Salesforce CRM continued its metamorphosis towards enhanced financial performance, surpassing Q2 projections and elevating profit forecasts.

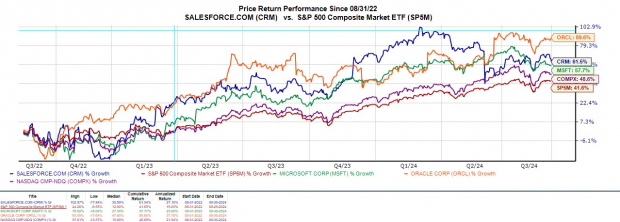

This victory also quelled concerns regarding mounting competition from industry giants like Microsoft MSFT and Oracle ORCL, possessors of their CRM software.

Accelerated Growth in Q2

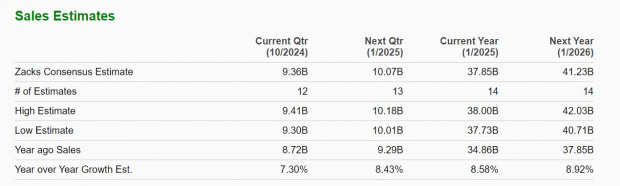

Powered by subscription and support revenue, Salesforce recorded Q2 sales of $9.32 billion, marking an 8% increase from the previous year and surpassing estimates by 1%. The Q2 EPS of $2.56 spiked by 21% from the comparative period and exceeded estimates by 9%.

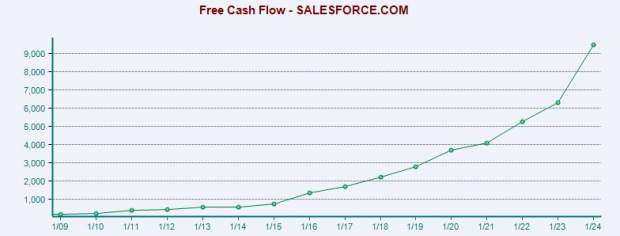

Of particular note, Salesforce demonstrated robust Q2 operating cash flow of $892 million, up by 10% YoY, with free cash flow surging by 20% to reach $755 million.

Image Source: Zacks Investment Research

AI Advancements

Salesforce highlighted the swift integration of artificial intelligence solutions across its product range, with new AI product bookings doubling quarter-over-quarter. The company sealed 1,500 AI deals in Q2 with major global brands including Alliant Energy LNT

Outlook and Growth Trajectory

For the fiscal year 2025, Salesforce maintains its sales forecast of $37.7 billion-$38 billion, aligning with Zacks Consensus estimates of $37.85 billion or 8% growth. Looking ahead to FY26, Salesforce’s revenue is anticipated to further expand by 9% to $41.23 billion.

Image Source: Zacks Investment Research

Salesforce has elevated its EPS guidance for FY25 to $10.03-$10.11, a notable increase from the previous projection of $9.86-$9.94 per share. This upward adjustment exceeds the current Zacks Consensus of $9.91 per share, reflecting a 20% growth trajectory. Forecasts indicate a further 10% rise in Salesforce’s EPS for FY26.

Image Source: Zacks Investment Research

Experiencing a record cash flow this year, Salesforce has heightened its operating cash flow projection to 23%-25% growth compared to the previous forecast of 21%-24%. Additionally, Salesforce anticipates free cash flow growth of 25%-27%, up from the initial estimates of 23%-26%.

Image Source: Zacks Investment Research

Stock Performance and Valuation Analysis

Despite facing intensified rivalry from Microsoft’s Dynamics 365 CRM and Oracle CRM, Salesforce has observed a -4% dip in stock performance year to date, lagging behind broader indexes with Microsoft and Oracle shares soaring by +9% and +33% respectively.

Image Source: Zacks Investment Research

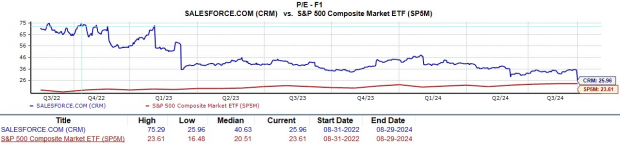

At present levels, Salesforce’s stock is traded at 25.9X forward earnings, slightly above the S&P 500’s 23.6X. It falls below Microsoft’s 31.6X forward earnings multiple but exceeds Oracle’s 22.5X.

Image Source: Zacks Investment Research

Key Insight

Presently designated with a Zacks Rank #3 (Hold), Salesforce’s stock potential hinges on the trajectory of earnings estimate revisions post-Q2, which are anticipated to be favorable given the enhanced profit outlook by the company.

This optimistic trend could herald a buy recommendation for Salesforce’s stock, as concerns over heightened competition from Microsoft and Oracle seemingly overshadow the company’s enticing growth prospects.