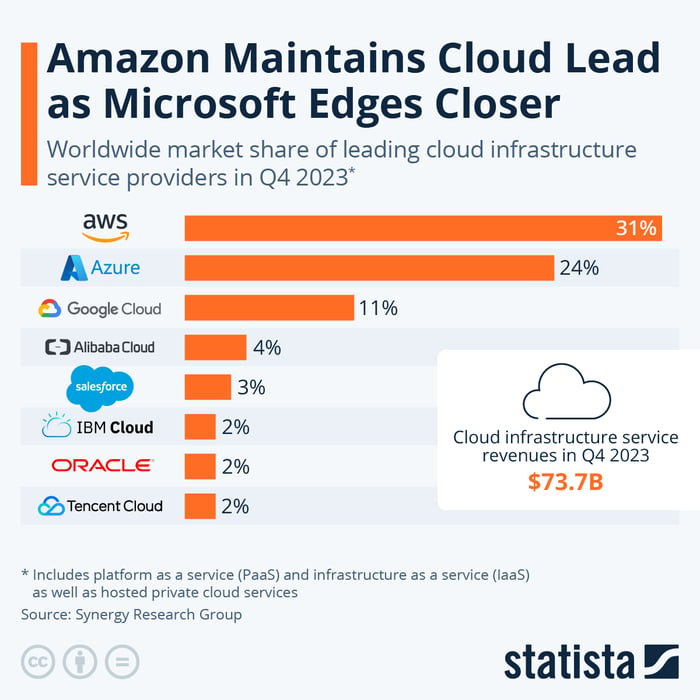

Amazon’s reach extends far beyond its e-commerce platform, with Amazon Web Services (AWS) emerging as a pivotal player in the cloud computing space. AWS’s role in supporting AI-driven applications positions Amazon as a leader in technological innovation.

In 2023, while AWS accounted for only 16% of Amazon’s revenue, it was responsible for two-thirds of the company’s operating income, underscoring its importance in driving profitability.

Image source: Synergy Research Group.

With a market cap of $1.8 trillion and expected net income growth rates of 44% in 2024 and 26% in 2025, Amazon offers a compelling investment opportunity. Its foray into AI-driven services positions it as a frontrunner in the tech landscape, all without demanding a hefty premium from investors.

The Rise and Reset of Nike

Nike has carved a niche for itself in the sporting goods market, capitalizing on a blend of brand recognition and operational efficiency. Its global supply chain efficiencies enable cost reduction while ensuring a loyal customer base.

Despite recent challenges in the marketplace, Nike’s investment in R&D, marketing, and endorsement deals with prominent athletes underscores its commitment to innovation and brand loyalty.

While facing a 45% dip from its pandemic-induced highs, Nike’s upcoming brand refreshes and strategic marketing initiatives around the Summer Olympics could serve as catalysts for its resurgence in the market.

Analysts anticipate an 18% profit increase by the next fiscal year, potentially mitigating concerns around its forward P/E ratio of 28 and reigniting investor interest in the iconic sportswear brand.