The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

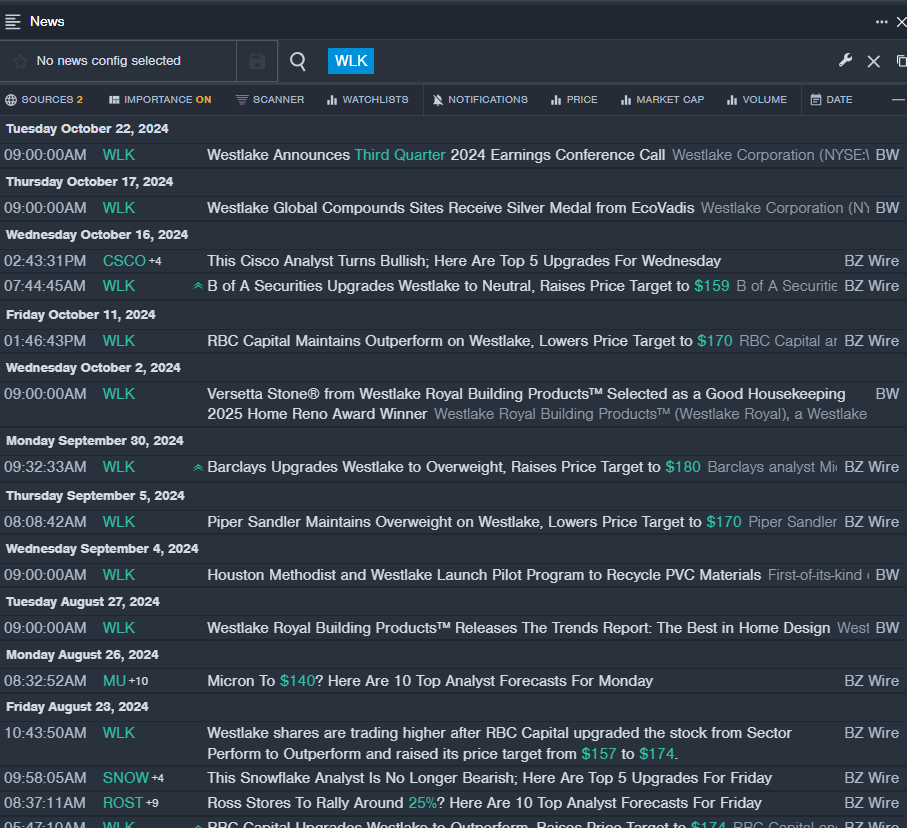

Westlake Corp WLK

- Westlake will release its third quarter 2024 earnings before the opening bell on Tuesday, Nov. 5. The company’s stock fell around 7% over the past month and has a 52-week low of $112.77.

- RSI Value: 27.60

- WLK Price Action: Shares of Westlake fell 0.9% to close at $134.79 on Thursday.

- Benzinga Pro’s real-time newsfeed alerted to latest WLK news.

Newmont Corporation NEM

- On Oct. 23, Newmont reported quarterly GAAP earnings of 76 cents per share and quarterly revenue of $4.605 billion which beat the consensus estimate of $4.568 billion. “In the third quarter, Newmont delivered 2.1 million gold equivalent ounces and generated $760 million in free cash flow from our world-class portfolio,” said Tom Palmer, Newmont’s president and CEO. The company’s stock fell around 13% over the past five days and has a 52-week low of $29.42.

- RSI Value: 20.36

- NEM Price Action: Shares of Newmont fell 14.7% to close at $49.25 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in NEM stock.

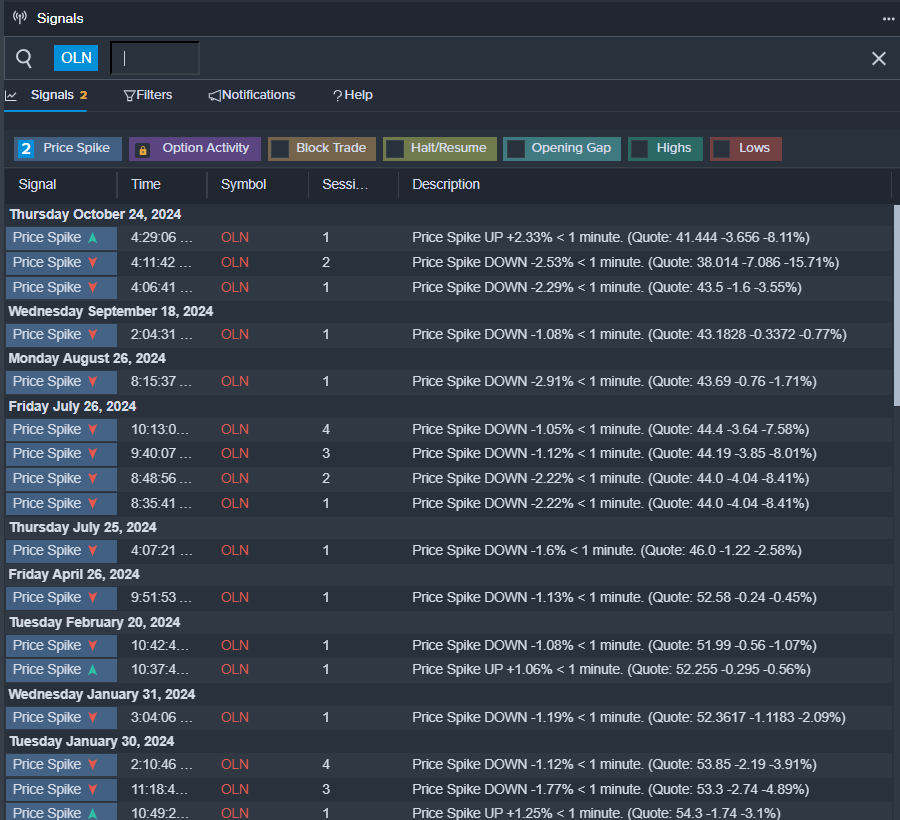

Olin Corp OLN

- On Oct. 24, Olin reported mixed third-quarter financial results. Also, the company said Hurricane Beryl will impact its chemical businesses. Ken Lane, President, and Chief Executive Officer, said, “During the third quarter, our Olin team worked tirelessly to recover from the effects of Hurricane Beryl. However, despite the team’s hard work, persistent operating limitations related to the hurricane necessitated an additional outage, which we commenced in late September and successfully completed this month.” The company’s shares fell around 5% over the past five days and has a 52-week low of $39.47.

- RSI Value: 27.97

- OLN Price Action: Shares of Olin fell 0.1% to close at $45.04 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in OLN shares.

Read More:

Market News and Data brought to you by Benzinga APIs