In the tumultuous waves of the stock market, there exist hidden gems – companies lingering in the shadowlands of potential greatness.

One metric, the Relative Strength Index (RSI), acts as a compass, guiding traders toward oversold assets primed for a rebound. Stocks with an RSI below 30 may indicate a buying opportunity, enticing the risk-takers seeking treasures in the murky depths.

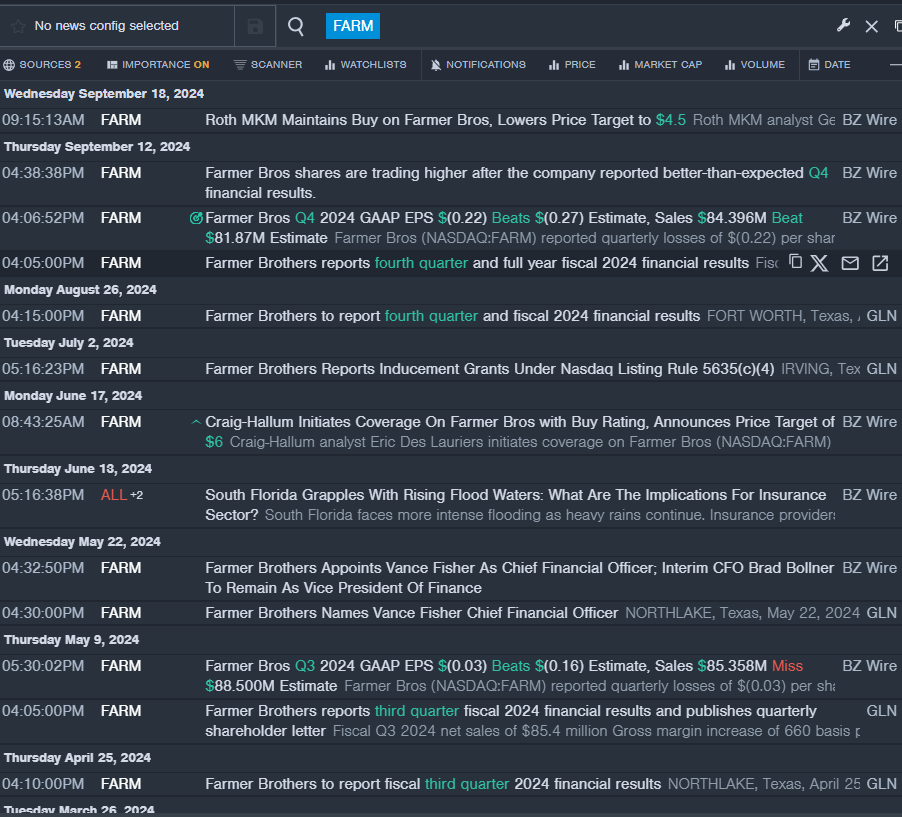

Freshly Brewed Optimism: Farmer Bros Co FARM

- Despite recent declines, Farmer Bros Co saw a glimmer of hope with better-than-expected financial results, a testament to resilience amidst adversity. President John Moore’s strategic decisions helped bolster gross margins and drive operational efficiency, painting a picture of redemption for the company.

- RSI Value: 27.27

- FARM Price Action: Like a phoenix rising from the ashes, Farmer Bros Co’s stock closed at $1.89, showcasing signs of revival.

- A faithful companion, Benzinga Pro, stood by to deliver real-time updates on Farmer Bros Co, guiding investors through the storm.

A Stalwart’s Regret: British American Tobacco PLC BTI

- British American Tobacco, a once-prominent figure, stumbled with a decline in adjusted earnings per share, signaling a moment of fragility. The company’s recent stock performance echoed a tale of sorrow, hinting at burdens too heavy to bear.

- RSI Value: 24.49

- BTI Price Action: British American Tobacco’s stock closed at $35.11, a faint whisper of what once was, as investors grappled with uncertainty.

- Guided by the astute observations of Benzinga Pro, traders navigated the turbulent waters surrounding British American Tobacco, seeking solace in data-driven insights.

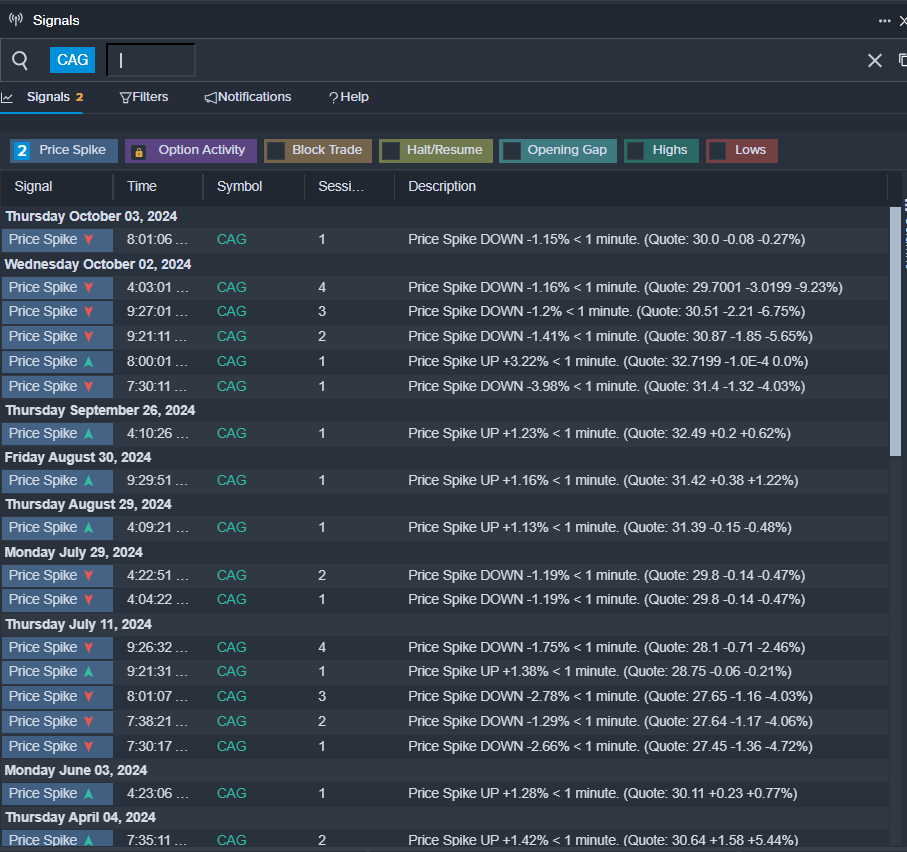

A Phoenix in the Ashes: Conagra Brands Inc CAG

- Conagra Brands, facing recent setbacks, held firm to its projections despite encountering stormy seas. Reaffirming fiscal guidance showcased a spirit of resilience in the face of adversity, projecting an aura of quiet strength amidst the chaos.

- RSI Value: 25.52

- CAG Price Action: Conagra Brands’ stock closed at $29.35, a warrior standing tall in the aftermath of battle, hinting at a steady resolve.

- Empowered by Benzinga Pro’s signals, investors braved the uncertainty surrounding Conagra Brands, primed for a potential resurgence in the company’s fortunes.

Read Next:

Market News and Data brought to you by Benzinga APIs