Large-cap technology stocks, especially those tied to the AI sector, have experienced significant downward pressure lately, catching the attention of many keen investors.

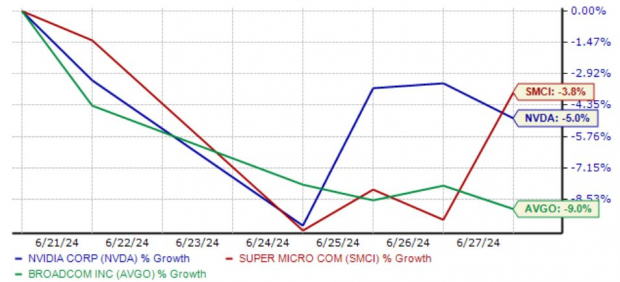

Notably, the beloved icons Nvidia NVDA, Super Micro Computer SMCI, and Broadcom AVGO have all witnessed significant dips in their stock prices, as depicted in the performance chart below tracking their progress since last Friday, June 21.

Image Source: Zacks Investment Research

This price action begs a pertinent question – is this merely a temporary setback, presenting a golden opportunity for astute investors waiting on the sidelines? Let’s delve deeper into the situation.

Nvidia’s Remarkable Data Center Performance

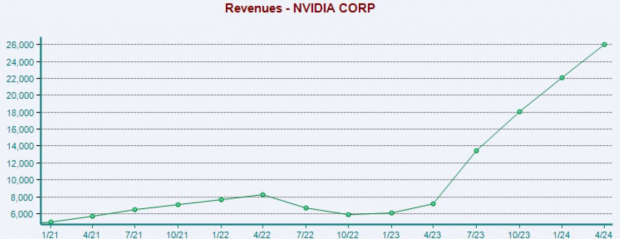

Nvidia’s Data Center sales have been at the forefront of the AI rush, showcasing extraordinary growth over the past year as businesses scramble to acquire chips. In its most recent quarter, Data Center revenue reached $22.6 billion, once again surpassing our consensus estimates and setting yet another quarterly record.

Illustrated below is a chart demonstrating the company’s quarterly revenue trend.

Image Source: Zacks Investment Research

The company’s remarkable growth has also maintained valuation multiples at historically reasonable levels, with the current 43.0X forward 12-month earnings multiple sitting below the five-year median of 50.7X and the five-year high of 106.3X.

It’s worth noting that NVDA shares had previously traded well above the current valuation levels back in 2020 and 2021, demonstrating the potential upside since the full emergence of the AI theme.

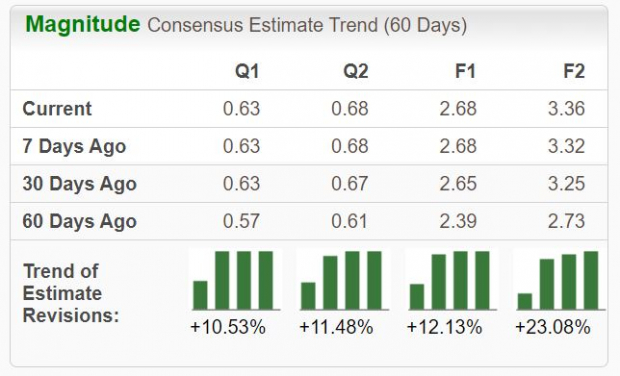

Image Source: Zacks Investment Research

Despite the recent price downturn, the optimistic narrative surrounding the stock rings true. Analysts continue to make positive revisions across the board, upholding the company’s Zacks Rank #1 (Strong Buy) status. With encouraging earnings estimates and a solid valuation outlook, the recent retreat could indeed signal a promising entry point.

Image Source: Zacks Investment Research

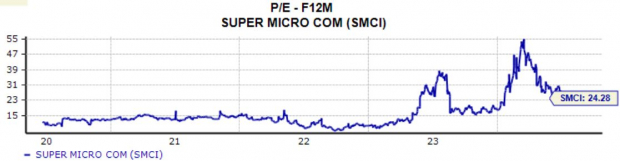

Super Micro Computer’s Strong Performance

Super Micro Computer has been a standout performer in 2024, with its shares skyrocketing by nearly 200%, making it the top-performing stock in the S&P 500. The company is a prominent provider of application-optimized, high-performance server and storage solutions catering to various computation-intensive workloads, explaining the robust demand it’s experiencing.

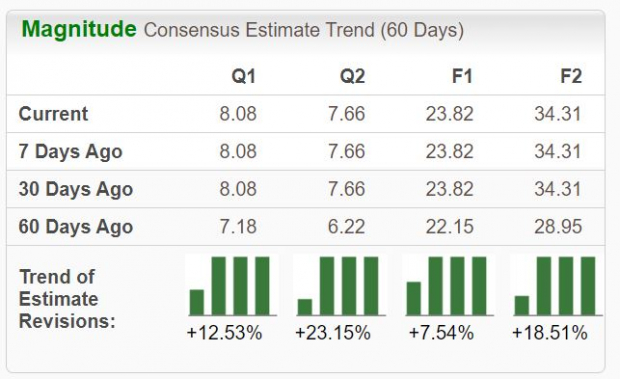

The earnings outlook for the company remains bright, with consistent revisions over the past few weeks indicating bullish sentiment from analysts. The growth trajectory appears promising, with consensus predictions for the current fiscal year pointing towards a 100% increase in EPS on a 110% surge in sales.

Image Source: Zacks Investment Research

Although the shares are trading at a forward 12-month earnings multiple of 24.3X, reflecting a premium compared to historical levels, they still present a significant discount from the 2024 high of 54.7X. This higher multiple mirrors investors’ expectations, with the current 0.4X PEG ratio also indicating a sound investment level.

Image Source: Zacks Investment Research

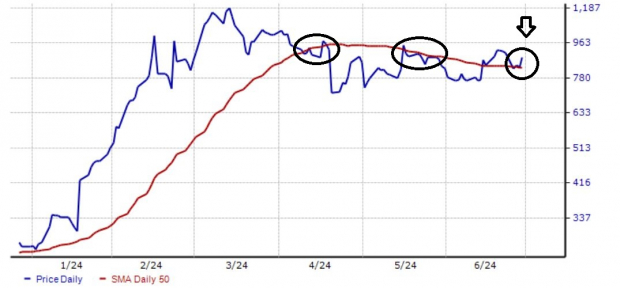

It’s worth highlighting that the shares have surpassed the 50-day moving average, a significant level that had previously acted as a resistance point.

Image Source: Zacks Investment Research

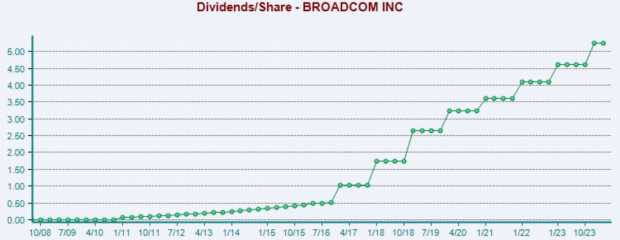

Broadcom’s Record AI Revenue

Broadcom, a global tech leader specializing in semiconductor and infrastructure software solutions, recently reported record revenue from AI products amounting to $3.1 billion, greatly pleasing investors post-earnings.

Subsequent to this strong performance, the company raised its sales forecast for the current year, coupled with an 18% year-over-year surge in free cash flow to $5.3 billion. AVGO has built a reputation as a consistent cash generator, enabling it to steadily increase its dividend payouts over the years.

Image Source: Zacks Investment Research

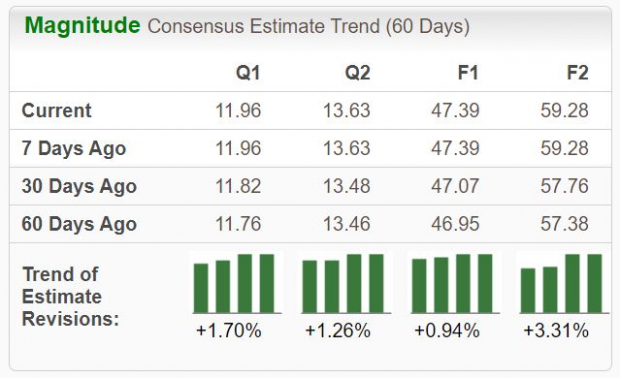

Following the favorable quarterly results, analysts revised their earnings projections upwards unanimously. The shares are currently trading at a 28.9X forward 12-month earnings multiple, notably higher than the five-year median but comfortably below the 2024 peak of 42.0X.

Image Source: Zacks Investment Research

The Verdict

Despite the recent challenges faced by several large-cap technology stocks associated with the AI sector, the three companies highlighted – Nvidia NVDA, Super Micro Computer SMCI, and Broadcom AVGO – continue to exhibit promising earnings prospects, supported by stable revisions.

The fundamental narrative remains unchanged, with market participants likely capitalizing on profits following substantial gains. The bullish sentiment persists, with earnings estimate revisions underscoring the positive business trends in play.

Want to read more articles?

Explore similar articles on Zacks Investment Research