Seeking to bolster passive income to cover monthly expenses is a noble financial quest. Whether through dividend stocks, real estate ventures, or bonds, investors perpetually scour the financial spectrum for the holy grail of financial security. For many, the gateway to this dreamland lies in the intricate world of exchange-traded funds (ETFs).

A standout in the constellation of income-focused ETFs is the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI), a beacon of hope for those yearning for a steady income stream. Let’s delve into the reasons why JEPI shines brightly in the arena of passive income.

The Elite Passive Income Generator

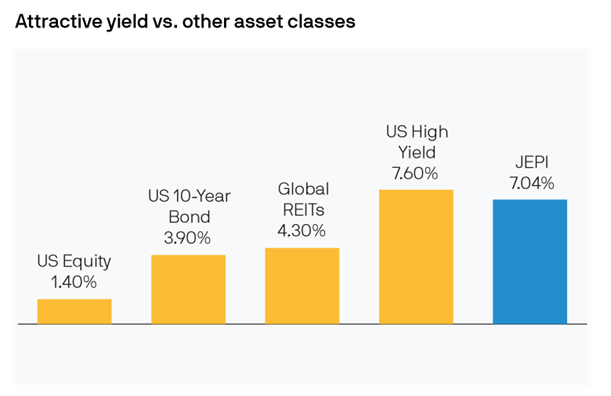

The JEPI ETF epitomizes proactive management, blending monthly income goals with equity market participation while mitigating the tumultuous waves of stock market volatility. Over the past year, JEPI has surpassed expectations, decreeing premium income in comparison to its yield-centric comrades.

Image source: JPMorgan Asset Management.

In recent days, JEPI graciously rivaled the returns of the average U.S. high-yield bond. Notably, its yield thrived at a towering 8.5% over the past year, a feast for the income-starved when juxtaposed with the meager offerings of a 10-year treasury or a real estate investment trust (REIT).

JEPI generously shares its bounty with investors each month, although it’s worth noting that these payouts may bob and weave with the tides of the market. Nevertheless, the ETF’s overall annual yield has been a siren song for astute investors since its inception.

Though shepherded by active hands, JEPI boasts a modest ETF expense ratio of 0.35%, enabling investors to bask in more of the income JEPI toils to bestow.

The Art of Yield Cultivation

The JPMorgan Equity Premium ETF operates on a dual-pronged strategy to cultivate income for the faithful:

- A Defensive Equity Portfolio: JEPI’s custodians meticulously select high-quality stocks through a bottom-up assessment, emphasizing dividends as a hallmark of their selection process.

- A Disciplined Options Overlay Strategy: Leveraging out-of-the-money call options on the S&P 500 Index, JEPI engineers a monthly torrent of distributable income.

The ETF’s defensive equity roster boasts over 100 holdings, spearheaded by:

- Progressive: The insurance stalwart, constituting 1.7% of the fund’s assets, doling out a 0.5%-yielding dividend.

- Trane Technologies: The HVAC juggernaut, comprising 1.7% of the portfolio, wafts a dividend yielding 1.1%.

- Microsoft Corporation: The tech behemoth, accounting for 1.7% of the holdings, disperses a 0.7% dividend.

- Amazon: The ubiquitous e-commerce titan…