In a world where mergers and acquisitions navigate treacherous waters, Warner Bros Discovery (WBD) is a behemoth waiting in the wings for a regulatory environment that is a little less combative. Against a backdrop of stringent antitrust sentiment at the Federal Trade Commission, Warner Bros Discovery treads cautiously while keeping a weather eye on changing tides. Investors, emboldened by the promise of better days, pushed shares up by a notable 4% during Friday’s trading session.

The media landscape is a thorny one, with companies vying for their slice of the pie amidst shifting sands. Warner Bros Discovery has toyed with the idea of consolidation to carve out breathing space and enhance its allure in a sea of competitors. Even the likes of Comcast (CMCSA) have exhibited lukewarm interest in intertwining fates with Warner Bros Discovery.

Amid this challenging climate, David Zaslav, CEO of Warner Bros Discovery, points a finger not at Warner’s appeal but at the iron grip of regulatory forces thwarting M&A endeavors. This sentiment resonates among industry players hopeful for a change in the political landscape to thaw the ice and resuscitate the allure of consolidation in media circles.

Perception of Warner’s Content

Zaslav’s stance brings forth a poignant question: Is Warner Bros Discovery’s desirability stymied by a stringent government or a lack of appeal in its content offerings? At odds with the former assumption is Disney’s recent bundling of Disney+, Hulu, and Warner’s Max at an affordable $16.99/month for the ad-supported tier, suggesting that the content does have its enthusiasts.

However, the specter of setbacks looms as Warner Bros Discovery grapples with the loss of coveted sports content, such as its recent unsuccessful bid against Amazon to reclaim NBA broadcasting rights, resulting in a legal tussle.

Evaluating Warner Bros Discovery Stock

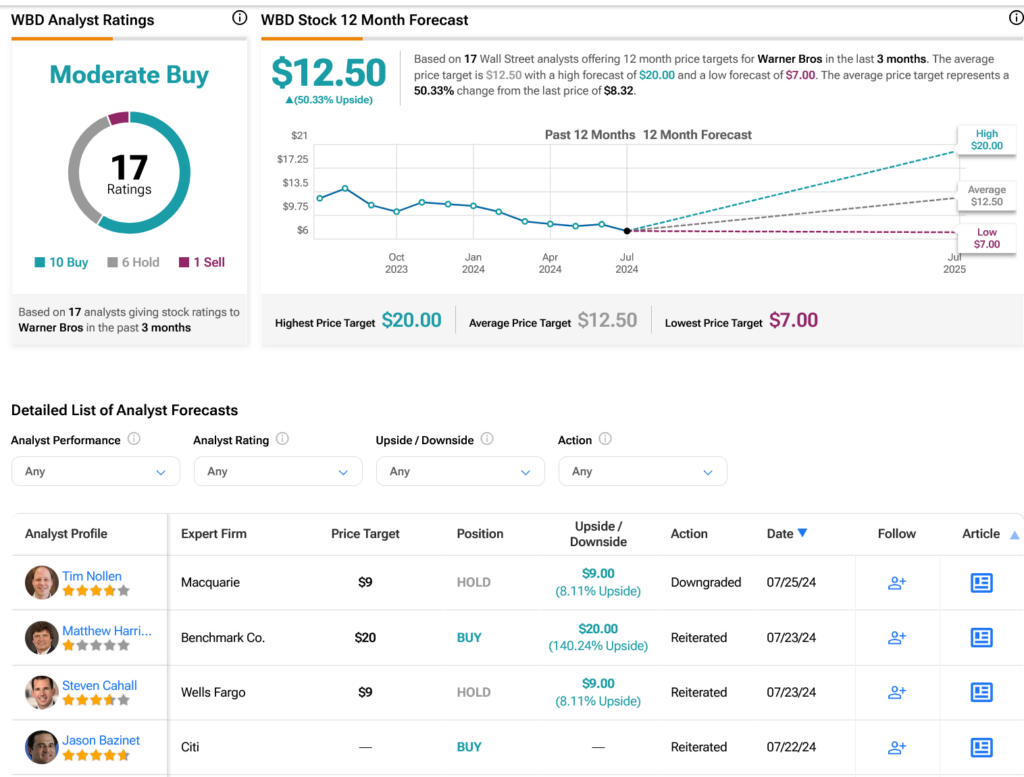

As analysts convene on Wall Street, a moderate Buy consensus on WBD stock emerges, underpinned by 10 Buy, six Hold, and one Sell ratings in the past three months. Despite a 32.3% plummet in share price over the last year, the average price target stands at $12.50 per share, hinting at a potential 50.33% upside.