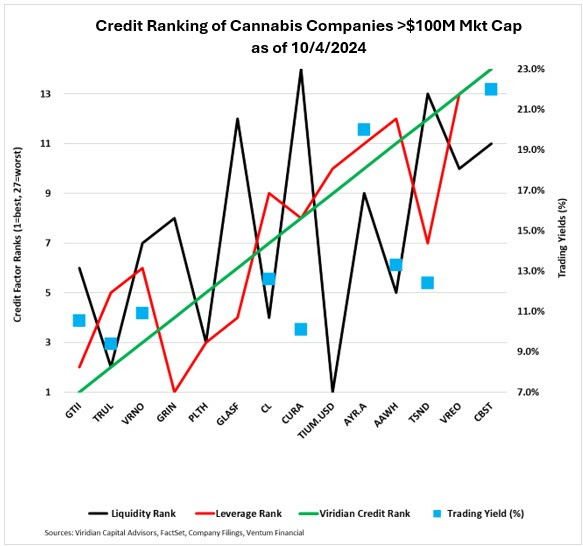

Florida’s upcoming vote on recreational cannabis has spurred investor interest in strategic market moves. The Viridian Credit Tracker identifies AYR Wellness (AYRWF) as a strong buy, offering a lucrative 20% yield, primarily driven by its extensive presence in Florida’s cannabis sector. Anticipating a positive outcome from Florida voters, AYR stands poised for substantial growth, positioning itself as an attractive investment opportunity before the vote.

Maximizing Gains with AYR Wellness’s 20% Yield

The Viridian Credit Tracker report highlights AYR Wellness’s significant exposure to the potential recreational cannabis market in Florida, setting it apart from competitors. With a remarkable 20% trading yield, AYR emerges as a top choice for investors seeking to capitalize on Florida’s potential legalization of recreational cannabis. Investors are encouraged to consider AYR Wellness for its promising outlook ahead of the vote.

Cresco Labs vs. Curaleaf: Analyzing Variances in Yields

An intriguing pair trade suggested by the report involves buying Cresco Labs (CRLBF) at a 12.6% yield and selling Curaleaf (CURLF) at 10.1%. This strategic move offers investors a notable 250 basis points yield advantage, supported by Cresco’s robust financial performance and credit enhancements. Investors seeking higher returns and enhanced credit stability may find this trade proposition appealing.

TerrAscend’s 12% Yield Under Scrutiny

In contrast, TerrAscend (TRSSF) presents a 12% yield but is recommended as a sell due to its limited growth potential and reduced exposure to Florida’s flourishing market dynamics. While TerrAscend remains a key player in the cannabis industry, its lower yield and market positioning make it a less favorable option compared to AYR Wellness.

Evaluating Credit Strength: Cannabist’s Challenges

Despite competitive opportunities in the market, Cannabist (CCHWF) faces liquidity concerns, contributing to its weaker credit standing within the sector. Recent asset sales have raised apprehensions about Cannabist’s creditworthiness, cautioning investors about its potential limited upside in the near term despite future improvements.

Seizing Opportunities Before Florida’s Decisive Vote

Given the potential expansion of Florida’s cannabis market, investors keen on maximizing returns should consider a strategic move: buying AYR Wellness at 20%, selling TerrAscend at 12%, and exploring Cresco Labs at 12.6% in comparison to Curaleaf at 10.1%. The upcoming vote has the capacity to reshape the landscape for cannabis stocks, emphasizing the significance of taking proactive steps before this pivotal event for substantial gains.

Follow-up on market updates: SEC charges ‘Magic Mushroom’ Co. Minerco in an $8M pump-and-dump scheme.

Market News and Data brought to you by Benzinga APIs