The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

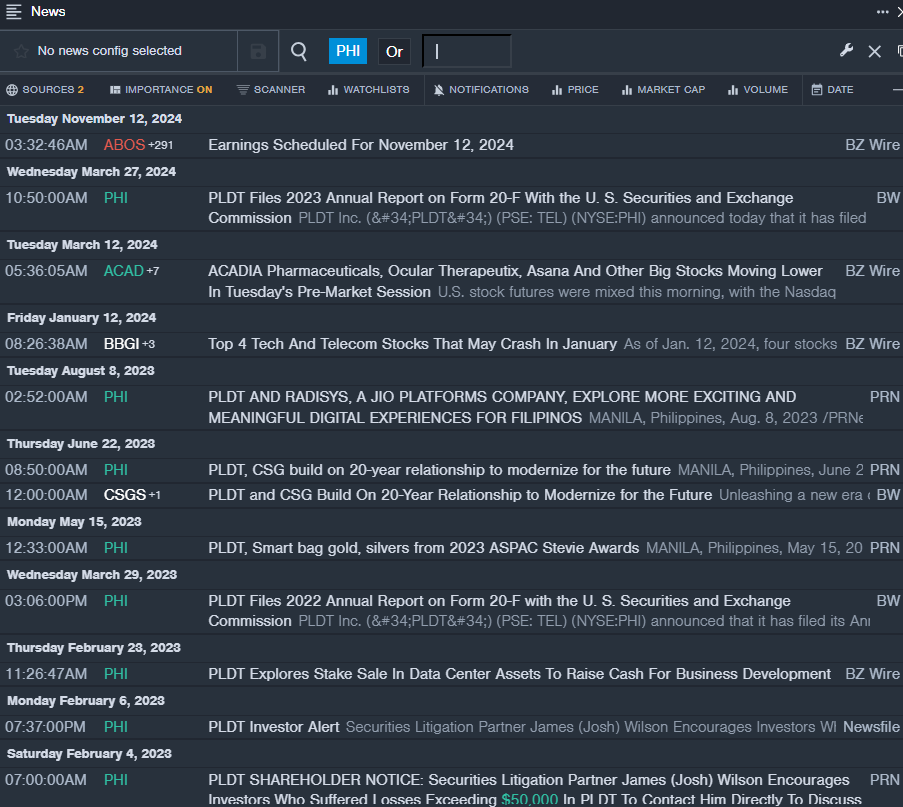

PLDT Inc ADR PHI

- On March 27, PLDT filed 2023 annual report on Form 20-F with the U.S. Securities and Exchange Commission. The company’s stock fell around 12% over the past month and has a 52-week low of $22.01.

- RSI Value: 25.90

- PHI Price Action: Shares of PLDT fell 1.8% to close at $22.90 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest PHI news.

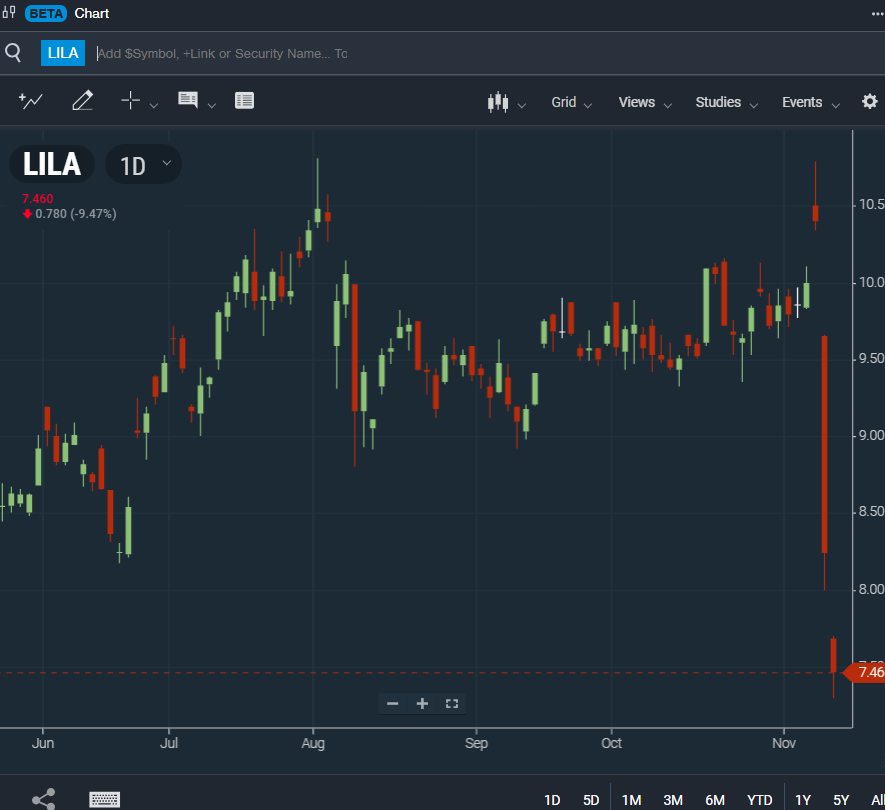

Liberty Latin America Ltd LILA

- On Nov. 6, Liberty Latin America reported worse-than-expected third-quarter revenue results. CEO Balan Nair commented, “We are continuing our strategy to connect communities and drive broadband and postpaid mobile penetration across our markets. We are encouraged by our transformation programs, which are increasingly gaining momentum and enabling us to connect with our customers through their channels of choice.” The company’s stock fell around 24% over the past five days and has a 52-week low of $5.90.

- RSI Value: 24.04

- LILA Price Action: Shares of Liberty Latin America fell 2% to close at $7.46 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in LILA stock.

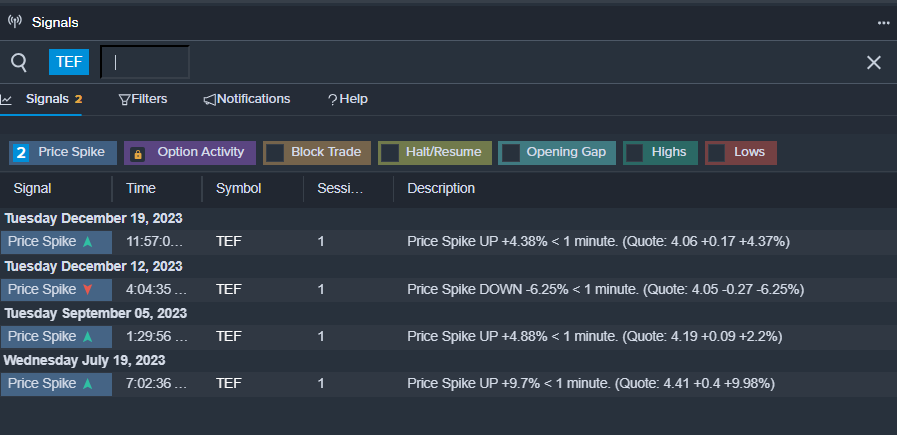

Telefonica SA TEF

- On Nov. 7, Telefonica posted third-quarter sales of $11.02 billion down from $11.23 billion in the year-ago period. The company’s stock fell around 9% over the past month and has a 52-week low of $3.82.

- RSI Value: 21.28

- TEF Price Action: Shares of Telefonica fell 2% to close at $4.37 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in TEF shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs