The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

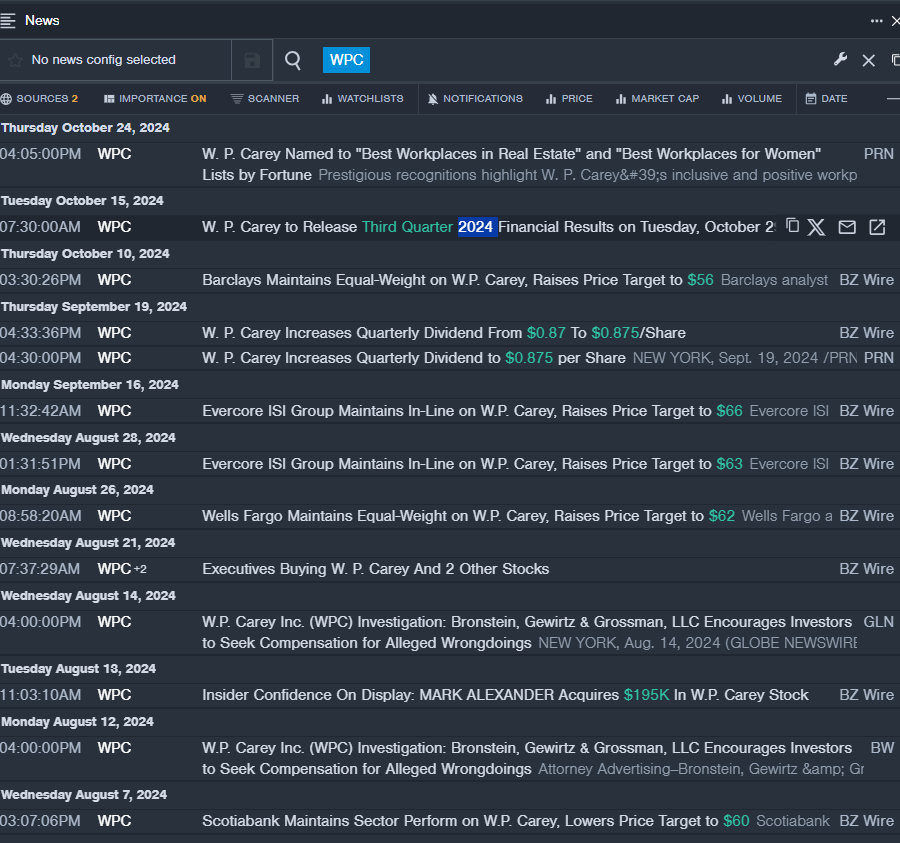

WP Carey Inc WPC

- W. P. Carey will release its financial results for the third quarter ended Sept. 30, after the market closes on Tuesday, Oct. 29. The company’s stock fell around 8% over the past month and has a 52-week low of $50.52.

- RSI Value: 25.64

- WPC Price Action: Shares of WP Carey fell 2.2% to close at $57.28 on Friday.

- Benzinga Pro’s real-time newsfeed alerted to latest WPC news.

Service Properties Trust SVC

- On Oct. 16, Service Properties Trust announced it reduced its quarterly dividend. The company’s stock fell around 21% over the past month and has a 52-week low of $3.44.

- RSI Value: 29.93

- SVC Price Action: Shares of Service Properties Trust fell 2.7% to close at $3.62 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in SVC stock.

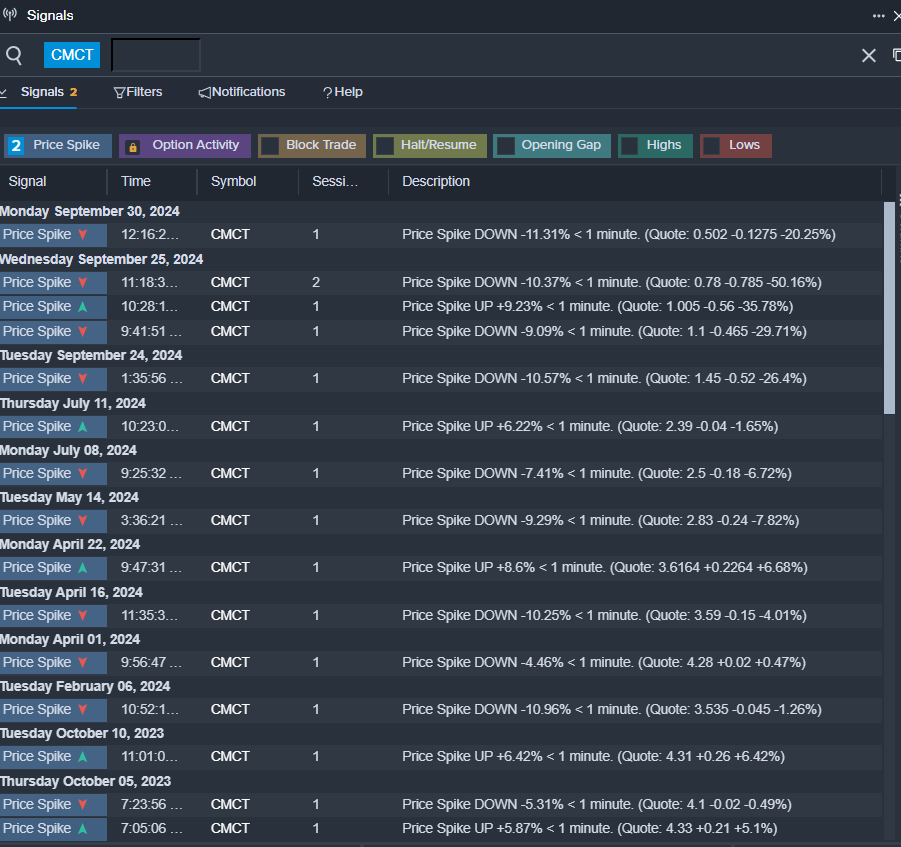

Creative Media & Community Trust Corp CMCT

- On Aug. 8, Creative Media posted better-than-expected quarterly results. “Our core FFO improved from the first quarter of 2024 due to improved net operating income across all of our real estate segments – multifamily, office and hotel,” said David Thompson, Chief Executive Officer of Creative Media & Community Trust Corporation. “Our goal is to strengthen our balance sheet and improve our cash flow. In order to achieve this goal, we continue to actively evaluate asset sales and other ways to reduce both our recourse debt and overall debt.” The company’s shares fell around 16% over the past five days and has a 52-week low of $0.42.

- RSI Value: 19.89

- CMCT Price Action: Shares of Creative Media & Community Trust fell 1.5% to close at $0.46 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in CMCT shares.

Read More:

Market News and Data brought to you by Benzinga APIs