The Impact of Core PCE Data

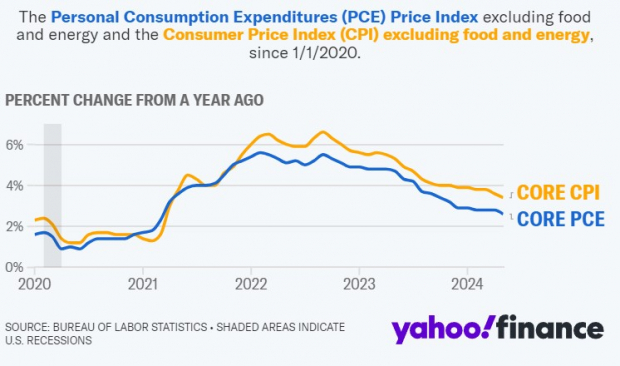

The Personal Consumption Expenditures (PCE) Price Index is a vital indicator that delineates the fluctuations in consumer goods and services’ prices through the lens of businesses in the United States.

Moreover, Core PCE serves as a significant economic barometer that the Federal Reserve relies on to assess inflation, excluding volatile items like food and energy from the average change in consumer goods prices.

Optimistic Market Outlook

Core PCE recently exhibited a positive trend, showing a modest 0.1% uptick in May compared to the previous month’s 0.3% surge. On an annual basis, Core PCE witnessed a 2.6% increase, marking the slowest yearly growth in three years, according to Yahoo Finance.

Although this uptick exceeds the Fed’s 2% annual inflation target, the May Core PCE data signals a favorable economic outlook, creating a ripple effect on stocks.

Stock Recommendations Post Data Trends

Image Source: Yahoo Finance

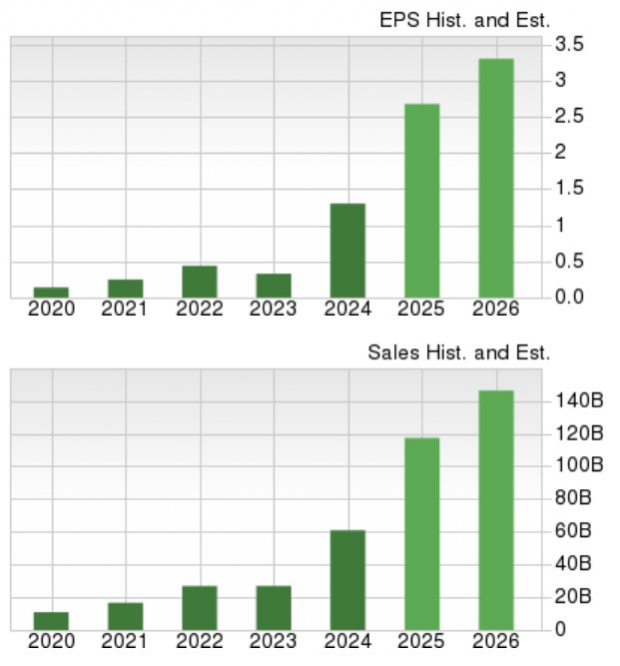

NvidiaNVDA

The easing inflation landscape plays a pivotal role in the tech sector by influencing internal costs and driving both consumer and business spending on non-essential yet essential technologies.

Nvidia, a key player in AI chip production, sees promising growth potential, with a Zacks Rank #1 (Strong Buy). Despite a modest post-stock split performance, Nvidia has shown stellar growth this year, aligning with positive earnings estimates.

Image Source: Zacks Investment Research

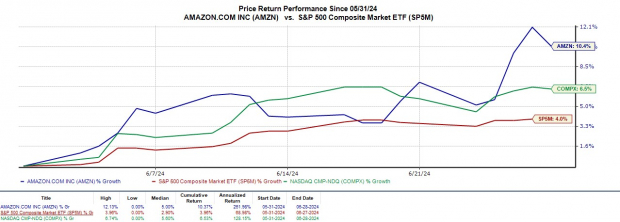

Amazon AMZN

Outside the tech realm, consumer-driven companies like Amazon reap the benefits of a stabilized inflation environment. The recent spike in Amazon’s stock price, combined with a Zacks Rank #3 (Hold) and a 27% year-to-date gain, highlights its position in the market.

Image Source: Zacks Investment Research

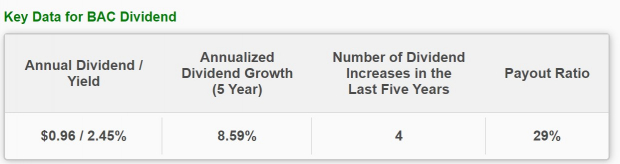

Bank of AmericaBAC

In a scenario of favorable inflation and data trends, banks like Bank of America stand to benefit from increased loan volumes. Utilizing tech innovations, Bank of America carries a Zacks Rank #2 (Buy) and boasts an enticing price point compared to industry peers.

Moreover, with a forward P/E ratio in line with its competitors and promising earnings estimates for the future, Bank of America presents a strong investment case.

Image Source: Zacks Investment Research

Bank of America also offers a 2.45% annual dividend yield, trailing only Citigroup’s 3.44% among the top four domestic banks, making it an attractive option compared to key industry players like Wells Fargo and JPMorgan.

Image Source: Zacks Investment Research

Wrapping Up

With Q2 coming to a close, the cooling Core PCE data paints a promising picture for businesses and the economy overall. Keep a keen eye on Nvidia, Amazon, and Bank of America as potential high-performers in the upcoming quarter.