Investors eyeing pharmaceutical behemoth Eli Lilly (NYSE: LLY) have reason to celebrate. With shares skyrocketing over 50% in the first half of the year, propelled by promising developments in the diabetes and obesity-care markets, the mood is undeniably upbeat.

While the buzz around Mounjaro and Zepbound intensifies, there’s more brewing at Lilly. In early June, the company received a shot in the arm from an advisory panel associated with the Food and Drug Administration (FDA).

The Dawn of Positive News for Lilly

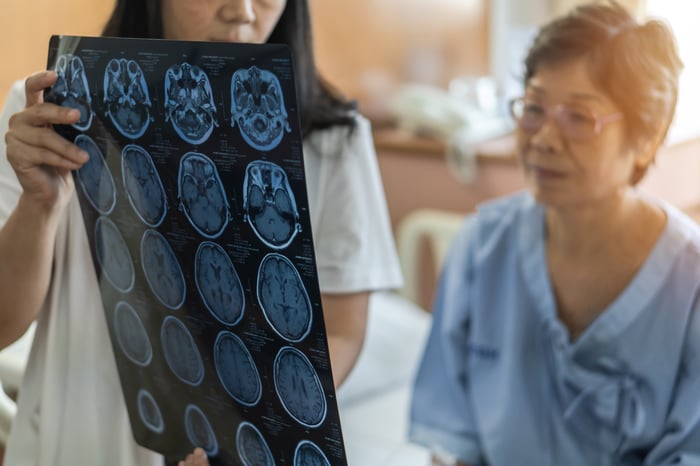

Amid its multitude of pursuits, Lilly places a premium on securing FDA approval for donanemab, its candidate aimed at battling Alzheimer’s disease. Reports suggest that every member of the FDA panel evaluating donanemab voted in favor of its potential use. While this doesn’t signify formal FDA approval, the panel’s favorable stance bodes well for investors.

Image source: Getty Images.

Unraveling the Alzheimer’s Market Landscape

Forecasts by Statista hint at a staggering surge in Alzheimer’s cases among the elderly in the U.S., with estimates peaking at 8.5 million by 2030 and a possibility of 13.8 million by 2060.

Grand View Research paints a rosy picture for the Alzheimer’s therapeutics market, predicting a robust 20% compound annual growth rate from 2023 to 2030, possibly resulting in over $15 billion in treatment revenues by 2030.

In a global context, Market.us reports that the worldwide Alzheimer’s disease market might ascend to a whopping $31 billion by 2033.

The Inflection Point for Lilly’s Business

With just a handful of notable players specializing in Alzheimer’s treatment like Biogen and Eisai, creators of Leqembi, Lilly enjoys a relatively uncluttered competitive landscape. Coupled with the immense market potential for Alzheimer’s treatments, Lilly could find itself in a sweet spot. Despite donanemab’s pending FDA approval and the recent encouraging signals from the FDA’s external panel, success is not a foregone conclusion.

Optimistically, I envision donanemab clinching approval by late 2024. The approval would not only open revenue floodgates but also aid in diversifying Lilly’s product portfolio. This diversification, I believe, holds more strategic value than the sheer sales numbers from donanemab.

Lilly’s revenue currently hinges on a trio of pillars: Mounjaro, Trulicity, and Verzenio, with Mounjaro being a diabetic mainstay rivalling Novo Nordisk’s Ozempic. Alongside, Zepbound, a newcomer in obesity treatment approved in November 2023, shows promising sales figures exceeding $2 billion on an annualized basis.

Verzenio’s oncological application, bolstered by an expanded FDA indication last year, showcases accelerated growth, hinting at Lilly’s robust pharmaceutical lineup.

Lilly’s legacy of medical innovation has underpinned its rise as a major healthcare entity, furnishing ample financial firepower to nurture new drug candidates. Donanemab signifies yet another shot at blockbuster status, poised to kindle fresh growth for the stalwart Lilly amid its reign as a healthcare juggernaut.

Is Eli Lilly a Gem for Investment?

Before diving into Eli Lilly shares, ponder this:

The Motley Fool Stock Advisor analysts have identified what they deem the 10 best stocks ripe for investors now, with Eli Lilly surprisingly omitted. The selected stocks are poised for substantial returns in the near future.

Think back to when Nvidia joined this elite list in April 2005 — a $1,000 investment back then would have burgeoned to a staggering $759,759 by now!*

Stock Advisor equips investors with a roadmap to success, furnishing portfolio construction advice, analyst insights, and bi-monthly stock picks. Since 2002, the service has outperformed the S&P 500 by a remarkable margin.*

*Stock Advisor returns as of June 24, 2024