When navigating the tumultuous waters of the stock market, seasoned investors keep their eyes peeled for undervalued gems among the rubble, like treasure hunters sifting through shards of glass. The recent market activity has cast a spotlight on some notable players in the information technology sector that have seen their share prices plummet to tantalizing lows, stirring up a ripple of interest in savvy traders seeking to unearth the next big opportunity.

Unraveling the RSI Indicator

The Relative Strength Index (RSI) stands as a beacon amid the maelstrom of market chaos, offering a glimpse into the fortitude of a stock amidst the turbulence of buying and selling. With its oscillations guiding traders like a lighthouse in the darkness, the RSI below 30 emerges as the clarion call signaling an oversold asset, a clarion call that may beckon investors to heed its siren song.

The Tale of Super Micro Computer Inc (SMCI)

- As August draws to a close, a tempest brews around Super Micro Computer Inc, with Hindenburg Research unleashing a short report that sends shockwaves through the market. The company’s stock, once a stalwart of stability, has stumbled a staggering 36% in the past month, plunging to a 52-week low of $226.59 like a wounded warrior fallen from grace.

- RSI Value: 25.38

- SMCI Price Action: Share prices of Super Micro Computer cascade downward, shedding 19% to close at $443.49 on the last trading day like a meteor hurtling towards the earth.

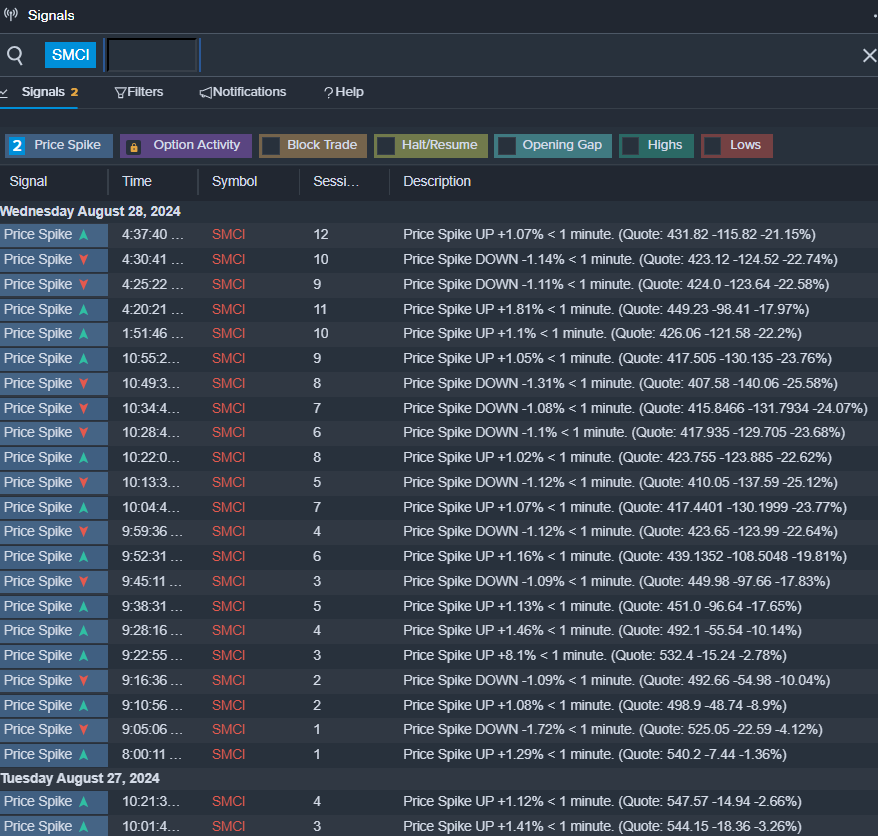

- Despite the ominous clouds hovering over Super Micro Computer, whispers of a potential breakout drift through the market, murmured by the heralds of Benzinga Pro’s signals feature like a harbinger of hope in the midst of despair.

Reflecting on the Landscape

In the ever-changing tableau of the stock market, where fortunes are made and lost with the caprice of the wind, the saga of Super Micro Computer echoes a common refrain of volatility and intrigue. As investors navigate these turbulent waters, seeking to discern the signals amidst the noise, the narrative of oversold tech stocks stands as a testament to the dynamism and unpredictability of the market.