Investors often ponder whether to jump aboard a certain stock based on the advice of Wall Street analysts. But is the whisper of these financial soothsayers truly golden?

Before delving into the reliability of brokerage recommendations, let’s scrutinize the current sentiment surrounding Ulta Beauty (ULTA) as projected by these market mavens.

The Brokerage Verdict on ULTA

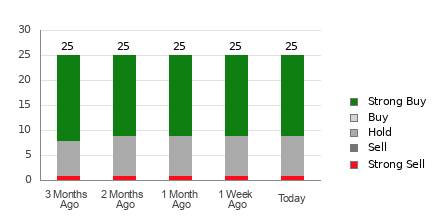

Ulta presently flaunts an average brokerage recommendation (ABR) of 1.80, spanning the spectrum from Strong Buy to Buy on a scale of 1 to 5. This derived metric hinges on the suggestions of 25 brokerage firms, with 16 enthusiastically chanting Strong Buy, representing a solid 64% of the consensus.

Brokerage Recommendation Trends for ULTA

While the brokerage affirmation nudges towards buying Ulta, treading cautiously solely based on this cue seems sagacious. Numerous studies depict the limited efficacy of such recommendations in guiding investors towards stocks with notable price ascensions.

Why the skepticism, you ask? Analysts in the brokerage realm, lured by their interests in the stocks they cover, often coat their opinions in a sugary veneer. For every somber “Strong Sell” whisper, these analysts conjure up five hearty “Strong Buy” accolades, steering clear of revealing the true trajectory of a stock’s price.

A ray of hope emerges from the Zacks Rank – an insight into stock worthiness that boasts an audited legacy. These rankings, ranging from Zacks Rank #1 to Zacks Rank #5, serve as a credible barometer for gauging a stock’s pending price performance. Aliasing the Zacks Rank with ABR could be a wise move in the investment arena.

Differentiating ABR from Zacks Rank

As the ABR chants brokerage blessings based on subjective recommendations, the Zacks Rank prides itself on objectivity, fueled by earnings estimate revisions. This quantifiable model caters in wholes – from Zacks Rank #1 to Zacks Rank #5.

Brokerage analysts, fettered by their employers’ interests, often lace their ratings with optimism, missing the mark on guiding investors. Conversely, the Zacks Rank pivots on earnings estimate trends, holding hands with stock price shifts, as empirical evidence supports.

Unlike the sometimes stale ABR, the Zacks Rank remains perpetually fresh, promptly reflecting analyst musings on earnings adjustments, rendering it a timely oracle for future price movements.

The ULTA Conundrum

Lurking in the shadows of Ulta’s horizon are dwindling earnings consensus estimates, with a 0.2% dip in the Zacks Consensus Estimate for the current year to $25.70 over the past month.

An air of gloom swirls around the company’s earnings outlook, evident through a harmonious chorus among analysts in slashing EPS estimates – a precursor to potential near-term turmoil that lands Ulta a Zacks Rank #4 (Sell).

It might be astute to digest the Buy-tiered ABR for Ulta with a zest of skepticism, handed the current market narrative.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding. Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands seized this opportunity, while others balked, suspecting a catch. Our intention? To introduce you to our portfolio services, like Surprise Trader, Stocks Under $10, Technology Innovators, and more – a treasure trove that bagged 228 positions with double- and triple-digit gains solely in 2023.