When pondering whether to invest in a stock, insights from Wall Street analysts often hold sway. The musings of these financial pundits can greatly influence a stock’s trajectory, but do they truly merit our undivided attention?

Before delving into the nuances of broker recommendations and how investors can extract value from them, let’s first examine what the esteemed Wall Street analysts have to say about Rivian Automotive (RIVN).

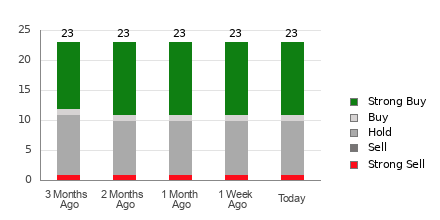

Rivian Automotive currently boasts an Average Brokerage Recommendation (ABR) of 2.00, utilizing a scale that ranges from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Strong Sell. This ABR, sourced from the collective input of 23 brokerage firms, points towards a Buy stance.

Within the pool of 23 recommendations that contribute to the current ABR, 12 are tagged as Strong Buy, while one leans towards Buy. These two categories cumulatively comprise 56.6% of all recommendations.

Analyzing Brokerage Recommendation Trends for RIVN

Despite the prevailing recommendation to buy Rivian Automotive, exercising caution solely on this advice may be judicious. Numerous studies have highlighted the limited efficacy of brokerage suggestions in pinpointing stocks with exceptional growth potential.

Ever pondered why? Well, brokerage firms, inherently tied to the stocks they cover, often showcase a distinct bias towards positivity when assigning ratings. For every “Strong Sell” rating, these firms pad the analysis with five “Strong Buy” designations.

Put succinctly, the analysts’ interests don’t always align with those of individual investors, offering scant insight into a stock’s future trajectory. Thus, the wisdom lies in using this data as a validation tool for your independent research or as a supplement to a proven predictor of stock movements.

Our proprietary stock rating tool, the Zacks Rank, with its stellar track record audited by external entities, segregates stocks into five bands, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool stands as a reliable harbinger of a stock’s forthcoming price performance. Therefore, cross-referencing the ABR with the Zacks Rank could potentially guide you towards profitable investment decisions.

Deciphering ABR vs. Zacks Rank

While both ABR and Zacks Rank operate on a 1 to 5 scale, their underlying frameworks diverge significantly.

ABR hinges purely on brokerage endorsements and usually presents in decimal figures (e.g., 1.28). Conversely, Zacks Rank operates as a quantitative model that leverages earnings estimate revisions, depicted in whole numbers from 1 to 5.

It remains a longstanding reality that analysts employed by brokerage firms lean heavily towards optimism in their appraisals. Fueled by their employers’ interests, these analysts often issue sunnier ratings than their investigations warrant, steering investors astray more often than guiding them.

On the flip side, Zacks Rank’s bedrock lies in earnings estimate revisions. Meticulous empirical research has forged a robust link between trends in earnings estimate revisions and near-term stock price shifts.

Furthermore, the diverse Zacks Rank grades are meticulously applied across all stocks featuring current-year earnings estimates from brokerage analysts. This model ensures a balanced assessment among its five categories.

Another notable disparity between ABR and Zacks Rank lies in timeliness. Whereas ABR may lag in real-time updates, brokerage analysts swiftly adjust their earnings estimates to reflect a company’s evolving fortunes. Consequently, Zacks Rank consistently offers punctual insights into future price movements.

Considering an Investment in RIVN

In terms of earnings estimate revisions for Rivian Automotive, the Zacks Consensus Estimate for the ongoing year has preserved a stable footing at -$3.78 over the past month.

The analysts’ unwavering stance on the company’s earnings outlook, corroborated by an unaltered consensus estimate, could lay the groundwork for Rivian’s stock to shadow the broader market in the near future.

In light of the recent consensus estimate stability, coupled with other factors tied to earnings estimates, Rivian Automotive secures a Zacks Rank #3 (Hold). Explore the complete ensemble of Zacks Rank #1 (Strong Buy) stocks here.

Given these circumstances, it might be prudent to exercise a modicum of caution regarding Rivian Automotive’s Buy-equivalent ABR.

Exploring the Best Stock Picks for the Near Future

Just unveiled: Analysts distill seven premier stocks from the current roster of 220 Zacks Rank #1 Strong Buys. They dub these selections as “Most Likely for Early Price Pops.”

Since 1988, this elite selection has outpaced the market by over two-fold, registering an annual average gain exceeding +23.7%. Hence, cast your focus on these hand-picked seven stocks without delay.

Witness these top-tier picks here.