Unveiling Opportunities in the Oversold Utilities Sector

Investors often flock to oversold stocks in the utilities sector, viewing them as diamonds in the rough. The Relative Strength Index (RSI) is a key tool, gauging a stock’s momentum and predicting its short-term performance. An RSI below 30 signifies that an asset may be oversold, presenting a ripe opportunity for value investors.

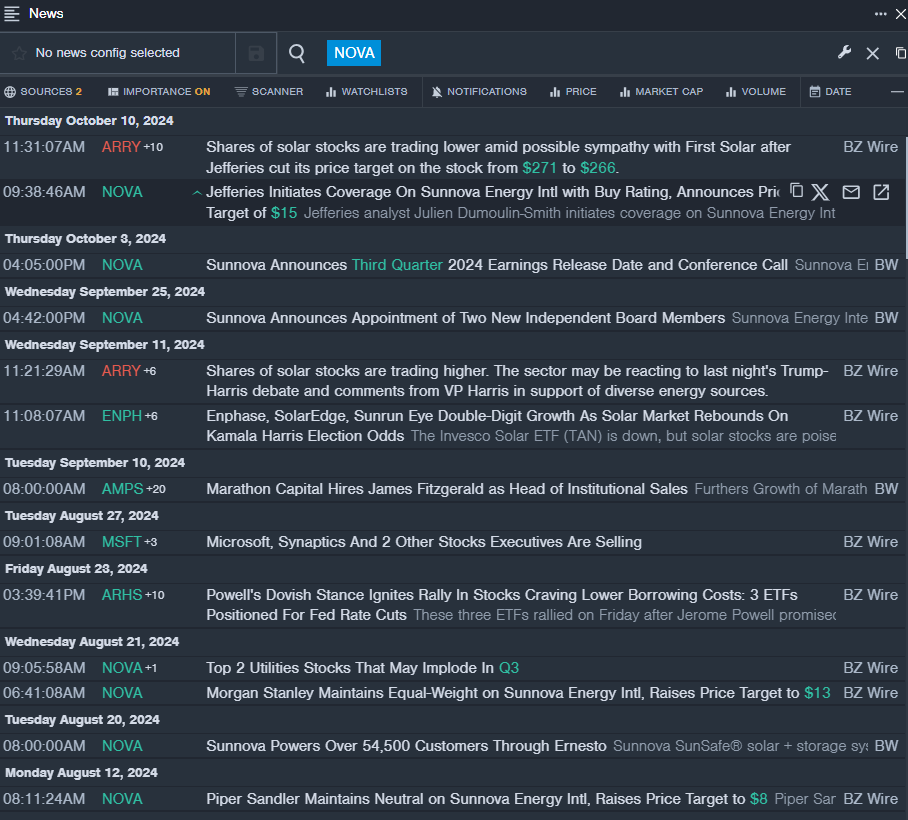

The Power Play: Sunnova Energy International Inc (NYSE: NOVA)

Sunnova Energy International Inc has attracted attention with an RSI value of 29.94, indicating potential for an upswing. Despite a recent 43% drop in stock price, analysts see a bright spot, with Jefferies initiating coverage at a Buy and setting a target price of $15. On the market’s latest close, Sunnova Energy’s shares rose by 1.1% to reach $6.57, hinting at a possible reversal in fortunes.

Shooting Star: VivoPower International PLC (NASDAQ: VVPR)

VivoPower International’s RSI value of 28.53 is turning heads towards a potential surge. The company recently announced a strategic partnership with Sarao Motors in the Philippines’ lucrative jeepney market. Despite a significant 59% decline in stock value over the past month, VivoPower’s shares reflected a minor uptick of 0.1% to close at $0.78. With a visionary CEO at the helm and a promising collaboration in the offing, could VivoPower be on the cusp of a remarkable turnaround?