After posting solid results for its fiscal second quarter on Thursday, investors may be contemplating whether it’s the right time to dive into Lamb Weston’s LW stock. Lamb Weston has built a reputation as a standout performer on Wall Street, in the league of esteemed consumer food firms like General Mills GIS and Hormel Foods HRL.

As the leading supplier of frozen potato products in North America, with a global presence, let’s evaluate whether this is the opportune moment to consider investing in Lamb Weston’s stock, following its remarkable Q2 performance.

Q2 Earnings & Achievements

Lamb Weston CEO Tom Werner attributed the company’s strong financial results in the quarter to effective execution across customer channels in North America and key international markets. This success was driven by inflation-driven pricing actions, improvements in customer and product mix, and supply chain productivity cost savings.

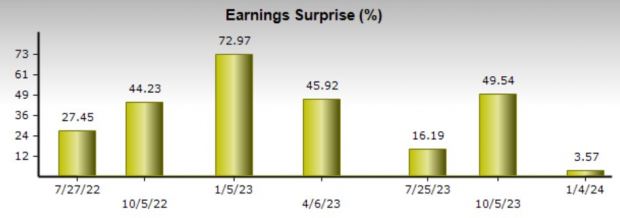

Lamb Weston reported a 36% year-over-year increase in net sales to $1.73 billion, surpassing the Zacks consensus by 2%. Adjusted net income rose 17% year over year to $212 million, with earnings per share up 13% to $1.45, beating expectations by 3%.

Notable milestones for the quarter included Lamb Weston repurchasing $50 million of common stock and raising its quarterly dividend by 29% to $0.36 per share.

For its full-year 2024 outlook, Lamb Weston increased its adjusted net income target to $830-$900 million and raised its earnings per share target. It also upheld its net sales target and adjusted EBITDA target.

Image Source: Zacks Investment Research

Growth & Future Prospects

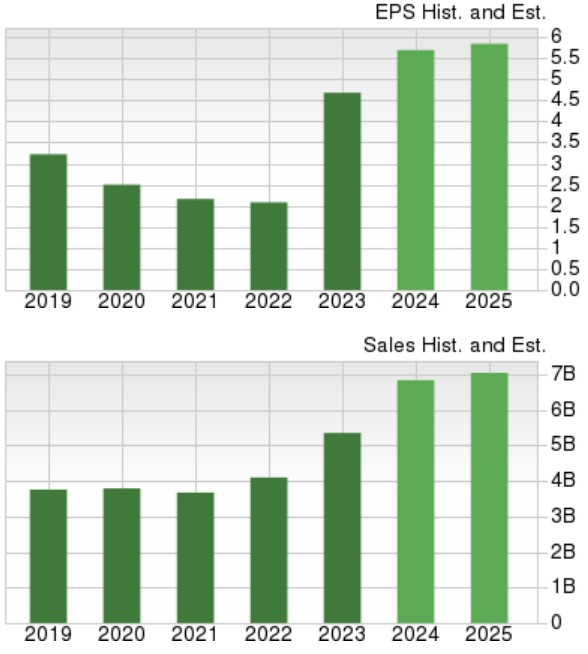

Zacks estimates reveal that Lamb Weston’s annual earnings are predicted to increase by 25% in fiscal 2024 to $5.84 per share, with further growth expected in fiscal 2025. Total sales are also anticipated to surge by 28% this year and 5% in the following fiscal year.

Image Source: Zacks Investment Research

Recent Performance

While other consumer food stocks have struggled over the last year, Lamb Weston’s stock has outperformed its sector and key rivals, with impressive gains over the past three years.

Image Source: Zacks Investment Research

Final Thoughts

Lamb Weston’s stock currently holds a Zacks Rank #3 (Hold). However, with the company’s improved earnings per share guidance, it is conceivable that annual earnings estimate revisions might trend higher in the coming weeks, potentially leading to a buy rating for Lamb Weston’s stock.