The tech sector, a magnetic force for investors, remained a focal point and source of capital influx in the first quarter. Those seeking a blend of Nasdaq exposure with tax-efficient, generous monthly income should cast their gaze towards the NEOS Nasdaq 100 High Income ETF (QQQI).

Following a fortnight of lackluster performance, tech equities surged in Monday’s trading realm. Reports that Apple was on the cusp of securing an iPhone license agreement with Google’s Gemini AI breathed life into Alphabet’s stocks, pushing them up by 5%, as per CNBC. Concurrently, Nvidia (NVDA) catapulted its stock value by inaugurating the GTC Conference, a high-octane event focusing on AI technologies.

Citing Jay Hatfield, the luminary founder and CEO of Infracap, market revival is anticipated in the upcoming month with the advent of earnings season.

“We’re currently dwelling in this trough of seasonal weakness, leaving investors grappling with uncertainty,” remarked Hatfield in a dialogue with CNBC. The market volatility has caused a seesaw effect, oscillating between selling off tech shares and liquidating stakes in other market segments.

Elevating Nasdaq Income Prospects with QQQI

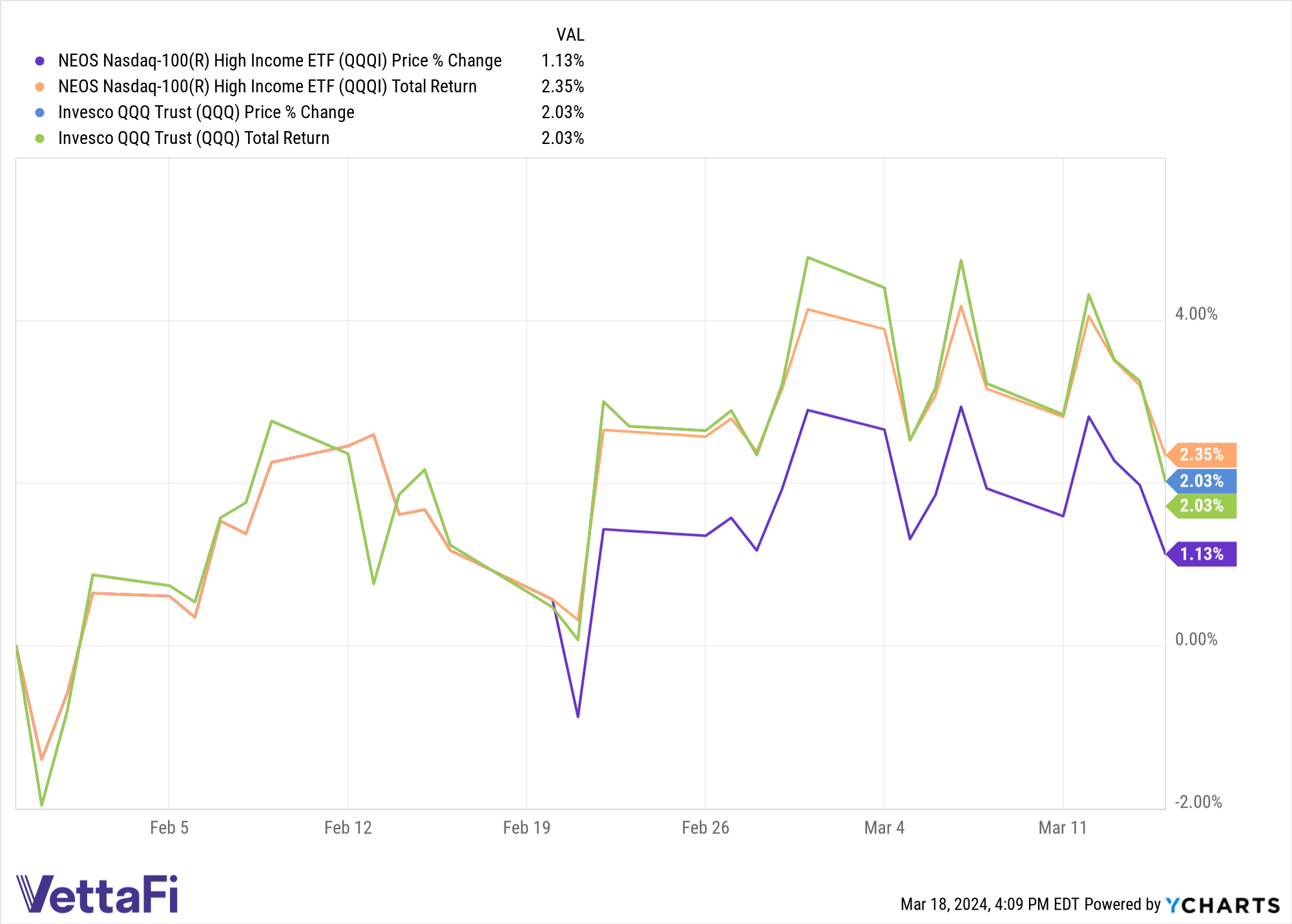

Amidst the tumultuous waves of market unpredictability, the NEOS Nasdaq 100 High Income ETF (QQQI) emerges as a beacon of opportunity. The fund, strategically designed to deliver substantial monthly income while navigating the Nasdaq-100 landscape, offers investors a chance to ride the tech wave.

Utilizing an options strategy entwined with covered calls, QQQI has witnessed a remarkable surge in net flows, eclipsing $30 million since its launch on January 30. This innovative approach generates premiums that can potentially cushion any market downtrends.

The beauty of QQQI lies in its tax-efficient framework, utilizing call options on the NDX that fall under the purview of section 1256 contracts, garnering favor with IRS regulations. These options, treated as if disposed of at fair market value on the last trading day of the year, incur capital gains or losses taxed at a favorable ratio—60% long-term and 40% short-term.

In the volatile terrain of market fluctuations, NEOS possesses the agility to tactically manage call options to seize underlying asset gains or hedge against losses. Furthermore, the fund’s managers engage in tax-loss harvesting maneuvers throughout the year on both call options and equity holdings, ensuring a prudent financial approach.

QQQI flaunts an expense ratio of 0.68%, solidifying its commitment to investor rewards amidst the relentless market dynamics.

For exhaustive insights, retrospection, and expert analysis, navigate to the Tax-Efficient Income Channel.