Recently, the transportation sector has been emitting caution signals akin to a flickering caution light on a winding road. Similar to how the health of a consumer reflects the pulse of the U.S. economy, the transportation industry serves as a vital artery that pumps vitality into various economic sectors.

The Wheels of Economy:

Driving Economic Momentum:

- The transportation industry contributes a hefty $1.2 trillion to the U.S. GDP, representing about 5.4% of the economic juggernaut.

- Comprising road, rail, air, maritime transport, as well as logistics and warehousing, its intricate web weaves connections across various sectors.

Movers and Shakers:

- With approximately 10.68 million Americans employed in transportation and warehousing, the sector is a bustling hub of activity.

- From truck drivers to pilots, railway operators to logistics wizards, this workforce keeps the wheels of commerce turning.

Environmental Crossroads:

- Transportation emissions account for a significant 27% of the total U.S. greenhouse gas emissions.

- The sector’s transition to cleaner, eco-friendly energy sources is pivotal for sustainable growth.

Journey of Goods:

- The trucking industry plays a dominant role, responsible for moving a whopping 72.5% of the country’s freight.

People on the Move:

- Passenger mobility, whether by air, public transit, or personal vehicles, enables individuals to navigate through life’s tapestry, linking home to work and leisure to necessity.

Building Bridges to Tomorrow:

- Continuous investment in transportation infrastructure, including roads, bridges, and airports, is essential for maintaining and expanding capacity.

- In 2021, a $1.1 trillion infrastructure bill was ratified by the government, but hitches in implementation surfaced, posing challenges.

Inflation woes buffet, construction worker shortages press, and the pursuit of viable benchmarks throttles our journey. The spectacle now facing the transportation sector beckons a query: Is this a mere hiccup, a gentle descent, a looming downturn, or the ominous shadow of stagflation?

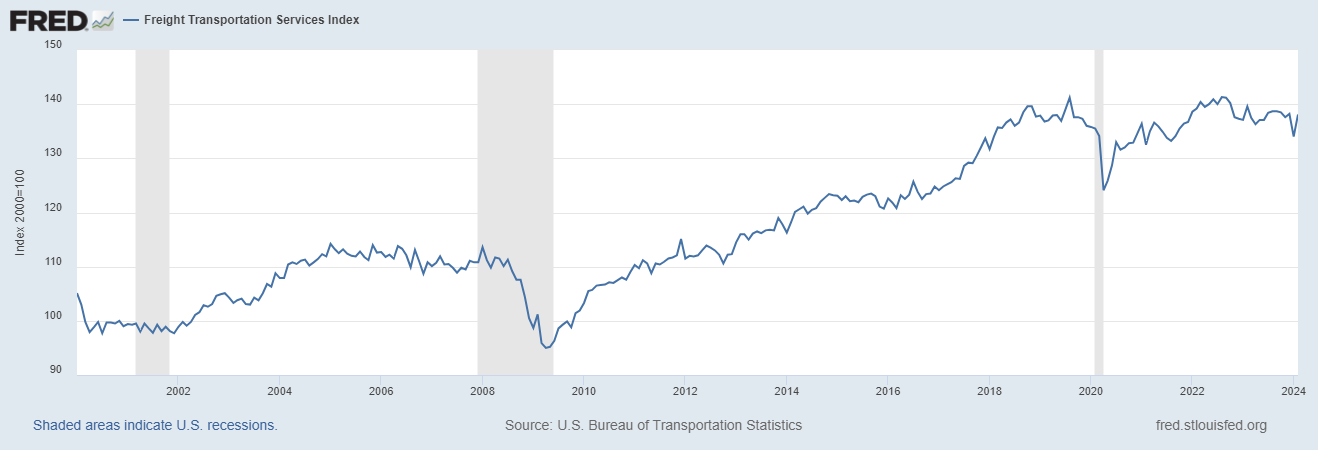

Delving deeper, the Transportation Services Index (TSI) provides a compass through the fog of economic uncertainty:

Deciphering the TSI Maze:

- The TSI measures the pulse of freight and passenger transportation services within the U.S., acting as a barometer of shifty economic winds.

- During boom years, a surge in the TSI heralds heightened transportation demand, whereas economic gloom begets a TSI downturn.

Freight as Fortune Teller:

- The freight TSI often acts as an economic Nostradamus, offering foretelling signs of economic shifts brewing on the horizon.

- While the TSI peaked in 2020, a recessionary plunge is yet to unfurl, indicated by a breach below 130 or revisitation of Covid-era lows.

Investor’s Observe:

- Aside from the TSI, investor sentiment and transportation stock performance serve as wisps on the breeze, hinting at broader economic skeins.

The TSI indexes the rhythmic symphony of transportation services, composed of Freight Index, tracking freight shifts, and Passenger Index, monitoring people’s travels leapfrogging boundaries.

As of February 2024, the Freight TSI dances at a seasonally adjusted 138.1, a melodious note amidst cacophonous markets.

The IYT price draws a melancholic picture, seeking solace on the 200-Daily Moving Average, akin to a weary traveler resting upon a well-worn milestone.

XRT and IYT whisper ominous tunes, for shadows of contraction loom in consumer spending, while the freight TSI flickers caution. Yet, the omens remain unfulfilled, lingering on the precipice.

Exchange-Traded Fund Rundown:

- S&P 500 (SPY) waves a bullish banner if it clasps the 50-DMA tight.

- Russell 2000 (IWM) echoes bullish murmurs with a firm 50-DMA embrace.

- Dow (DIA) croons bullish melodies, hugging the 50-DMA for dear life.

- Nasdaq (QQQ) hops on the bullish bandwagon, clasping the 50-DMA hand-in-hand.

- Regional banks (KRE) beckon at 50.50, a siren song for the interest incline.

- Semiconductors (SMH) mirror the bullish dance, pirouetting gracefully atop the 50-DMA.

- Transportation (IYT) stumbles at 63, shadows of loss creeping near, resistance at 67 a distant mirage.

- Biotechnology (IBB) unveils 128-135, a new stage set for spectacles yet unknown.

- Retail (XRT) sketches a tale of 71.50 support yet dreams of breaching 75 resistance.

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) clutches 77.00 for sustenance and longevity, eyeing the 50-DMA for kinship.