A common misconception among beginner investors is that choosing growth stocks is required to generate lucrative portfolio gains. Many times, the best-performing stocks are actually blue chip businesses that grow sales and profits steadily and consistently over a long period of time. In turn, these companies may reward shareholders in the form of a dividend.

Warren Buffett has perfected this approach to portfolio management. His Berkshire Hathaway portfolio owns very few smaller growth stocks. Instead, Buffett is known for taking positions in industry-leading brands that sport strong cash flow and dividend payments.

One Buffett stock that looks particularly tempting right now is credit card company Visa (NYSE: V). Below, I’ll explore why Visa is a solid choice for passive income and assess how owning the stock for decades could prove to be a wise move.

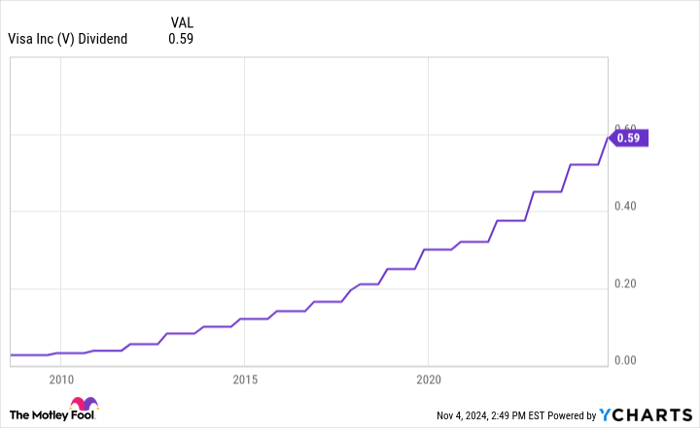

On Oct. 29, Visa reported financial and operating results for its fiscal fourth quarter and full year 2024. One of the highlights of the report was that Visa’s board of directors approved a 13% increase to the company’s quarterly dividend, bringing it to $0.59 per share.

As the chart below shows, Visa has raised its dividend steadily since the company’s initial public offering (IPO) in 2008.

V Dividend data by YCharts.

The importance of dividend stocks in your portfolio

Investors hold on to dividend stocks for different reasons. For retirees, dividend income can be a good source of cash and help prevent dipping into your savings for unnecessary reasons.

However, younger demographics may want to augment their stocks with reliable dividend players as well.

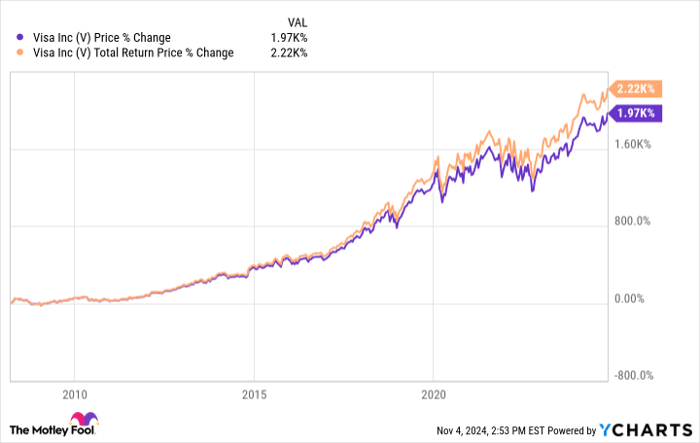

The chart above shows how Visa stock has performed since its IPO both on a stand-alone and total return basis. The big difference between these two lines is that the total return includes reinvesting dividend income into Visa stock as opposed to receiving the payment as cash. As you can see, reinvesting dividends has added significant appreciation to Visa’s long-run return.

Unlike retirees, younger investors may not need to supplement their cash savings each month or quarter. But as the chart makes clear, reinvesting dividend income into your stock portfolio can bolster your gains in a material way.

Image source: The Motley Fool.

Why I think Visa is a safe dividend opportunity

An important thing for dividend investors to consider is whether or not these payments are sustainable. In other words, does the company in question have the financial wherewithal not only to maintain paying a dividend, but hopefully raise it?

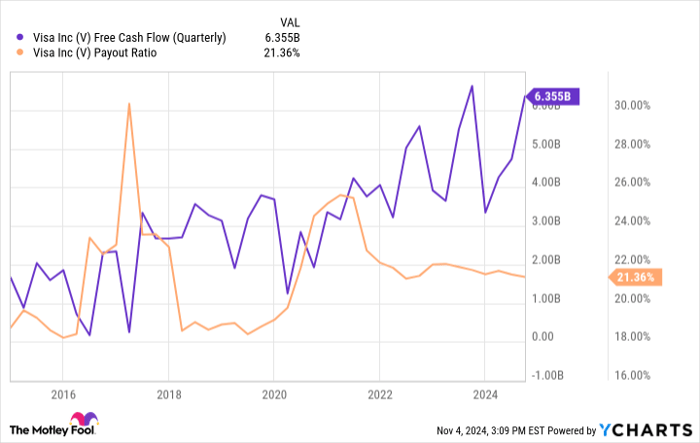

Some good metrics to help determine the answer to this question are free cash flow and the payout ratio. Free cash flow measures a company’s excess profits after capital expenditures (capex), making it a potentially more useful and accurate assessment of profitability compared to net income. Moreover, the payout ratio helps investors get an idea of how much of a company’s earnings are being returned to shareholders in the form of a dividend.

V Free Cash Flow (Quarterly) data by YCharts.

For Visa, it’s important for the company to balance shareholder rewards while maintaining adequate liquidity to invest in product development, cybersecurity protocols, and expansion efforts such as acquisitions — all important areas for the highly intensive credit card payments industry.

As the chart above shows, Visa has done a stellar job of generating free cash flow growth over a long-term horizon. The company has used these profits to raise its dividend.

Indeed, these trends suggest that Visa has room to continue investing in growth opportunities while maintaining (and likely raising) its dividend even further in the long run. To me, Visa stock is a no-brainer for investors looking for growth and passive income — a pretty rare combination. Right now looks like a great opportunity to scoop up shares of Visa stock and prepare to hold on for decades to come, just as Buffett often encourages investors to do.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $23,657!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,034!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $429,567!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 4, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Visa. The Motley Fool has a disclosure policy.