In the world of streaming services, Netflix’s NFLX financial results hold the suspense of a thrilling season finale. After discontinuing its habit of predicting subscriber growth, all eyes turn to Netflix that boasted over 260 million users as of the end of 2023, firmly seated atop the streaming subscription hill.

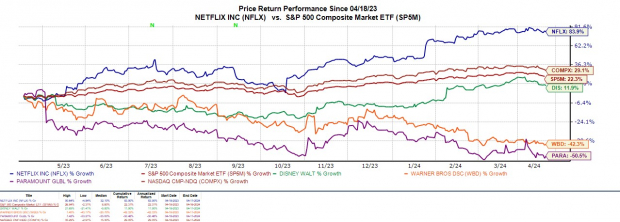

The stock of Netflix has exhibited a fiery performance, soaring a prolific +26% year to date, edging past Disney’s DIS +25%, and eclipsing the lackluster showings of competitors like Paramount Global’s PARAA and Warner Bros. Discovery’s WBD.

The question now lingering on every investor’s mind is whether it’s the opportune moment to dive into Netflix shares as the Q1 earnings report looms, scheduled to be unveiled after market hours on Thursday, April 18.

Image Source: Zacks Investment Research

Assessing Q1 Ahead

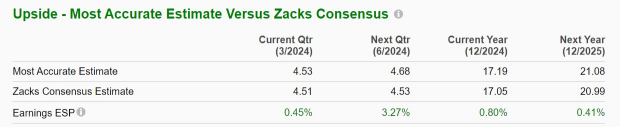

Anticipated Zacks estimates project a 13% rise in first-quarter sales for Netflix, reaching a substantial $9.26 billion. The consensus speaks of a bullish 56% surge in Q1 earnings to $4.51 per share, soaring from $2.88 per share in the corresponding quarter.

Of particular intrigue is the revelation by Zacks ESP (Expected Surprise Precipitation) suggesting that Netflix might outperform its bottom-line projections, with the Most Accurate Estimate pegging Q1 EPS at $4.53, slightly exceeding the Zacks Consensus.

Image Source: Zacks Investment Research

Streaming Insights

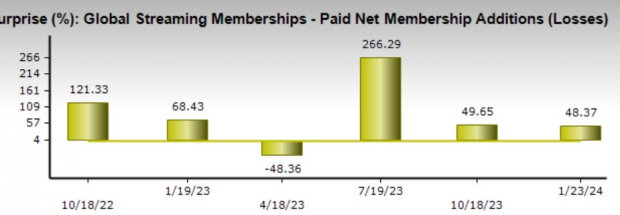

Despite various new streaming services emerging, Netflix has stayed ahead of the curve by offering a more economical option supported by paid advertising. It’s estimated that Netflix could have amped up its global paid memberships by 5.73 million in the first quarter, marking an impressive 227% surge from the 1.75 million paid subscriptions noted in Q1 2023. Notably, Netflix stunned the market by adding a whopping 13.12 million paid subscribers in Q4, surpassing the estimations by a solid 48%.

Image Source: Shutterstock

Evaluating P/E Valuation

At present, Netflix shares trade at 36.2X forward earnings, comfortably below the five-year high of 114.9X and a tad discounted in comparison to the median of 49.7X. Projections anticipate a meteoric 42% leap in annual earnings in fiscal 2024 to $17.05 per share versus last year’s $12.03 per share. Moreover, FY25 EPS is foreseen to ascend by an additional 23%.

Image Source: Zacks Investment Research

In Summary

Basking in a remarkable year-to-date rally that has propelled its value to over $600 a share, Netflix’s stock currently holds a Zacks Rank #3 (Hold). While Netflix’s valuation seems more rational now, meeting or exceeding Q1 expectations will be pivotal in solidifying the company’s trajectory of expansive growth.