GE Aerospace, once part of the powerhouse General Electric, offers innovative aviation solutions and diverse integrated businesses. On the other hand, General Mills, a global giant in consumer food manufacturing, continues to provide a stable investment option.

This year has seen a significant rise of +23% in GE Aerospace’s stock and a commendable +8% surge in General Mills’ shares. With these impressive numbers, investors are pondering whether it’s the right time to dive into stocks of these iconic companies for additional gains.

Image Source: Zacks Investment Research

Growth Signals

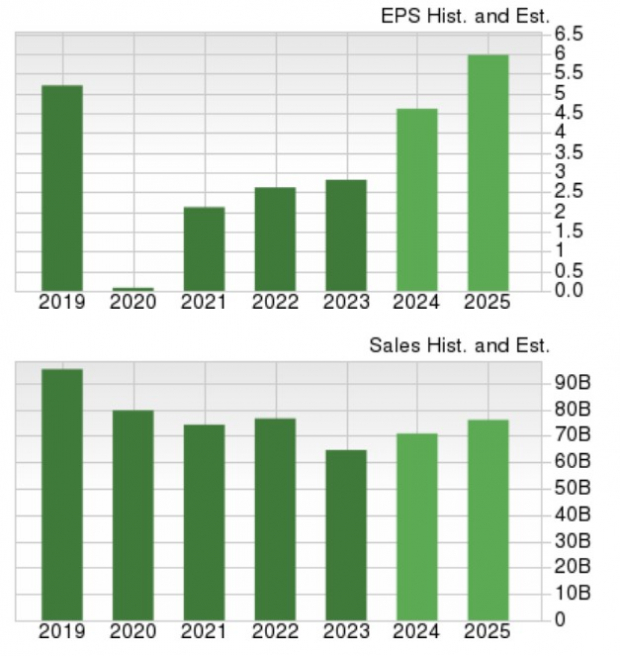

GE Aerospace is set for a phenomenal journey with annual earnings predicted to surge by 64% in fiscal 2024, reaching $4.61 per share compared to $2.81 per share last year. Even more enticing, FY25 anticipates another 29% growth to $5.97 per share. On the revenue front, total sales are expected to climb by 8% this year and a further 7% in FY25, reaching $76.02 billion.

Image Source: Zacks Investment Research

Looking at General Mills, a 5% EPS growth is estimated in FY24, with a 3% increase anticipated in FY25 to $4.65 per share. While total sales might see a slight dip in FY24 to $20.04 billion from $20.09 billion in 2023, FY25 is predicted to bring a 1% uptick to $20.24 billion.

Image Source: Zacks Investment Research

Valuation Insights

With GE Aerospace trading at around $155 per share, its forward earnings multiple stands at 33.9X, a notable premium compared to the Zack’s Diversified Operations Industry average of 21.3X and the S&P 500’s 21.9X. Despite this, GE Aerospace’s industry leadership shines, standing tall alongside notable peers like Honeywell International and 3M.

Image Source: Zacks Investment Research

Comparatively, General Mills boasts a stock price of $70 trading at a more enticing 15.4X forward earnings multiple. This figure lands comfortably below the industry benchmark and the Zacks Food-Miscellaneous Industry average of 17.1X, with close competitors including Kraft Heinz and Conagra Brands.

Image Source: Zacks Investment Research

Dividend Comparison

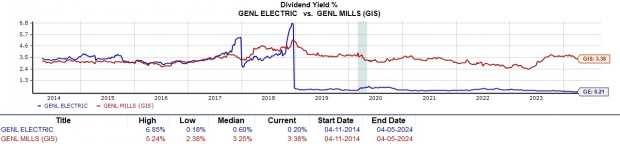

General Mills stands out in the dividend arena with a 3.38% annual yield, outshining the S&P 500’s 1.3%. In contrast, GE Aerospace lagged behind with a 0.2% yield after reducing its payouts following the pandemic.

Image Source: Zacks Investment Research

Final Thoughts

The resurgence in both top and bottom lines for GE Aerospace is captivating investors, along with the stock’s impressive performance this year. However, the compelling valuation and generous dividend from General Mills provide a strong counterargument. For now, both stocks hold a Zacks Rank #3 (Hold), making them intriguing options for investors exploring potential in the market.

5 Stocks Set to Double:

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. Previous recommendations have proven successful with massive gains, making this report a valuable source for investors seeking hidden gems in the stock market.