A Nosedive After Strong Earnings

Following a stellar showing in their quarterly financials, Nike and Lululemon faced a harsh reality as their stocks tumbled in today’s market action due to lukewarm guidance for the future.

Despite Nike’s earnings of $0.98 per share, surpassing expectations by a whopping 42%, and Lululemon’s Q4 earnings of $5.29 per share which beat estimates by 5%, both companies grappled with disappointing forecasts.

Impressive Results in a Gloomy Outlook

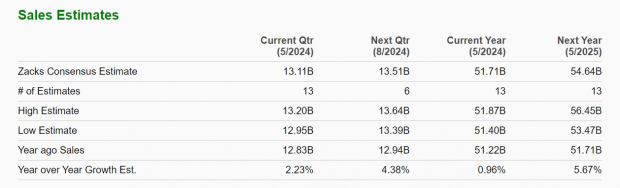

Nike’s sales of $12.42 billion, marginally up from the previous year, topped estimates and continued the trend of surpassing earnings expectations. On the other hand, Lululemon witnessed a 15% surge in quarterly sales which outperformed estimates.

Troubling Projections Cast a Shadow

Both industry giants issued cautious guidance with Nike anticipating a drop in revenue for the first half of FY25, attributing it to a sluggish economic environment. Lululemon’s softer-than-expected sales outlook for the next quarter stemmed from reduced consumer demand, leading to a dip in revenue projections.

Earnings Insights and Predictions

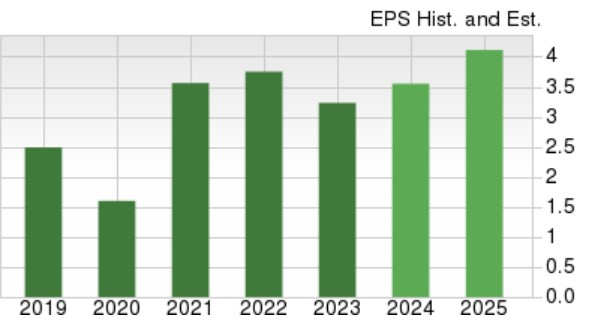

Nike maintained its full-year net income outlook for FY24 with a projected EPS increase of 9%. Looking ahead to FY25, the company forecasts a substantial 16% jump in earnings per share.

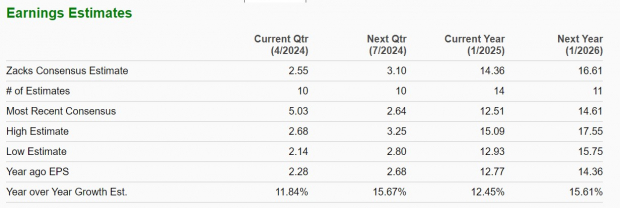

Lululemon provided Q1 EPS guidance slightly below estimates and a moderate full-year EPS forecast for FY25. Despite these projections, the company anticipates a 15% EPS growth for FY26.

Final Thoughts and Considerations

While challenges loom on the horizon for both Nike and Lululemon, they currently hold a Zacks Rank #3 (Hold). For patient investors, the current stock prices could offer long-term rewards, although short-term hurdles might impact their growth trajectories.