February is off to a promising start, following a tumultuous January characterized by market swings and speculation around Federal Reserve interest rate cuts. While uncertainties prevailed in the initial half of January, the latter half saw a shift with robust economic data and decreasing inflation figures. However, the upbeat sentiment was dashed as U.S. stock markets experienced a downturn on the final day of January when the Fed dismissed the likelihood of an imminent rate cut.

The Continuing Momentum

Despite these fluctuations, Wall Street managed to uphold its upward trajectory throughout January. The Dow, the S&P 500, and the Nasdaq Composite advanced by 1.2%, 1.6%, and 1% respectively.

The Department of Commerce’s report indicating a 3.3% growth in the U.S. economy for the fourth quarter of 2023, well above the consensus estimate of 2%, served as a major source of optimism. Additionally, positive economic indicators such as the rise in personal consumption expenditure (PCE) price index and increased personal spending further bolstered confidence in the market.

Our Top Picks

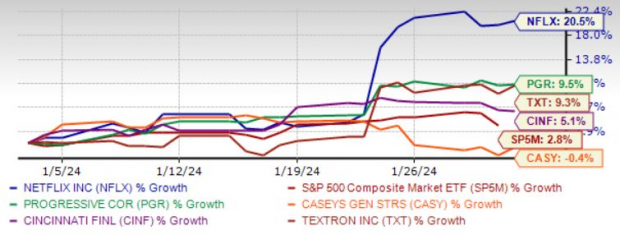

In light of the current advantageous momentum, there are five large-cap stocks that have stood out with strong potential for February. These stocks have not only seen positive earnings estimate revisions in the past 60 days but also boast a Zacks Rank #1 (Strong Buy) and a Momentum Score of A or B. These factors make them strong candidates for investment throughout 2024.

The following are the top momentum stocks for February:

Image Source: Zacks Investment Research

Netflix Inc. (NFLX)

Netflix witnessed an addition of 13.12 million paid subscribers globally in the fourth quarter of 2023, with a 1% rise in average revenue per subscription. The company’s diversified content portfolio, attributed to heavy investments in localized and foreign-language content production and distribution, positions it well to continue dominating the streaming space. Amidst this, NFLX anticipates an expected revenue and earnings growth rate of 14.3% and 40.7%, respectively, for the current year, with the Zacks Consensus Estimate for current-year earnings improving by 5.3% over the last seven days.

The Progressive Corp. (PGR)

The Progressive Corp. continues to excel with higher premiums, bolstering its standing through a compelling product portfolio and leadership position in both the Vehicle and Property businesses. The company’s strategic focus on becoming a one-stop insurance destination, especially for customers opting for a combination of home and auto insurance, adds to the positive outlook for PGR. With an expected revenue and earnings growth rate of 12.6% and 19.1% respectively for the current year, and the Zacks Consensus Estimate for current-year earnings improving by 5.4% over the last seven days, The Progressive Corp. remains a promising momentum stock for February.

Casey’s General Stores Inc. (CASY)

Casey’s General Stores reported impressive second-quarter fiscal 2024 results, supported by stellar performance in prepared food and grocery categories, driving a 6.2% jump in inside sales and 2.9% growth in inside same-store sales. The company’s business operating model, omnichannel capabilities, enhanced customer reach, and private-label offerings solidify its position in the industry. Amidst this, initiatives such as price and product optimization strategies, increased penetration of private brands, and digital engagements merit attention. With an expected revenue and earnings growth rate of 0.3% and 7.4% respectively for the current year, and the Zacks Consensus Estimate for current-year earnings having improved by 6.3% over the past 30 days, Casey’s General Stores Inc. is a noteworthy pick for February.

Cincinnati Financial Corp. (CINF)

Cincinnati Financial Corp. continues to flourish, driven by a disciplined expansion of Cincinnati Re, which contributes significantly to its overall earnings. The company’s focus on earning new business by appointing new agencies and its belief in an agent-focused business model for driving long-term premium growth are key positives. With sustained growth in premiums and the implementation of price increases, Cincinnati Financial Corp. continues to project strong potential for February.