Before making any pivotal investment decisions, investors often turn to the whims and whispers of Wall Street analysts. But do these brokerage recommendations hold any real weight? Let’s explore.

Unveiling Celestica’s Analyst Ratings

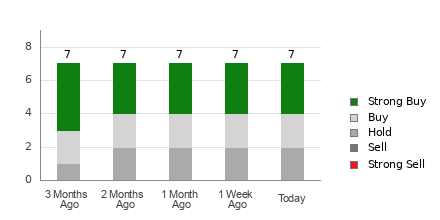

Celestica (CLS) currently boasts an average brokerage recommendation (ABR) of 1.86, nestled between Strong Buy and Buy on a 1 to 5 scale. With seven brokerage firms contributing recommendations, three are Strong Buy and two are Buy, collectively dominating the landscape with positivity and promise.

Pinpointing Trends in Brokerage Recommendations for CLS

The allure of the ABR may beckon investors, but swimming against the current of conventional advice might be a wiser choice. Research reveals that brokerage firms have a tendency to cloak stocks with a glow of positivity due to their vested interests, skewing recommendations towards the bullish end.

However, hope shines bright with the Zacks Rank, a trustworthy tool that dances hand in hand with earnings estimates. This model, backed by a strong track record, carves stocks into five definitive categories, each foretelling a different tale of fortune.

Distinguishing ABR from Zacks Rank

The ABR and Zacks Rank might share a numeric resemblance, but their paths diverge drastically. ABR thrives on brokerage recommendations, often cloaked in decimal nuances, while the Zacks Rank revels in a world of quantitative models and earnings estimate revisions, standing as a beacon of unbiased guidance.

In the battle between analyst-driven optimism and earnings estimate realities, the Zacks Rank emerges victorious. Its ability to foresee future stock prices through the lens of earnings estimate revisions paints a refreshing and accurate picture.

Beyond just a color-coded range, the Zacks Rank unfurls its hues consistently across all stocks, ensuring fairness and balance in its predictions, a rare gem in the realm of stock market prophecies.

Shedding Light on Celestica’s Investment Potential

For Celestica, the Zacks Consensus Estimate for the current year holds steady at $3.32, echoing a sense of stability and predictability in the company’s earnings realm. This steadfast view ushers in a Zacks Rank #3 (Hold) for Celestica, placing it in a snapshot of cautious optimism.

As the dice roll on Celestica’s Buy-equivalent ABR, a pinch of caution might be the seasoning needed for any forthcoming investment gambles. The stock market, much like a grand ballroom dance, waltzes to the tunes of uncertainty and risk, with analysts’ recommendations often cloaked in mystery.

Whether Celestica’s stars align for a grand investment performance or a mere lull in the market symphony, the realm of stock recommendations remains a playground of intrigue and insight, always beckoning investors to dance to the beat of their own drums.