When it comes to making investment decisions, the opinions of Wall Street analysts are often viewed as the holy grail by investors looking to navigate the stock market. The buzz around these analysts’ rating changes can send ripples through a stock’s price. But before diving headfirst into the realm of brokerage recommendations, let’s unravel the insights surrounding Accenture (ACN), and explore the intricate world of financial forecasting.

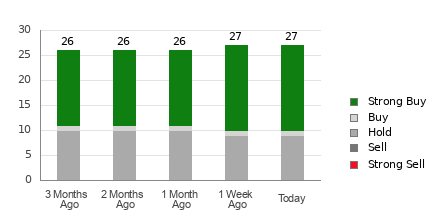

Currently basking in the limelight is Accenture, boasting an Average Brokerage Recommendation (ABR) of 1.70. This figure, standing on a scale ranging from 1 to 5 (where Strong Buy to Strong Sell reside), stems from the collective wisdom of 27 brokerage firms. The ABR score of 1.70 positions Accenture in the sweet spot between Strong Buy and Buy. Within this cohort, 63% echo a sentiment of Strong Buy, while Buy recommendations make up a modest 3.7%.

Analyzing Brokerage Trends for ACN

While the brokerage chorus seems to be singing praises for Accenture, it’s crucial not to hang all investment decisions on this one hook. Studies reveal that brokerage recommendations, although often hailed as the oracle by investors, might not always steer you towards the stocks primed for the most significant price upticks.

So, what’s cooking behind the scenes? The analysts’ ratings are not swathed in impartiality, with a glaring positive bias resulting from the entangled interests of brokerage firms in the stocks they cover. Our investigations reveal an alarming ratio where for every “Strong Sell” recommendation, brokerage firms ladle out a quintet of “Strong Buy” endorsements.

It’s akin to a fanciful tale where the sheen of brokerage recommendations might just be a mirage, painting a rosy picture that diverges from the gritty reality of stock price movements. Hence, while the brokerage verve might offer some validation or insights, placing your bets solely on their proclamations could be likened to traversing murky waters without a compass.

Speaking of beacons in the haze, the Zacks Rank emerges as a stalwart guide, boasting an audited track record that can help steer investors towards profitable shores. From Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this tool classifies stocks with a precision that transcends the brokerage spell.

Clarity Amidst the Jumble: ABR vs. Zacks Rank

Funky as it may sound, the ABR and Zacks Rank – though sporting a 1 to 5 scale – dance to distinct tunes. While the ABR jives to the brokerage tune, painted with decimal nuances like 1.28, the Zacks Rank sways to the rhythm of quantitative models, molded by earnings estimate gyrations, shimmering in wholesome numbers from 1 to 5.

In the age-old saga of brokerage optimism versus empirical sagacity, the Zacks Rank trumps with its allegiance to earnings movements. Research underscores the tight tango between near-term stock prices and the sways in earnings estimates, showcasing a correlation as vivid as the sun at dawn.

Furthermore, the Zacks Rank plays no favors – unlike its brokerage buddy – as it apportions its ratings objectively across all stocks, harnessing the power of earnings estimate twirls provided by analysts. Freshness-wise, while the ABR might sport a stale jacket, the Zacks Rank dazzles in real-time garb, promptly reflecting the winds of change in earnings landscapes.

Delving into Accenture’s earnings estuary, the Zacks Consensus Estimate for this year has donned a 1.6% embellishment in the past moon cycle, soaring to an altitude of $12.75.

The symphony of optimism among analysts, orchestrating a gust of EPS revisions heavenward, propels Accenture into the coveted Zacks Rank #2 (Buy) territory. This serenade, coupled with other earnings-related factors, could serve as a melodic prelude to a crescendo of soaring stock prices.

Thus, the Buy-equivalent ABR for Accenture might just be the north star guiding investors through the labyrinth of stock market mazes.

Embrace the Investment Journey

Peering into the kaleidoscope of investment decisions, the realm of Wall Street ratings and tools like the Zacks Rank offers a nuanced perspective. While the brokerage trail might be paved with golden promises, the Zacks Rank stands as a beacon of objective insights, transcending the myopic gaze of vested interests.

So, dear investors, as you navigate the tumultuous seas of stock markets, let the cautionary tales of bias-laden recommendations be your compass, while the Zacks Rank steers you towards the shores of profitable investments.